Question: a a a 6. Luis Pinzon is a foreign exchange trader for a bank in New York. He has $1 million for a short term

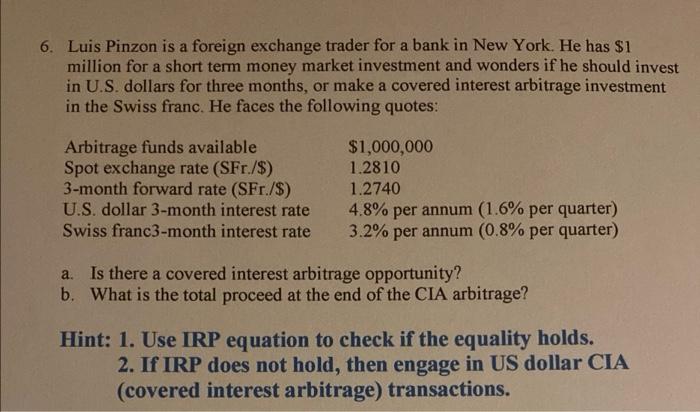

a a a 6. Luis Pinzon is a foreign exchange trader for a bank in New York. He has $1 million for a short term money market investment and wonders if he should invest in U.S. dollars for three months, or make a covered interest arbitrage investment in the Swiss franc. He faces the following quotes: Arbitrage funds available Spot exchange rate (SFr./$) 3-month forward rate (SFr./S) U.S. dollar 3-month interest rate Swiss franc3-month interest rate $1,000,000 1.2810 1.2740 4.8% per annum (1.6% per quarter) 3.2% per annum (0.8% per quarter) a. Is there a covered interest arbitrage opportunity? b. What is the total proceed at the end of the CIA arbitrage? Hint: 1. Use IRP equation to check if the equality holds. 2. If IRP does not hold, then engage in US dollar CIA (covered interest arbitrage) transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts