Question: A A E E BIU B 4x Merge & Center sv% 9 .99 Conditional Format HS Question 5. (15 points Marcus Company, is a successful

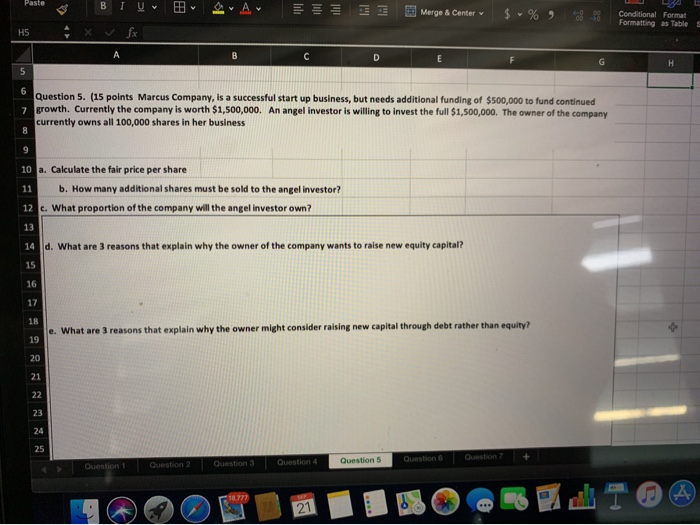

A A E E BIU B 4x Merge & Center sv% 9 .99 Conditional Format HS Question 5. (15 points Marcus Company, is a successful start up business, but needs additional funding of $500,000 to fund continued growth. Currently the company is worth $1,500,000. An angel investor is willing to invest the full $1,500,000. The owner of the company currently owns all 100,000 shares in her business 11 10 a. Calculate the fair price per share b. How many additional shares must be sold to the angel investor? 12 c. What proportion of the company will the angel investor own? 14 d. What are 3 reasons that explain why the owner of the company wants to raise new equity capital? What are 3 reasons that explain why the owner might consider raising new capital through debt rather than equity? Question Question + Question 5 Question 1 Question 2 Question 3 Question 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts