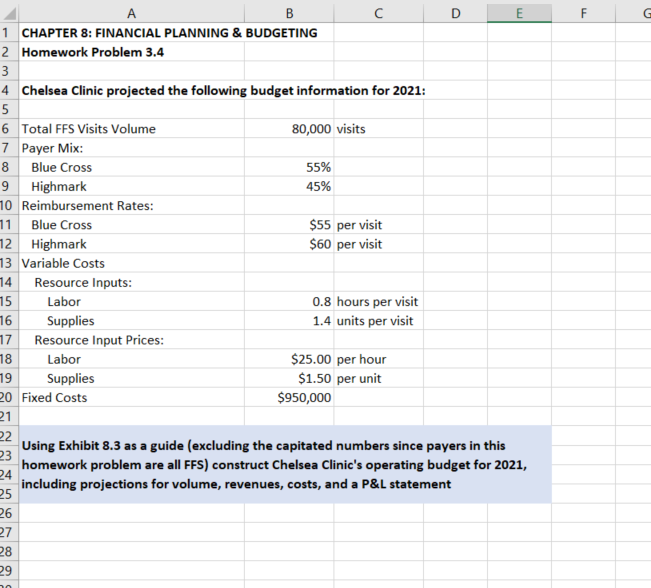

Question: A B C D E F 1 CHAPTER 8: FINANCIAL PLANNING & BUDGETING Homework Problem 3.4 W Chelsea Clinic projected the following budget information for

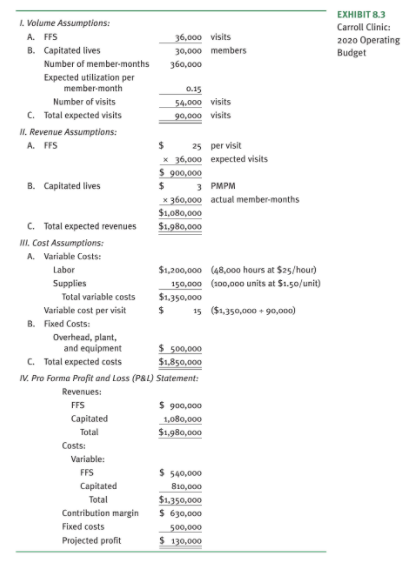

A B C D E F 1 CHAPTER 8: FINANCIAL PLANNING & BUDGETING Homework Problem 3.4 W Chelsea Clinic projected the following budget information for 2021: 6 Total FFS Visits Volume 80,000 visits 7 Payer Mix: 8 Blue Cross 55% 9 Highmark 45% 0 Reimbursement Rates: 1 Blue Cross $55 per visit 2 Highmark $60 per visit 13 Variable Costs 4 Resource Inputs: 15 Labor 0.8 hours per visit 16 Supplies 1.4 units per visit Resource Input Prices: 8 Labor $25.00 per hour 9 Supplies $1.50 per unit 10 Fixed Costs $950,000 Using Exhibit 8.3 as a guide (excluding the capitated numbers since payers in this homework problem are all FFS) construct Chelsea Clinic's operating budget for 2021, including projections for volume, revenues, costs, and a P&L statement 5 6 28 29EXHIBIT 8.3 L. Volume Assumptions: Carroll Clinic: A. FFS 36,000 visits 2020 Operating B. Capitated lives 30,000 members Budget Number of member-months 360,000 Expected utilization per member-month 0.15 Number of visits 54-000 visits C. Total expected visits 90,000 visits I. Revenue Assumptions: A. FFS 25 per visit x 36,000 expected visits $ 900,000 B. Capitated lives $ 3 PMPM x 360,000 actual member-months $1,080,000 C. Total expected revenues $1,980,000 IT. Cost Assumptions: A. Variable Costs: Labor $1,200,000 (48,000 hours at $25/hour) Supplies 150,000 (100,000 units at $1.50/unit) Total variable costs $1.350,000 Variable cost per visit $ 15 ($1,350,000 +90,000) B. Fixed Costs: Overhead, plant, and equipment $ 500,000 C. Total expected costs $1,850,000 IV. Pro Forma Profit and Loss (PAL) Statement: Revenues: FFS $ 900,000 Capitated 1,080,000 Total $1,980,000 Costs: Variable: FFS $ 540,000 Capitated 810,000 Total $1.350,000 Contribution margin $ 630,000 Fixed costs 500,000 Projected profit $ 130,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts