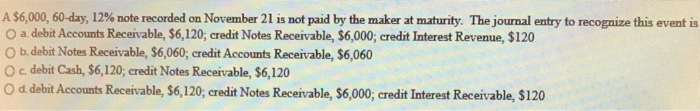

Question: A $6,000, 60-day, 12% note recorded on November 21 is not paid by the maker at maturity. The journal entry to recognize this event is

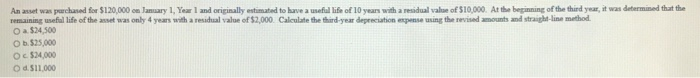

A $6,000, 60-day, 12% note recorded on November 21 is not paid by the maker at maturity. The journal entry to recognize this event is a debit Accounts Receivable, 56,120, credit Notes Receivable, $6,000; credit Interest Revenue, $120 b. debit Notes Receivable, $6,060; credit Accounts Receivable, $6,060 Oc debit Cash, $6,120; credit Notes Receivable, $6,120 Od debit Accounts Receivable, 56,120; credit Notes Receivable, $6,000; credit Interest Receivable, $120 An asset was purchased for $120,000 on January 1, Yearl and originally estimated to have a full life of 10 years with a residual value of $10,000. At the beginning of the third year, it was determined that the remaining useful life of the was only 4 years with a residual value of $2,000 Calculate the third-year depreciation expense ning the revised amounts and line method O a $24,500 1.525,000 O $24,000 Od 511000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts