Question: A B C D E 1 Part I: You have just won the state lottery and have two choices for collecting your winnings. You can

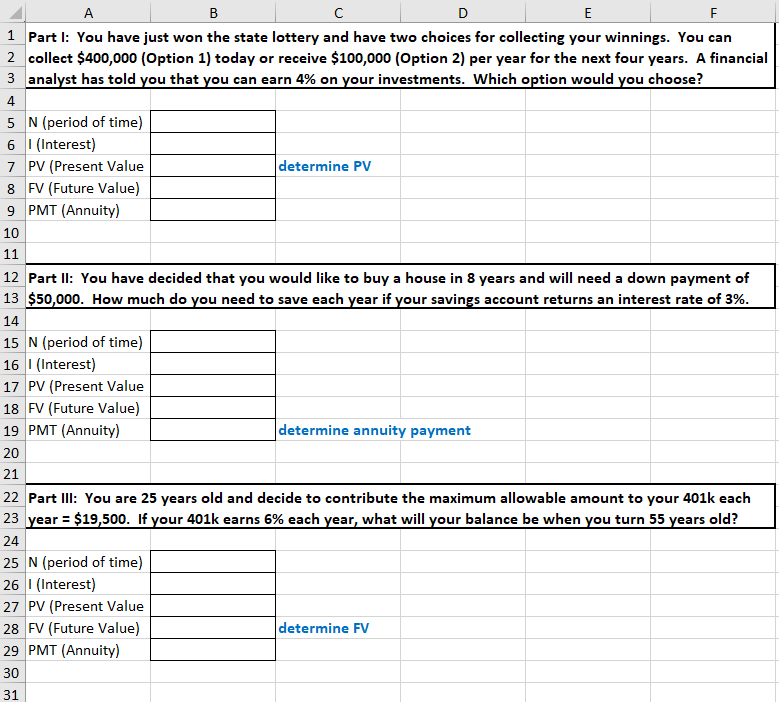

A B C D E 1 Part I: You have just won the state lottery and have two choices for collecting your winnings. You can 2 collect $400,000 (Option 1) today or receive $100,000 (Option 2) per year for the next four years. A financial 3 analyst has told you that you can earn 4% on your investments. Which option would you choose? 4 5 N (period of time) 6 (Interest) 7 PV (Present Value determine PV 8 FV (Future Value) 9 PMT (Annuity) 10 11 12 Part II: You have decided that you would like to buy a house in 8 years and will need a down payment of 13 $50,000. How much do you need to save each year if your savings account returns an interest rate of 3%. 14 15 N (period of time) 16 (Interest) 17 PV (Present Value 18 FV (Future Value) 19 PMT (Annuity) determine annuity payment 20 21 22 Part III: You are 25 years old and decide to contribute the maximum allowable amount to your 401k each 23 year = $19,500. If your 401k earns 6% each year, what will your balance be when you turn 55 years old? 24 25 N (period of time) 26 I (Interest) 27 PV (Present Value 28 FV (Future Value) determine FV 29 PMT (Annuity) 30 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts