Question: A B begin{tabular}{l|l|l|l} C & D & E & F end{tabular} G 1 Formula: Multiply, Divide, Subtract; Cell Referencing 3 Using Excel to Calculate a

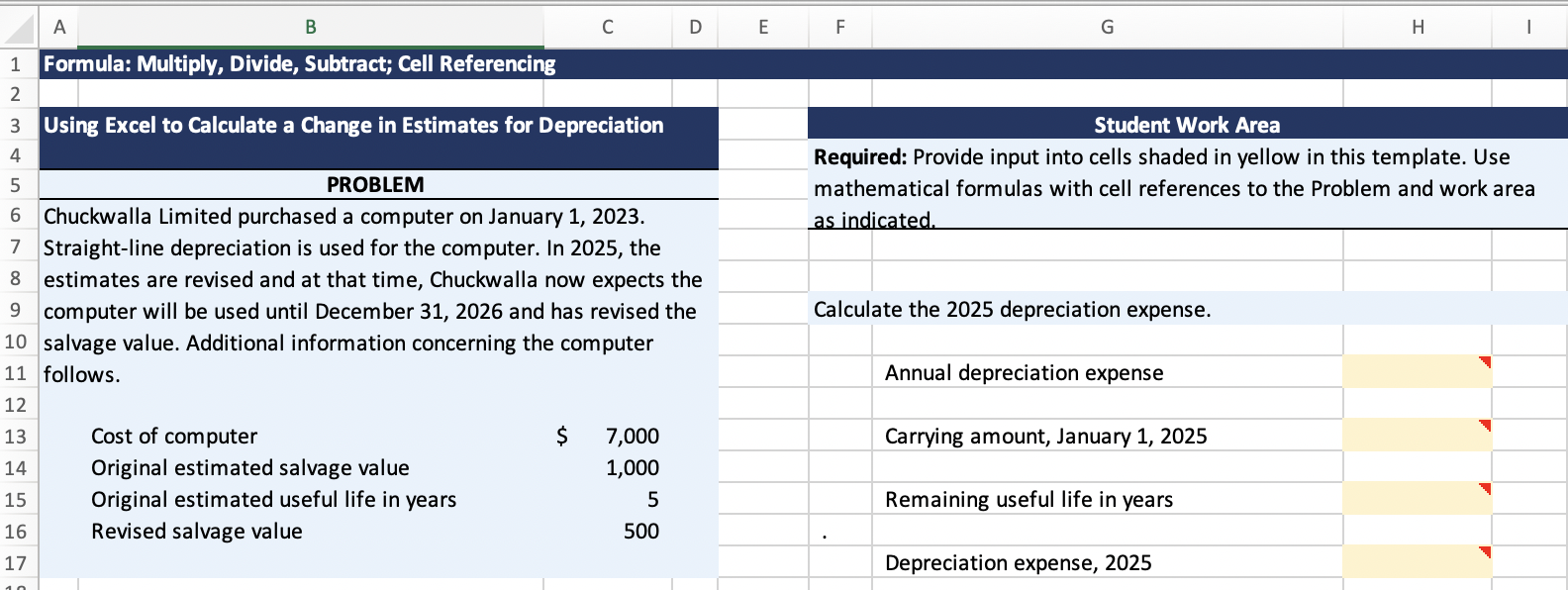

A B \begin{tabular}{l|l|l|l} C & D & E & F \end{tabular} G 1 Formula: Multiply, Divide, Subtract; Cell Referencing 3 Using Excel to Calculate a Change in Estimates for Depreciation Student Work Area Required: Provide input into cells shaded in yellow in this template. Use PROBLEM mathematical formulas with cell references to the Problem and work area Chuckwalla Limited purchased a computer on January 1, 2023. as indicated. Straight-line depreciation is used for the computer. In 2025, the estimates are revised and at that time, Chuckwalla now expects the computer will be used until December 31, 2026 and has revised the Calculate the 2025 depreciation expense. salvage value. Additional information concerning the computer follows. Annual depreciation expense Cost of computer Carrying amount, January 1, 2025 Original estimated salvage value Original estimated useful life in years Remaining useful life in years Revised salvage value Depreciation expense, 2025

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts