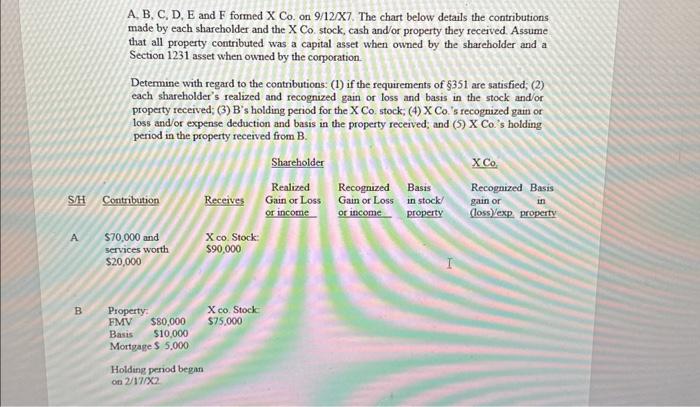

Question: A, B, C, D, E and F formed X Co. on 9/12/X7. The chart below details the contributions made by each shareholder and the X

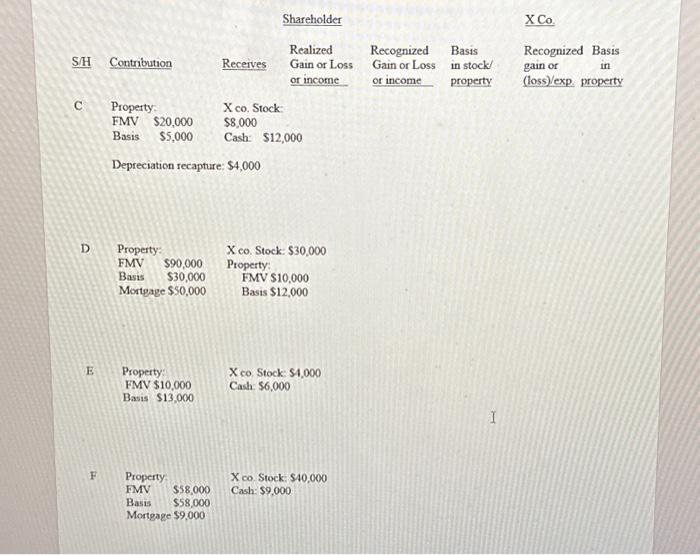

A, B, C, D, E and F formed X Co. on 9/12/X7. The chart below details the contributions made by each shareholder and the X Co. stock, cash and/or property they received. Assume that all property contributed was a capital asset when owned by the sharcholder and a Section 1231 asset when owned by the corporation. Determine with regard to the contributions: (1) if the requirements of $351 are satisfied; (2) each shareholder's realized and recognized gain or loss and basis in the stock and/or property received; (3) B's holding period for the X Co. stock; (4) X Co.'s recognized gain or loss and/or expense deduction and basis in the property recerved; and (S)XCo 's holding period in the property received from B. Shareholder Depreciation recapture: $4,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts