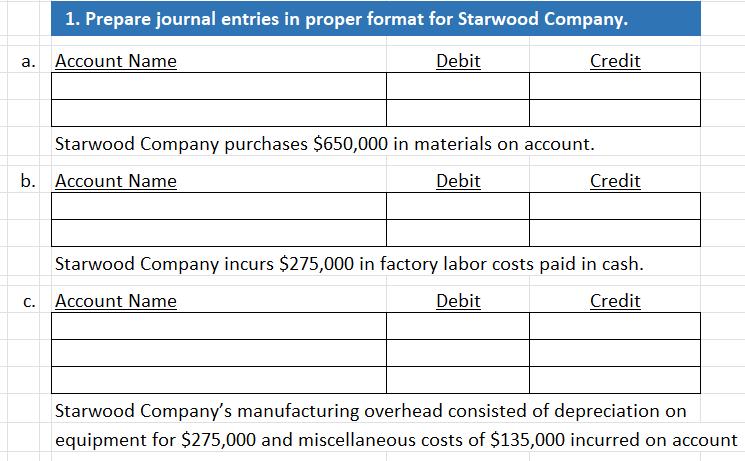

Question: a. b. C. 1. Prepare journal entries in proper format for Starwood Company. Debit Account Name Credit Starwood Company purchases $650,000 in materials on

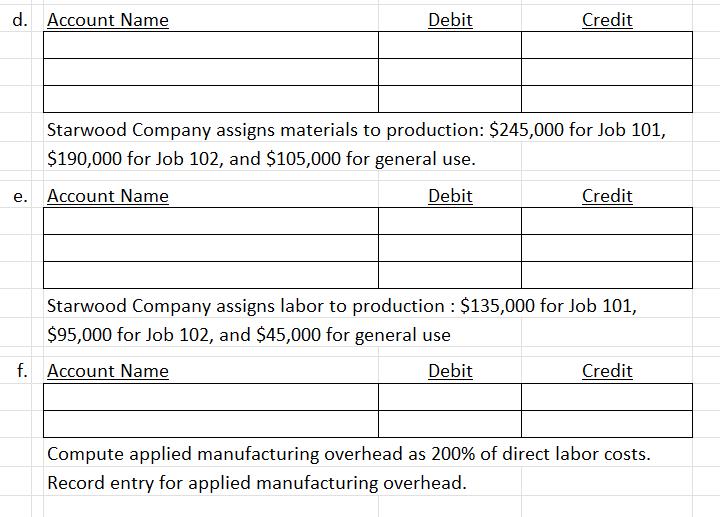

a. b. C. 1. Prepare journal entries in proper format for Starwood Company. Debit Account Name Credit Starwood Company purchases $650,000 in materials on account. Account Name Debit Credit Starwood Company incurs $275,000 in factory labor costs paid in cash. Account Name Debit Credit Starwood Company's manufacturing overhead consisted of depreciation on equipment for $275,000 and miscellaneous costs of $135,000 incurred on account d. Account Name e. Debit Credit Starwood Company assigns materials to production: $245,000 for Job 101, $190,000 for Job 102, and $105,000 for general use. Account Name Debit Credit Starwood Company assigns labor to production : $135,000 for Job 101, $95,000 for Job 102, and $45,000 for general use f. Account Name Debit Credit Compute applied manufacturing overhead as 200% of direct labor costs. Record entry for applied manufacturing overhead. 2. Complete the Job Cost Worksheets for Job 101 and Job 102: Job 101 - Job Cost Worksheet Job 102 - Job Cost Worksheet Job 101 Job 102 DM DM DL DL Applied MOH Applied MOH Total Total *Tip: Enter the product costs for Job 101 and Job 102 from the d. entry (DM), e. entry (DL), and f. entry (applied MOH). Product Costs Product Costs

Step by Step Solution

There are 3 Steps involved in it

a Journal entry for the purchase of materials on account Account Name Debit Credit Materials Expense ... View full answer

Get step-by-step solutions from verified subject matter experts