Question: A: B: C: D: Calculate the missing items in the income statement. Dollar amounts indicated are in thousands. The Income Tax field also includes interest

A:

B:

C:

C:

D:

D:

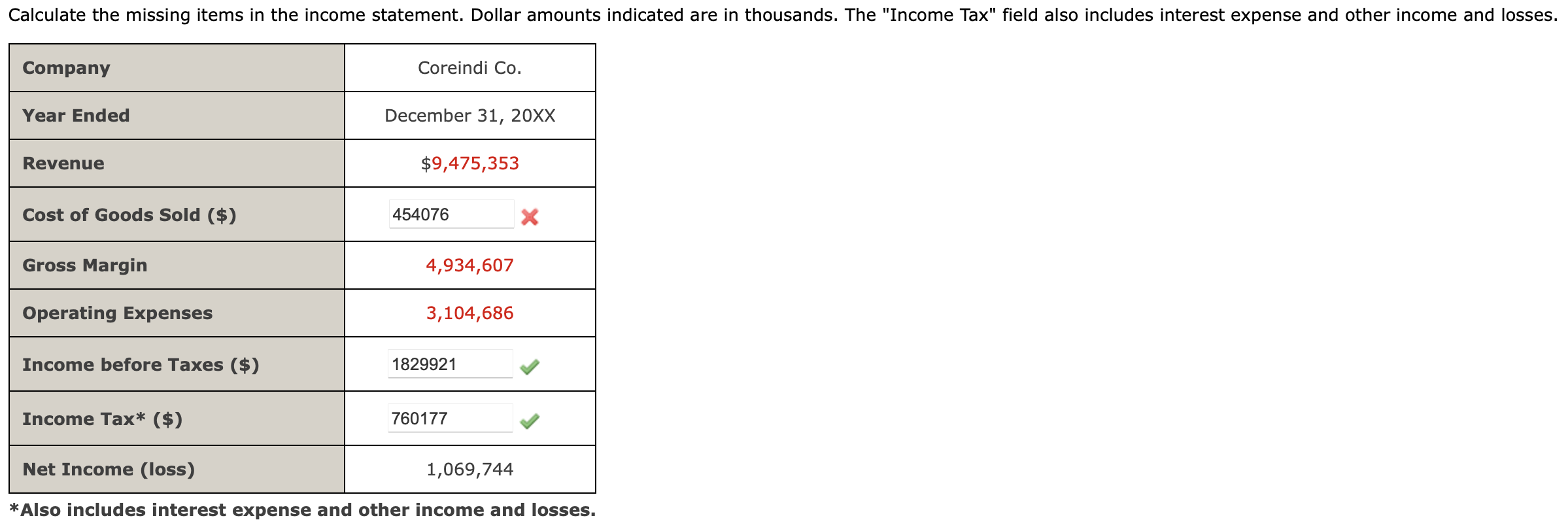

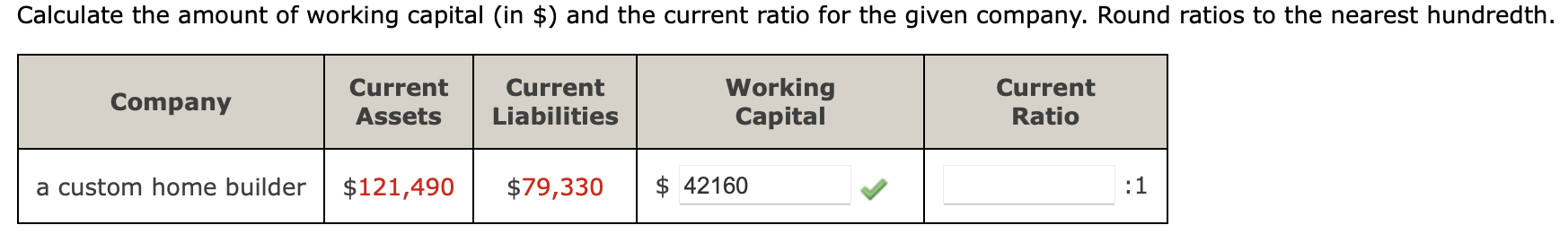

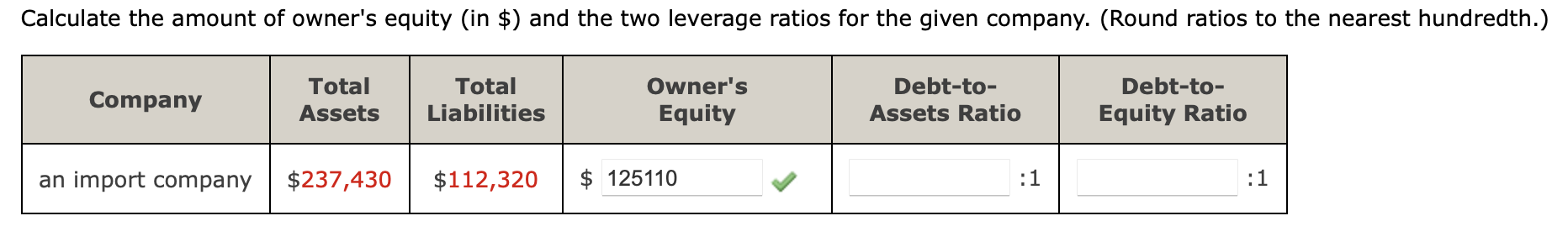

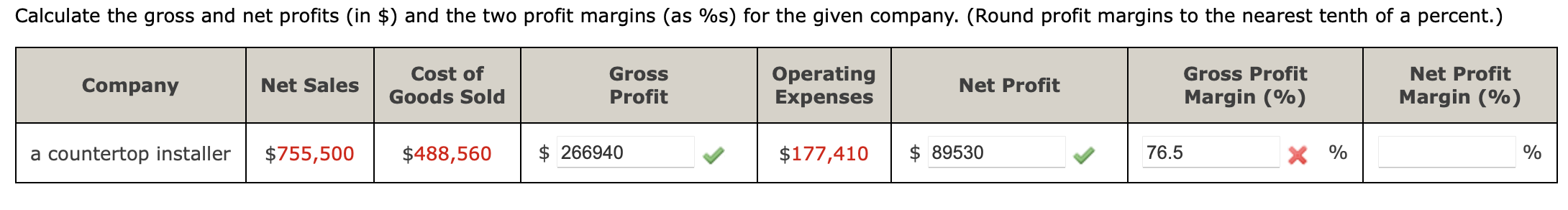

Calculate the missing items in the income statement. Dollar amounts indicated are in thousands. The "Income Tax" field also includes interest expense and other income and losses. Company Coreindi Co. Year Ended December 31, 20XX Revenue $9,475,353 Cost of Goods Sold ($) 454076 x Gross Margin 4,934,607 Operating Expenses 3,104,686 Income before Taxes ($) 1829921 Income Tax* ($) 760177 Net Income (loss) 1,069,744 * Also includes interest expense and other income and losses. Calculate the amount of working capital (in $) and the current ratio for the given company. Round ratios to the nearest hundredth. Company Current Assets Current Liabilities Working Capital Current Ratio a custom home builder $121,490 $79,330 $ 42160 :1 Calculate the amount of owner's equity (in $) and the two leverage ratios for the given company. (Round ratios to the nearest hundredth.) Company Total Assets Total Liabilities Owner's Equity Debt-to- Assets Ratio Debt-to- Equity Ratio an import company $237,430 $112,320 $ 125110 :1 :1 Calculate the gross and net profits (in $) and the two profit margins (as %s) for the given company. (Round profit margins to the nearest tenth of a percent.) Company Net Sales Cost of Goods Sold Gross Profit Operating Expenses Net Profit Gross Profit Margin (%) Net Profit Margin (%) a countertop installer $755,500 $488,560 $ 266940 $177,410 $ 89530 76 76.5 X % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts