Question: A) B) C) Butterfly Option Spread. For a given stock, you observe the following option prices. Use these options to create a long buttertly spread

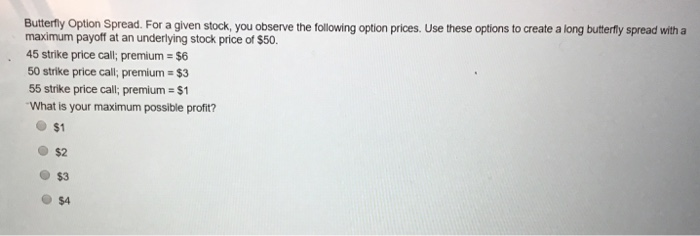

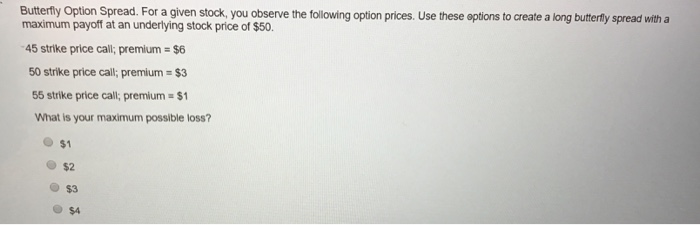

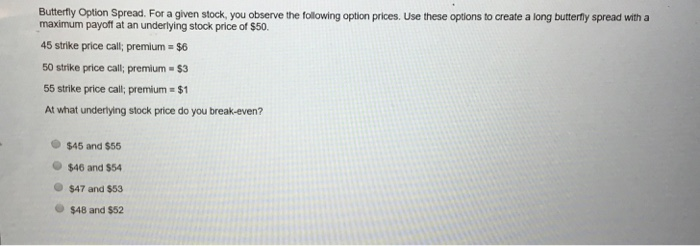

Butterfly Option Spread. For a given stock, you observe the following option prices. Use these options to create a long buttertly spread with maximum payoff at an underlying stock price of $50. 45 strike price call; premium-$6 50 strike price call; premium $3 55 strike price call; premium $1 What is your maximum possible profit? $1 $2 $3 $4 Buttertly Option Spread. For a given stock, you observe the following option prices. Use these eptions to create a long butterily spread with a maximum payof at an underlying stock price of $50. 45 strike price call; premium $6 50 strike price call; premium 55 strike price call; premium What is your maximum possible loss? $3 $1 $1 $2 O $3 O $A Butterfly Option Spread. For a given stock, you observe the following option prices. Use these options to create a long buttertly spread with a maximum payoff at an underlying stock price of $50 45 strike price call; premium $6 50 strike price call; premium $3 55 strike price call; premium-$1 At what underlying stock price do you break-even? $45 and $55 $46 and $54 $47 and $53 $48 and $52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts