Question: A and B are equal partners in AB, Ltd. A and B have 704(b) book capital balances as shown below. The only activity in AB,

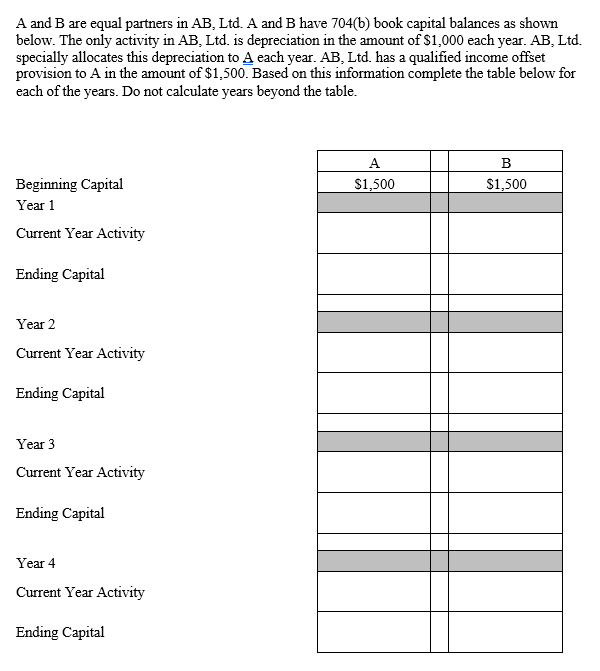

A and B are equal partners in AB, Ltd. A and B have 704(b) book capital balances as shown below. The only activity in AB, Ltd. is depreciation in the amount of $1,000 each year. AB, Ltd. specially allocates this depreciation to A each year. AB, Ltd. has a qualified income offset provision to A in the amount of $1,500. Based on this information complete the table below for each of the years. Do not calculate years beyond the table. A B Beginning Capital $1,500 $1,500 Year 1 Current Year Activity Ending Capital Year 2 Current Year Activity Ending Capital Year 3 Current Year Activity Ending Capital Year 4 Current Year Activity Ending Capital

A and B are equal partners in AB, Ltd. A and B have 704(b) book capital balances as shown below. The only activity in AB, Ltd. is depreciation in the amount of $1,000 each year. AB, Ltd. specially allocates this depreciation to A each year. AB, Ltd. has a qualified income offset provision to A in the amount of $1,500. Based on this information complete the table below for each of the years. Do not calculate years beyond the table. A B Beginning Capital $1.500 $1.500 Year 1 Current Year Activity Ending Capital Year 2 Current Year Activity Ending Capital Year 3 Current Year Activity Ending Capital Year 4 Current Year Activity Ending Capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts