Question: (a) Appraise any three (3) risks that a wheat farmer faces. (25 marks) (b) Suppose the farmer expects to harvest about 1,000,000 bushels of wheat.

(a) Appraise any three (3) risks that a wheat farmer faces. (25 marks)

(b) Suppose the farmer expects to harvest about 1,000,000 bushels of wheat. Worried that the price of wheat may fall, he hedges by selling 200 futures contracts (Contract size for wheat is 5,000 bushels) at a contract price of $6 per bushel. However, due to poor weather conditions, the farmer manages to harvest only 800,000 bushels. Meanwhile the poor wheat harvest has caused the price to rise to $7 per bushel. Discuss the overall loss or gain for the farmer. (10 marks)

(c) Appraise the risks, if any, that the farmer did not take into account and what are the considerations for any actions he could he have undertaken? (15 marks)

Question 2:

(a) An options investor made this remark: "The underlying stock of my call option has reached its highest price ever. It has appreciated over 100% in the last 6 months. I should exercise my call now. Unlike a stock, the call option has limited life. Should the stock price fall due to a technical correction, the 2 months left before the call expires is too short to see a rebound in the price. If I were to hold the stock instead, I would definitely not sell now."

(i) Appraise the merit of the remark, assuming the stock does not pay a dividend. (10 marks)

(ii) Appraise the merit of the remark, assuming the stock pays a dividend. (5 marks)

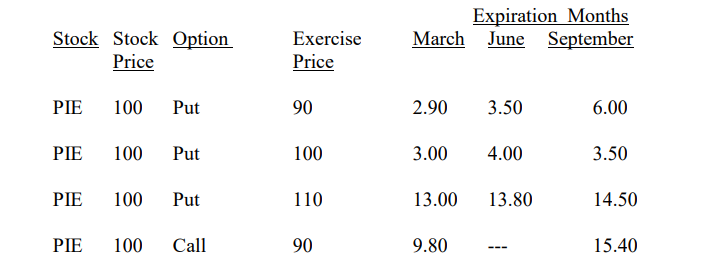

(b) You are an options trader for a hedge fund. Your assistant prepared the following sheet containing the prices of various options.

Expiration Months Stock Stock Option Price Exercise March June June September Price PIE 100 Put 90 2.90 3.50 6.00 PIE 100 Put 100 3.00 4.00 3.50 PIE 100 Put 110 13.00 13.80 14.50 PIE 100 Call 90 90 9.80 --- 15.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts