Question: A 60-day, 12% note fin $10,000, dated May 1, is received from a customer on account. If the note is discounted on May 21 at

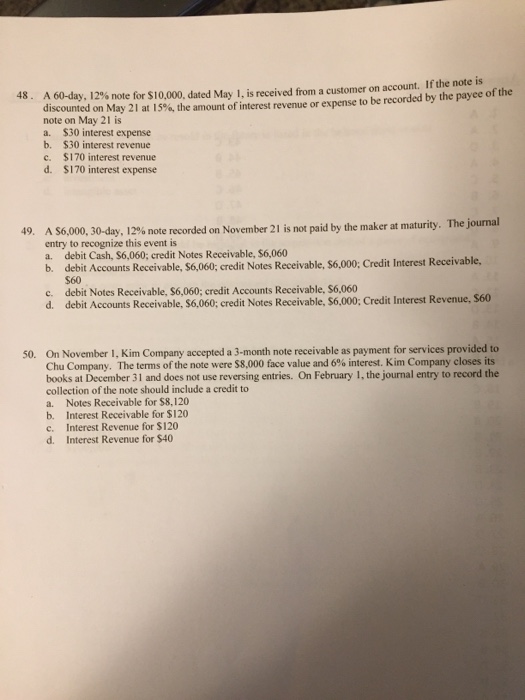

A 60-day, 12% note fin $10,000, dated May 1, is received from a customer on account. If the note is discounted on May 21 at 15%, the amount of interest revenue or expense to be recorded by the payee of the note on May 21 is a. $30 interest expense b. $30 interest revenue c. $170 interest revenue d. $170 interest expense A $6,000, 30-day, 12% note recorded on November 21 is not paid by the make at maturity. The journal entry to recognize this event is a. debit Cash, $6, 060: credit Notes Receivable, $6, 060 b. debit Accounts Receivable, $6, 060: credit Notes Receivable, $6,000: Credit Interest Receivable, $60 c. debit Notes Receivable, $6, 060: credit Accounts Receivable, $6, 060 d. debit Accounts Receivable, $6, 060: credit Notes Receivable, $6,000: Credit Interest Revenue, $60 On November 1, Kim Company accepted a 3-month note receivable as payment for services provided to Chu Company. The terms of the note were $8,000 face value and 6% interest. Kim Company closes its books at December 31 and does not use reversing entries. On February 1, the journal entry to record the collection of the note should include a credit to a. Notes Receivable for $8, 120 b. Interest Receivable for $120 c. Interest Revenue for $120 d. Interest Revenue for $40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts