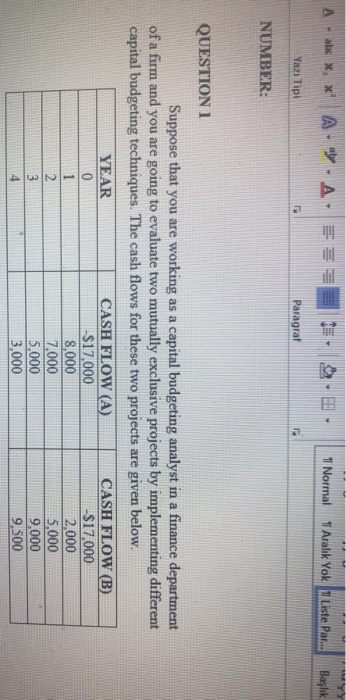

Question: A - ab *, x A.-A. ES - 3. 1 Normal 1 Aralk Yok 1 Liste Par... Baslik Yaz Tipi Paragraf NUMBER: QUESTION 1 Suppose

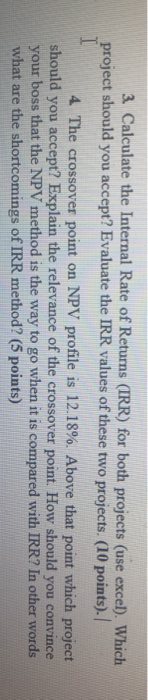

A - ab *, x A.-A. ES - 3. 1 Normal 1 Aralk Yok 1 Liste Par... Baslik Yaz Tipi Paragraf NUMBER: QUESTION 1 Suppose that you are working as a capital budgeting analyst in a finance department of a firm and you are going to evaluate two mutually exclusive projects by implementing different capital budgeting techniques. The cash flows for these two projects are given below. YEAR 0 1 2 3 4 CASH FLOW (A) -$17.000 8,000 7.000 5,000 3,000 CASH FLOW B. -$17,000 2,000 5,000 9,000 9,500 3. Calculate the Internal Rate of Returns (IRR) for both projects (use excel). Which project should you accept? Evaluate the IRR values of these two projects. (10 points). I 4 The crossover point on NPV profile is 12.18%. Above that point which project should you accept? Explain the relevance of the crossover point. How should you convince your boss that the NPV method is the way to go when it is compared with IRR? In other words what are the shortcomings of IRR method? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts