Question: a) A trader wants to create a butterfly spread using three put options on a stock with the same maturity, strike prices of 80, 90,

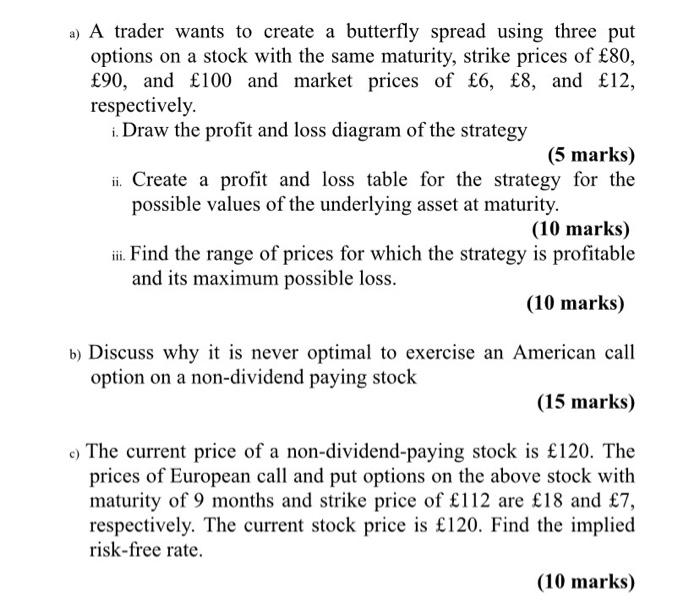

a) A trader wants to create a butterfly spread using three put options on a stock with the same maturity, strike prices of 80, 90, and 100 and market prices of 6, 8, and 12, respectively. 1. Draw the profit and loss diagram of the strategy (5 marks) ii. Create a profit and loss table for the strategy for the possible values of the underlying asset at maturity. (10 marks) iii. Find the range of prices for which the strategy is profitable and its maximum possible loss. (10 marks) b) Discuss why it is never optimal to exercise an American call option on a non-dividend paying stock (15 marks) c) The current price of a non-dividend-paying stock is 120. The prices of European call and put options on the above stock with maturity of 9 months and strike price of 112 are 18 and 7, respectively. The current stock price is 120. Find the implied risk-free rate. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts