Question: Question 16 BULLET IMMUNIZATION. FOR THIS AND THE NEXT TWO QUESTIONS. A portfolio manager wishes to invest $9,734 in bonds and desires to earn 4.2%

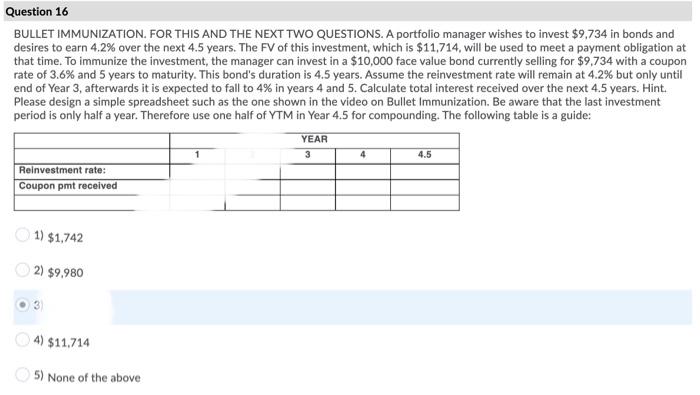

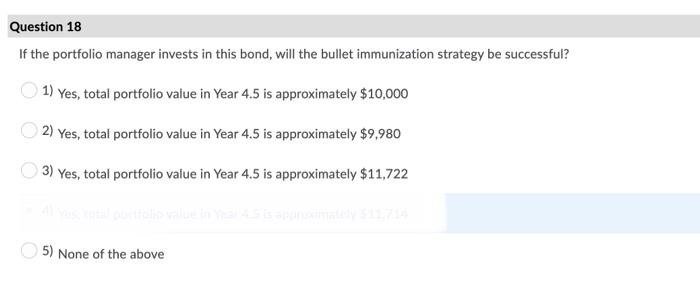

Question 16 BULLET IMMUNIZATION. FOR THIS AND THE NEXT TWO QUESTIONS. A portfolio manager wishes to invest $9,734 in bonds and desires to earn 4.2% over the next 4.5 years. The FV of this investment, which is $11,714, will be used to meet a payment obligation at that time. To immunize the investment, the manager can invest in a $10,000 face value bond currently selling for $9.734 with a coupon rate of 3.6% and 5 years to maturity. This bond's duration is 4.5 years. Assume the reinvestment rate will remain at 4.2% but only until end of Year 3, afterwards it is expected to fall to 4% in years 4 and 5. Calculate total interest received over the next 4.5 years. Hint. Please design a simple spreadsheet such as the one shown in the video on Bullet Immunization. Be aware that the last investment period is only half a year. Therefore use one half of YTM in Year 4.5 for compounding. The following table is a guide: YEAR 3 4 4.5 Reinvestment rate: Coupon pmt received 1) $1,742 2) $9.980 4) $11,714 5) None of the above Question 18 If the portfolio manager invests in this bond, will the bullet immunization strategy be successful? 1) Yes, total portfolio value in Year 4.5 is approximately $10,000 2) Yes, total portfolio value in Year 4.5 is approximately $9,980 3) Yes, total portfolio value in Year 4.5 is approximately $11,722 5) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts