Question: a) Assuming that your capital is constrained, what is the fifth project that you should invest in? Please show work. b) Assuming that your capital

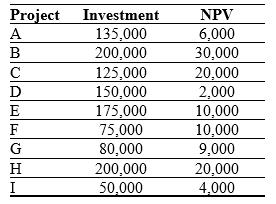

a) Assuming that your capital is constrained, what is the fifth project that you should invest in? Please show work.

b) Assuming that your capital is constrained so that you only have $600,000 available to invest in projects, which projects should you invest in and in what order? Please explain and show work.

c) Discuss why the NPV method of evaluating which competing projects should be undertaken by a company is the best.

Project A B D E F G H I Investment 135,000 200,000 125,000 150,000 175,000 75,000 80,000 200,000 50,000 NPV 6,000 30,000 20,000 2,000 10,000 10,000 9,000 20,000 4,000

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Solution A The profitability index tool is used to determine the correct investmen... View full answer

Get step-by-step solutions from verified subject matter experts