Question: A . A call option with exercise price $ 1 0 is expiring today. If the underlying asset is worth $ 1 3 , the

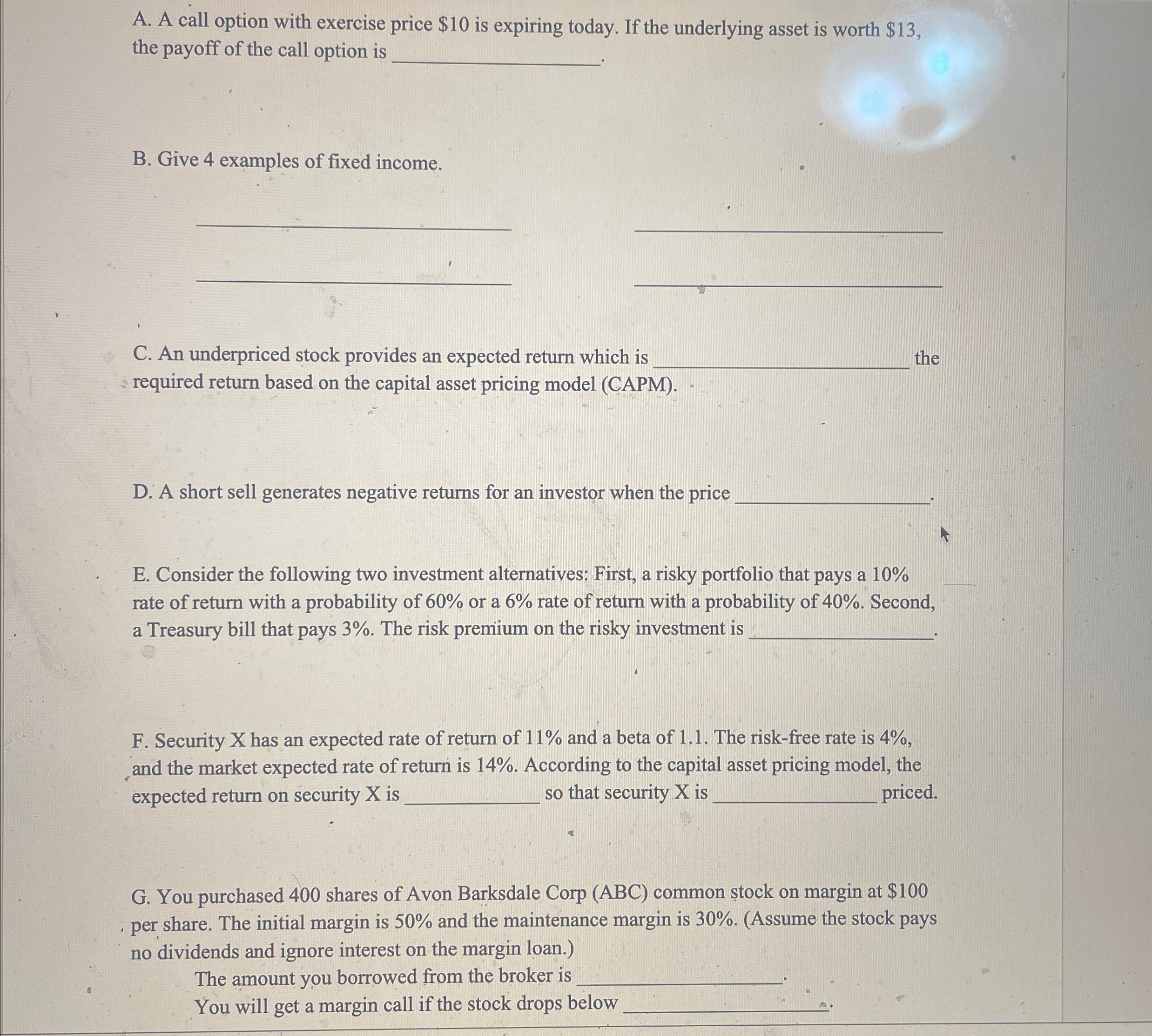

A A call option with exercise price $ is expiring today. If the underlying asset is worth $ the payoff of the call option is

B Give examples of fixed income.

C An underpriced stock provides an expected return which is required return based on the capital asset pricing model CAPivi

D A short sell generates negative returns for an investor when the price

E Consider the following two investment alternatives: First, a risky portfolio that pays a rate of return with a probability of or a rate of return with a probability of Second, a Treasury bill that pays The risk premium on the risky investment is

F Security has an expected rate of return of and a beta of The riskfree rate is and the market expected rate of return is According to the capital asset pricing model, the expected return on security is so that security is priced. C rest

G You purchased shares of Avon Barksdale Corp ABC common stock on margin at $ per share. The initial margin is and the maintenance margin is Assume the stock pays no dividends and ignore interest on the margin loan.

The amount you borrowed from the broker is You will get a margin call if the stock drops below

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock