Question: PROBLEM: A , B , C , D , E and F formed X Co . on 9 / 1 2 / X 7 .

PROBLEM:

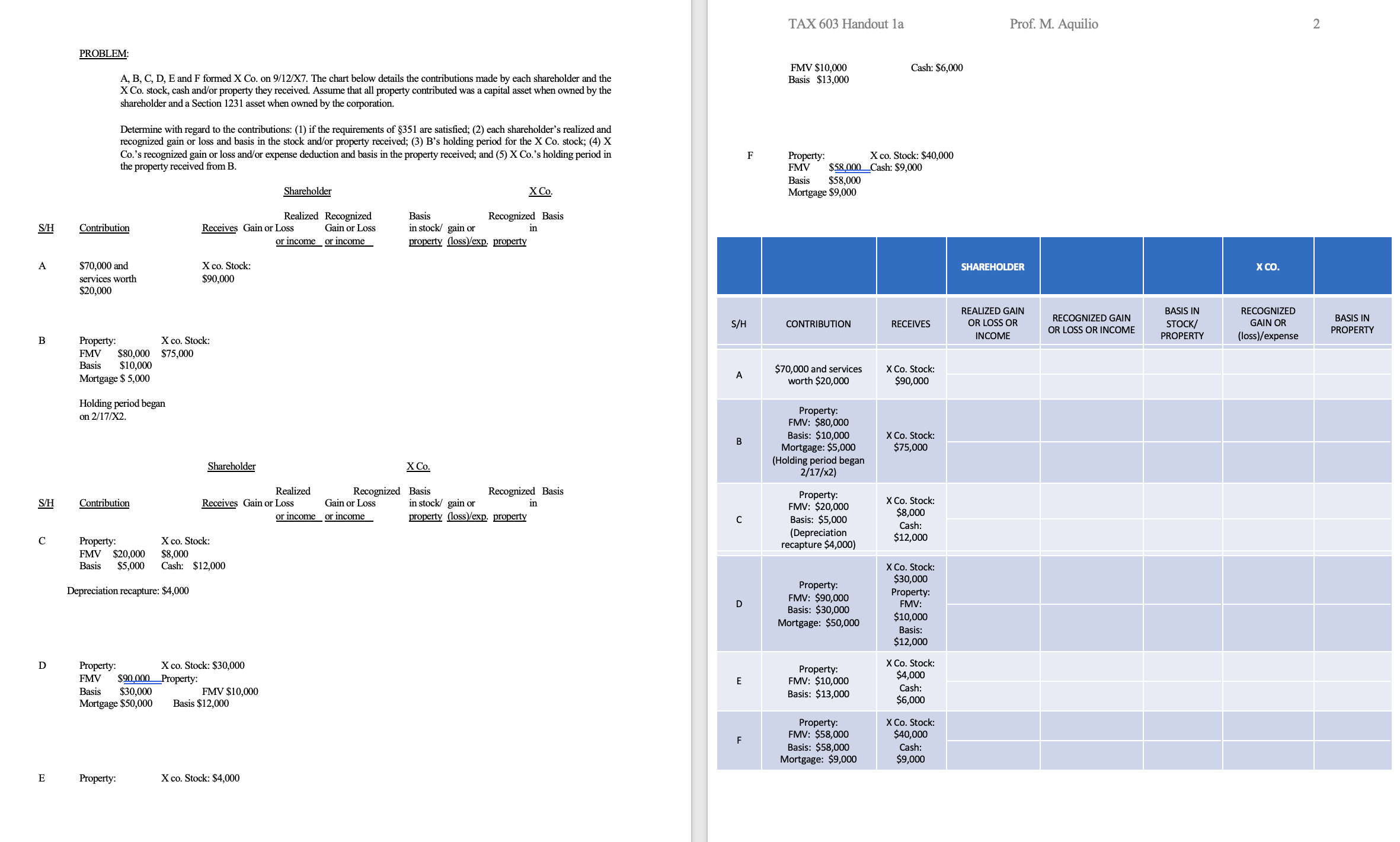

A B C D E and F formed X Co on X The chart below details the contributions made by each shareholder and the

X Co stock, cash andor property they received. Assume that all property contributed was a capital asset when owned by the

shareholder and a Section asset when owned by the corporation.

Determine with regard to the contributions: if the requirements of are satisfied; each shareholder's realized and

recognized gain or loss and basis in the stock andor property received; Bs holding period for the X Co stock; X

Cos recognized gain or loss andor expense deduction and basis in the property received; and X Cos holding period in

the property received from

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock