Question: A B C D Depreciation Calculations - Double - Declining Balance On January 1 , 2 0 2 5 , Rosini Company bought a piece

A

B

C

D

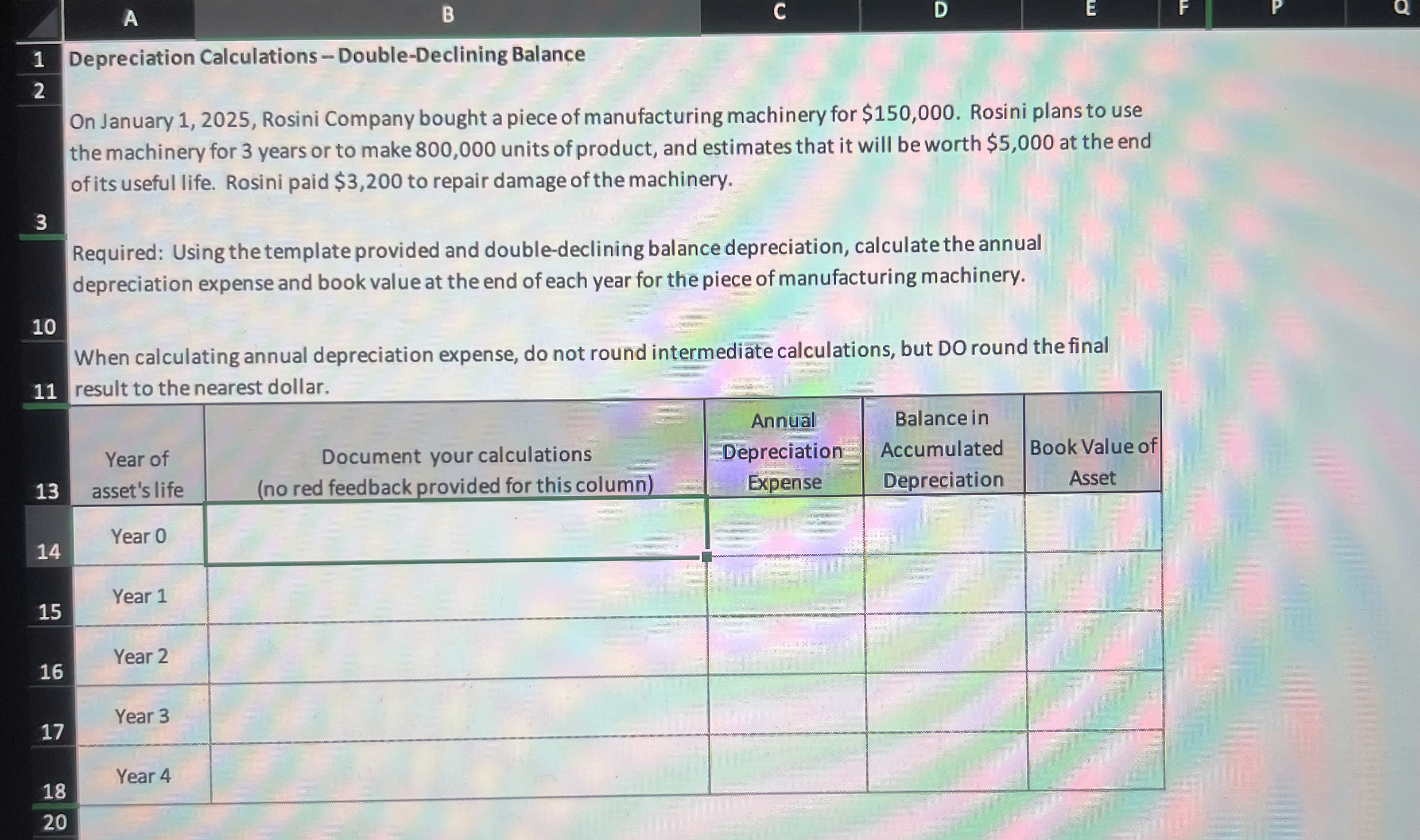

Depreciation Calculations DoubleDeclining Balance

On January Rosini Company bought a piece of manufacturing machinery for $ Rosini plans to use the machinery for years or to make units of product, and estimates that it will be worth $ at the end of its useful life. Rosini paid $ to repair damage of the machinery.

Required: Using the template provided and doubledeclining balance depreciation, calculate the annual depreciation expense and book value at the end of each year for the piece of manufacturing machinery.

When calculating annual depreciation expense, do not round intermediate calculations, but DO round the final

result to the nearest dollar.

tableYear of asset's life,Document your calculations no red feedback provided for this columnAnnual Depreciation Expense,tableBalance inAccumulatedDepreciationBook Value of AssetYear Year Year Year Year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock