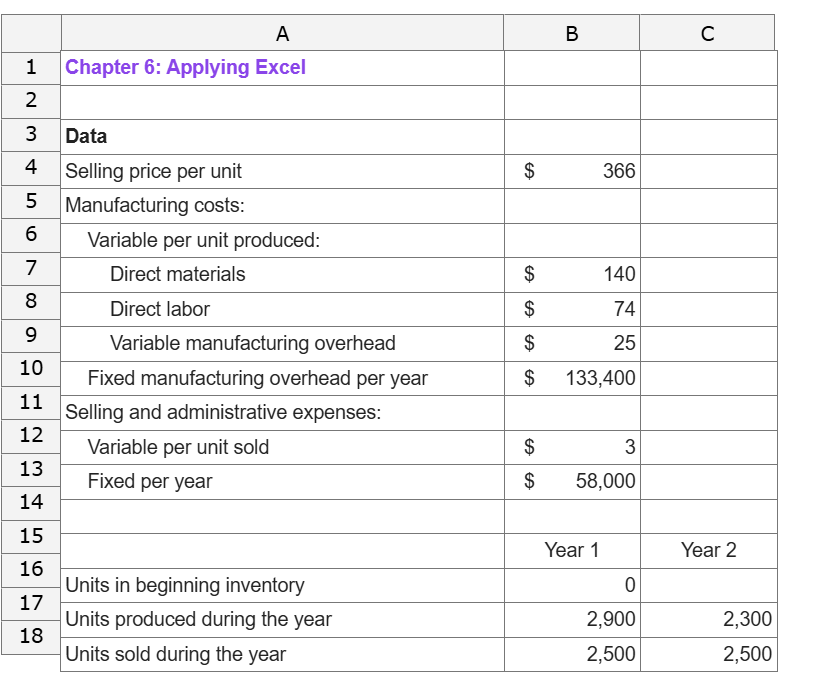

Question: A B C 1 Chapter 6 : Applying Excel 2 3 Data 4 Selling price per unit $ 3 6 6 5 Manufacturing costs: 6

A B C Chapter : Applying Excel Data Selling price per unit $ Manufacturing costs: Variable per unit produced: Direct materials $ Direct labor $ Variable manufacturing overhead $ Fixed manufacturing overhead per year $ Selling and administrative expenses: Variable per unit sold $ Fixed per year $ Year Year Units in beginning inventory Units produced during the year Units sold during the year

a What is the net operating income loss in Year under absorption costing?

b What is the net operating income loss in Year under absorption costing?

c What is the net operating income loss in Year under variable costing?

d What is the net operating income loss in Year under variable costing?

t the end of Year the companys board of directors set a target for Year net operating income of $ under absorption costing. If this target is met, a large bonus would be paid to the CEO of the company. Keeping everything else the same from part above, change the units produced in Year to units.

a Would this change result in a bonus being paid to the CEO?

multiple choice

Yes

No

b What is the net operating income loss in Year under absorption costing?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock