Question: Windsor Industries acquired two copyrights during 2025. One copyright related to a textbook that was developed internally at a cost of $9,000. This textbook

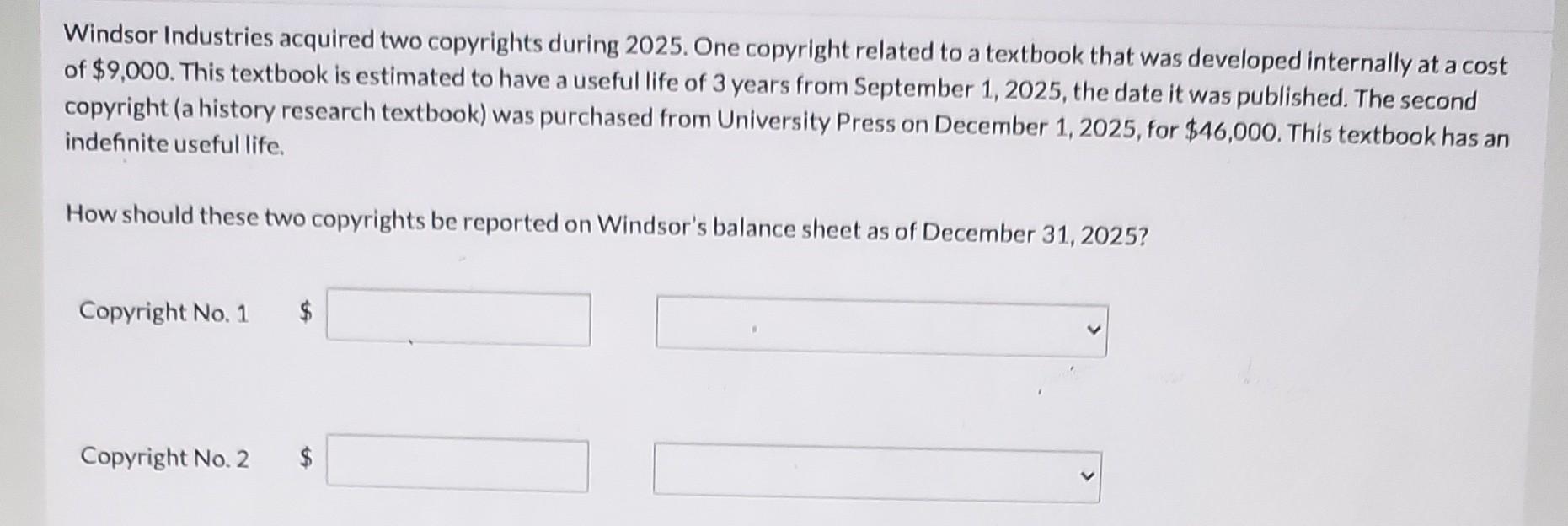

Windsor Industries acquired two copyrights during 2025. One copyright related to a textbook that was developed internally at a cost of $9,000. This textbook is estimated to have a useful life of 3 years from September 1, 2025, the date it was published. The second copyright (a history research textbook) was purchased from University Press on December 1, 2025, for $46,000. This textbook has an indefinite useful life. How should these two copyrights be reported on Windsor's balance sheet as of December 31, 2025? Copyright No. 1 Copyright No. 2 $ $ Windsor Industries acquired two copyrights during 2025. One copyright related to a textbook that was developed internally at a cost of $9,000. This textbook is estimated to have a useful life of 3 years from September 1, 2025, the date it was published. The second copyright (a history research textbook) was purchased from University Press on December 1, 2025, for $46,000. This textbook has an indefinite useful life. How should these two copyrights be reported on Windsor's balance sheet as of December 31, 2025? Copyright No. 1 Copyright No. 2 $ $

Step by Step Solution

There are 3 Steps involved in it

Heres how Windsor Industries should report the two copyrights on its balance sheet as of December 31... View full answer

Get step-by-step solutions from verified subject matter experts