Question: A. An analyst is attempting to value a three-year American Put option with strike 1,000 on a non-income bearing security with a spot price of

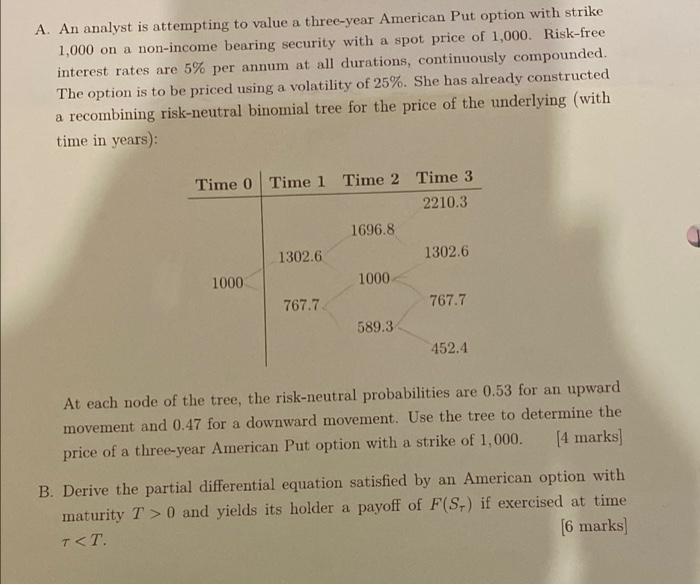

A. An analyst is attempting to value a three-year American Put option with strike 1,000 on a non-income bearing security with a spot price of 1,000. Risk-free interest rates are 5% per annum at all durations, continuously compounded. The option is to be priced using a volatility of 25%. She has already constructed a recombining risk-neutral binomial tree for the price of the underlying (with time in years): Time 0 Time 1 Time 2 Time 3 2210.3 1696.8 1302.6 1302.6 1000 1000 767.7 767.7 589.3 452.4 At each node of the tree, the risk-neutral probabilities are 0.53 for an upward movement and 0.47 for a downward movement. Use the tree to determine the price of a three-year American Put option with a strike of 1,000. [4 marks) B. Derive the partial differential equation satisfied by an American option with maturity T >0 and yields its holder a payoff of F(S) if exercised at time T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts