Question: ( a ) Assuming Mr . Chan survives and does not get the critical illness. How many years does he need to wait to get

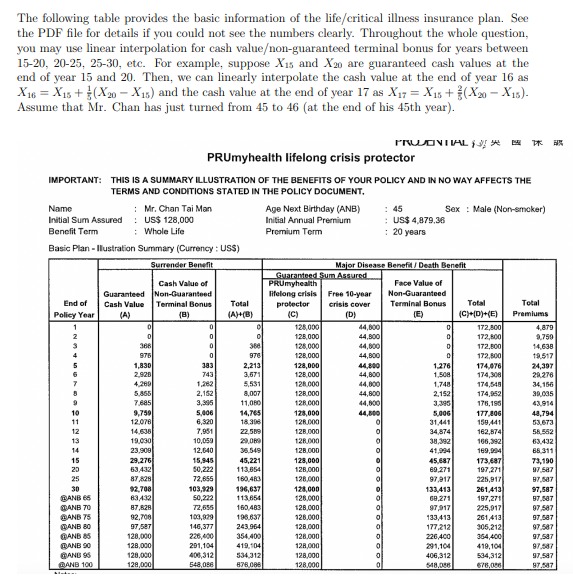

a Assuming Mr Chan survives and does not get the critical illness. How many years does he need to wait to get a guaranteed cash value plus projected dividend assuming realized that is equal to the total premium he contributed? Here, you may ignore the time value of money. b In the year that corresponds to your answer in the previous question, if he chooses to surrender the policy and assume the nonguaranteed terminal bonus is realized, what is the internal rate of return IRR he can get from this policy? What is his IRR if only the fulfillment ratio of the nonguaranteed terminal bonus is that is the actual nonguaranteed terminal bonus is of the projected values listed in the table. c Suppose the time discount rate is Add a column in the spreadsheet that calculates the future value of total premium paid in each year. Make sure you mark your answer clearly. Hint: You may use the NPV function and FV function in Excel. See here for the use of NPVd This question follows question c If Mr Chan wants to surrender the policy when the guaranteed cash value plus projected dividend assuming fulfillment ratio is higher than or equal to the future value of the total premium he contributed. How many years does he need to wait to surrender the policy? Is your answer in question c larger or smaller than your answer in question a Explain the intuition. a Use the information in the Life Table attached and add two columns that calculate the theoretical cash value at the end of each year assuming zero premium loading The theoretical cash value follows Cash Valuet Cash valuet Interestt Premiumt Mortality costt Dividendt We assume that the mortality cost earns the interest before being withdrawn from the survivors account. You may use the death probability to proxy for the probability of death plus having critical illness in each year. We assume that the terminal dividends are realized as in Column B and E and the dividends paid out to those who die or get critical illness is not financed by the survivors. Assume the insurance company can get a annual return without risk and the terminal dividend realization depends on the additional return from risky investment on top of the riskless investment return. Note that here dividends are terminal. Make sure you mark your answer clearly. b Compare your answer in c and a what makes them different? c Compare your answer in aunder the scenario of fulfillment ratio and the surrender benefit Total AB shown in the table. What makes them different? d Assume Mr Chan survives until years old after years and does not get a major disease. Calculate the IRR Mr Chan earned when he surrenders the policy at years old at the end of his th year assuming the projected dividends are realized. Do you think the insurers financial investment return is higher or lower than the IRR you calculated? Explain. a The policy provided a promotional offer to Mr Chan that there is a free year crisis cover for the first years when the policy is in force. The crisis coverage provides more deathmajor illness benefit in the first ten years. Calculate the present value of this year crisis cover, assuming a discount rate. b If the cost of the year crisis cover is fully passed to the insurance buyer, how much annual premium can policyholders save if the plan does not include the free year crisis cover? Again, assume discount rate is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock