Question: a. Analyze Ryan Boot Company, using ratio analysis. Compute the Ryan ratios and compare them to the industry data that are given. Discuss the weak

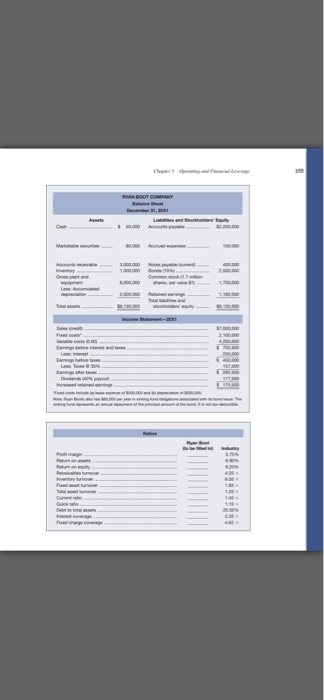

a. Analyze Ryan Boot Company, using ratio analysis. Compute the Ryan ratios and compare them to the industry data that are given. Discuss the weak points, strong points, and what you think should be done to improve the company's performance. b. In your analysis, calculate the overall break-even point in sales dollars and the cash break-even point. Also compute the degree of operating leverage, degree of financial leverage, and degree of combined leverage. (Use footnote 2 for DOL and footnote 3 for DCL.) c. Use the information in parts a and b to discuss the risk associated with this company. Given the risk, decide whether a bank should lend funds to Ryan Boot. RIAN BOOT OWNY Decem, .. hardcore home 130 14 1 a. Analyze Ryan Boot Company, using ratio analysis. Compute the Ryan ratios and compare them to the industry data that are given. Discuss the weak points, strong points, and what you think should be done to improve the company's performance. b. In your analysis, calculate the overall break-even point in sales dollars and the cash break-even point. Also compute the degree of operating leverage, degree of financial leverage, and degree of combined leverage. (Use footnote 2 for DOL and footnote 3 for DCL.) c. Use the information in parts a and b to discuss the risk associated with this company. Given the risk, decide whether a bank should lend funds to Ryan Boot. RIAN BOOT OWNY Decem, .. hardcore home 130 14 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts