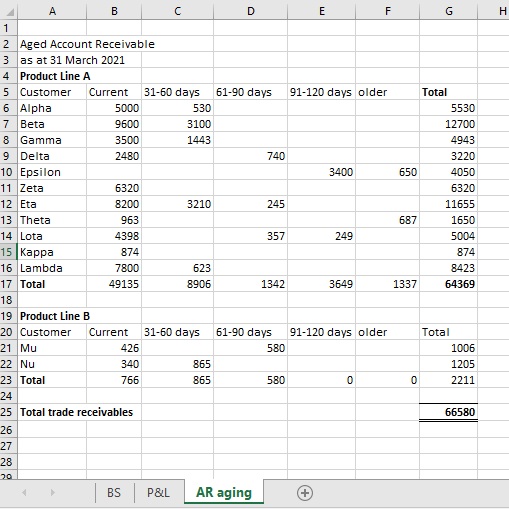

Question: A B C D E F G H Aged Account Receivable as at 31 March 2021 4 Product Line A 5 Customer Current 31-60 days

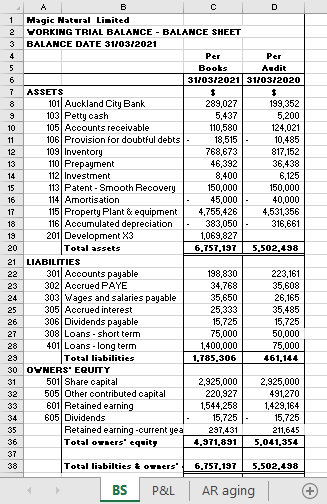

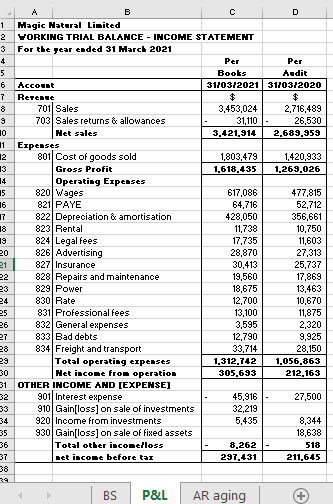

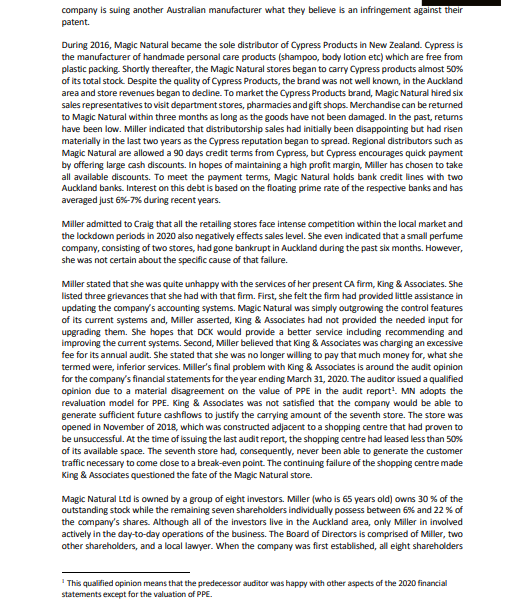

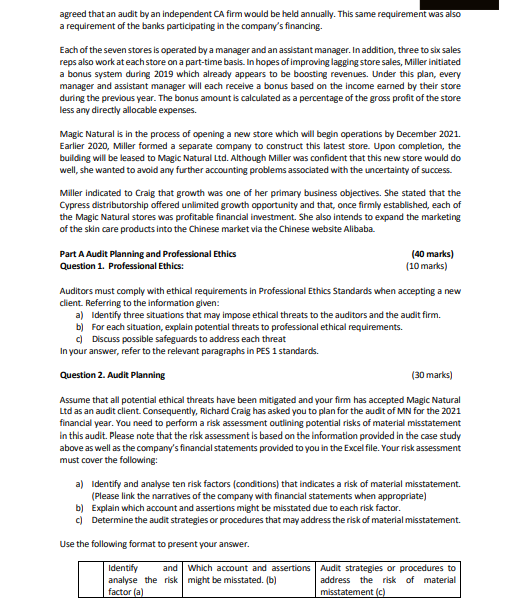

A B C D E F G H Aged Account Receivable as at 31 March 2021 4 Product Line A 5 Customer Current 31-60 days 61-90 days 91-120 days older Total 6 Alpha 5000 530 5530 7 Beta 9600 3100 12700 8 Gamma 3500 1443 4943 9 Delta 2480 740 3220 10 Epsilon 3400 650 4050 11 Zeta 6320 6320 12 Eta 8200 3210 245 11655 13 Theta 963 687 1650 14 Lota 4398 357 249 5004 Kappa 874 874 16 Lambda 7800 623 8423 17 Total 49135 8906 1342 3649 1337 64369 18 19 Product Line B 20 Customer Current 31-60 days 61-90 days 91-120 days older Total 21 Mu 426 580 1006 22 Nu 340 865 1205 23 Total 766 865 580 0 2211 24 25 Total trade receivables 66580 26 27 28 BS P &L AR aging +B C Magic Natural Limited YORKING TRIAL BALANCE - BALANCE SHEET 3 BALANCE DATE $1/03/2021 4 Per Per Books Andit 31/03/2021 31/03/2020 7 ASSETS $ 101 Auckland City Bank 289,027 199,352 103 Petty cash 5.437 5,200 10 105 Accounts receivable 110,580 124,021 11 106 Provision for doubtful debts 18,515 10,485 12 109 Inventory 768.673 817.152 13 110 Prepayment 46,392 36,438 14 112 Investment 8,400 6,125 15 113 Patent - Smooth Recovery 150,000 150,000 16 114 Amortisation 45,000 40,000 17 115 Property Plant & equipment 4,755,426 4,531,356 18 116 Accumulated depreciation 383,050 316,661 13 201 Development X3 1,069,827 20 Total assets 6.757.197 5.502.498 21 LIABILITIES 23 301 Accounts payable 198,830 223,161 23 302 Accrued PAYE 34,768 35,608 24 303 Wages and salaries payable 35,650 26,165 25 305 Accrued interest 25,333 35,485 26 306 Dividends payable 15,725 15,725 27 308 Loans - short term 75,000 50,000 28 401 Loans - long term 1,400,000 75,000 23 Total liabilities 1.785.306 461,144 30 OVNERS' EQUITY 31 501 Share capital 2,925,000 2.925,000 32 505 Other contributed capital 220,927 491,270 33 601 Retained earning 1,544.258 1,429,164 34 605 Dividends 15,725 15,725 35 Retained earning -current yea 237,431 211,645 36 Total owners' equity 4.971.891 5.041.354 37 38 Total liabilties & owners' 6.757.197 5.502.498 BS P &L AR agingB C Magic Natural Limited WORKING TRIAL BALANCE - INCOME STATEMENT 3 For the year ended 31 March 2021 Per Per Books Audit 6 Account 31/03/2021 31/03/2020 Revenue $ $ 8 701 Sales 3,453,024 2,716,489 A 703 Sales returns & allowances 31,110 26,530 Net sales 3.421.914 2.689.959 11 Expenses 2 801 Cost of goods sold 1,803,479 1,420,933 Gross Profit 1.618 435 1.269 026 14 Operating Expenses 5 820 Wages 617,086 477.815 16 821 PAYE 64,716 52,712 822 Depreciation & amortisation 428,050 356,661 823 Rental 11,738 10,750 324 Legal fees 17,735 11,603 826 Advertising 28,870 27,313 327 Insurance 30,413 25,737 12 828 Repairs and maintenance 19,560 17.869 829 Power 18,675 13,463 830 Rate 12,700 10,670 15 831 Professional fees 13,100 11,875 26 832 General expenses 3,595 2,320 27 833 Bad debts 12,790 9,925 834 Freight and transport 33,714 28,150 13 Total operating expenses 1.312.742 1.056.863 30 Net income from operation 305 693 212.163 31 OTHER INCOME AND [EXPENSE] 32 901 Interest expense 45,916 27,500 910 Gain[loss] on sale of investments 32,219 920 Income from investments 5.435 8,344 930 Gain[loss] on sale of fixed assets 18,638 Total other incomelloss B.262 518 37 net income before tar 297 431 211 645 BS P&L AR agingTHE AUDIT OF MAGIC NATURAL LIMITED Background Celia Miller is the Chief Executive Officer (CEO) of Magic Natural (MN) Lid, a manufacturer and wholesale distributor and retailer of toiletries and cosmetics based in Auckland. MN is a private company, Miller is both the Chair of the Board of Directors and CEO. Although Magic Natural Lid had previously been audited by King & Associates, a Chartered Accountants firm, Miller has recently become aware of DCK, Chartered Accountants, a second-tier accounting firm, through word of mouth. Her interest in the accounting firm was heightened when she discovered that DICK audited the primary bank with which she did business. In March 2020, Miller contacted her bankers who arranged for a lunch meeting with one of the CA firm's audit partners Richard Craig. At that time, a wide-ranging conversation was held concerning Magic Natural Lid as well as DCK. Miller discussed the history of the company along with her hopes for the future. She also discovered that one of her grandnephew (her sister's grandson] work for DCK as a senior associate auditor. Craig, in turn, described many of the attributes possessed by his CA firm. The firm has 12 offices throughout New Zealand and offers a range of services induding assurance, consulting, and tax. Subsequently, Miller appointed Richard Craig of DCK as the auditor for the financial audit of 2021. The reporting date for MN is 31 March. On 1 June 2020, another meeting was held to discuss further details about the potential engagement. Craig, Miller and you, Les Chang, an audit manager of DCK who would be assisting in the investigation of this prospective dient, were in that meeting. Both Craig and you were quite interested in learning as much as possible about the hand-made toiletries and cosmetics business. DCK has never had a client in this field. Thus, the engagement offers an excellent opportunity to break into a new industry. During a rather lengthy conversation with Miller, Craig and Chang were able to obtain a significant amount of information about the company and the possible audit engagement. During the conversation, the following facts about Magic Natural Ltd are established: Miller, a qualified cosmetic chemist, founded Magic Natural Ltd in 1995 as a wholesale distributor of hand- made soaps. Today, the company handles an expanded line of organic skin care products. The company sources ingredients both locally and internationally following its ethical buying policy. The products are produced in Auckland and distribute to retailers (like pharmacies and department stores) throughout New Zealand. In 2004, the production of hand-made soaps was dropped by Magic Natural in a move to concentrate on hair and skin care products. It also became a BioGro Certified organic skin care manufacturer during that year. BloGro certification program is awarded to manufacturers, producers and farmers who comply to organic standards. This certificate is trusted by consumers in New Zealand. With the expansion in business, the company started setting up retail stores to market its products in addition to wholesale distributions. This business did well and the company expanded thereafter at the rate of one new store every two or three years. Presently seven stores are in operation, three in Auckland with one in each of major cities in New Zealand. The first six were set up in rented spaces within shopping centres. However, the most recent store was located in a building constructed by Magic Natural itself, adjacent to a new shopping mall on the east side of Auckland. In addition, the company owns a two-stories building in East Tamaki Auckland. The ground floor is a warehouse, production and packaging lines and office area for packaging staff and sales personnel, and the upstairs provide office space for the company's administrative staff, a kitchen, laboratories and meeting rooms. The industry has multiple regulations to ensure the product is safe to use. The company has stringent quality control process and also invests heavily in its R&D to formulate new products. The company has a patent for its Smooth Recovery anti-aging serum. Currently thecompany is suing another Australian manufacturer what they believe is an infringement against their patent. During 2016, Magic Natural became the sole distributor of Cypress Products in New Zealand. Cypress is the manufacturer of handmade personal care products (shampoo, body lotion etc) which are free from plastic packing. Shortly thereafter, the Magic Natural stores began to carry Cypress products almost 50%% of its total stock. Despite the quality of Cypress Products, the brand was not well known, in the Auckland area and store revenues began to dedine. To market the Cypress Products brand, Magic Natural hired six sales representatives to visit department stores, pharmacies and gift shops. Merchandise can be returned to Magic Natural within three months as long as the goods have not been damaged. In the past, returns have been low. Miller indicated that distributorship sales had initially been disappointing but had risen materially in the last two years as the Cypress reputation began to spread. Regional distributors such as Magic Natural are allowed a 90 days credit terms from Cypress, but Cypress encourages quick payment by offering large cash discounts. In hopes of maintaining a high profit margin, Miller has chosen to take all available discounts. To meet the payment terms, Magic Natural holds bank credit lines with two Auckland banks. Interest on this debt is based on the floating prime rate of the respective banks and has averaged just 6%-7% during recent years. Miller admitted to Craig that all the retailing stores face intense competition within the local market and the lockdown periods in 2020 also negatively effects sales level. She even indicated that a small perfume company, consisting of two stores, had gone bankrupt in Auckland during the past six months. However, she was not certain about the specific cause of that failure. Miller stated that she was quite unhappy with the services of her present CA firm, King & Associates. She listed three grievances that she had with that firm. First, she felt the firm had provided little assistance in updating the company's accounting systems. Magic Natural was simply outgrowing the control features of its current systems and, Miller asserted, King & Associates had not provided the needed input for upgrading them. She hopes that DCK would provide a better service including recommending and improving the current systems. Second, Miller believed that King & Associates was charging an excessive fee for its annual audit. She stated that she was no longer willing to pay that much money for, what she termed were, inferior services. Miller's final problem with King & Associates is around the audit opinion for the company's financial statements for the year ending March 31, 2020. The auditor issued a qualified opinion due to a material disagreement on the value of PPE in the audit report'. MN adopts the revaluation model for PPE. King & Associates was not satisfied that the company would be able to generate sufficient future cashflows to justify the carrying amount of the seventh store. The store was opened in November of 2018, which was constructed adjacent to a shopping centre that had proven to be unsuccessful. At the time of issuing the last audit report, the shopping centre had leased less than 50%% of its available space. The seventh store had, consequently, never been able to generate the customer traffic necessary to come close to a break-even point. The continuing failure of the shopping centre made King & Associates questioned the fate of the Magic Natural store. Magic Natural Lid is owned by a group of eight investors. Miller (who is 65 years old) owns 30 % of the outstanding stock while the remaining seven shareholders individually possess between 6% and 22 % of the company's shares. Although all of the investors live in the Auckland area, only Miller in involved actively in the day-to-day operations of the business. The Board of Directors is comprised of Miller, two other shareholders, and a local lawyer. When the company was first established, all eight shareholders This qualified opinion means that the predecessor auditor was happy with other aspects of the 2020 financial statements except for the valuation of PPE.agreed that an audit by an independent CA firm would be held annually. This same requirement was also a requirement of the banks participating in the company's financing. Each of the seven stores is operated by a manager and an assistant manager. In addition, three to six sales reps also work at each store on a part-time basis. In hopes of improving lagging store sales, Miller initiated a bonus system during 2019 which already appears to be boosting revenues. Under this plan, every manager and assistant manager will each receive a bonus based on the income earned by their store during the previous year. The bonus amount is calculated as a percentage of the gross profit of the store less any directly allocable expenses. Magic Natural is in the process of opening a new store which will begin operations by December 2021. Earlier 2020, Miller formed a separate company to construct this latest store. Upon completion, the building will be leased to Magic Natural Lid. Although Miller was confident that this new store would do well, she wanted to avoid any further accounting problems associated with the uncertainty of success. Miller indicated to Craig that growth was one of her primary business objectives. She stated that the Cypress distributorship offered unlimited growth opportunity and that, once firmly established, each of the Magic Natural stores was profitable financial investment. She also intends to expand the marketing of the skin care products into the Chinese market via the Chinese website Alibaba. Part A Audit Planning and Professional Ethics (40 marks) Question 1. Professional Ethics: [10 marks) Auditors must comply with ethical requirements in Professional Ethics Standards when accepting a new client. Referring to the information given: a) Identify three situations that may impose ethical threats to the auditors and the audit firm. bj For each situation, explain potential threats to professional ethical requirements. c) Discuss possible safeguards to address each threat In your answer, refer to the relevant paragraphs in PES 1 standards. Question 2. Audit Planning (30 marks) Assume that all potential ethical threats have been mitigated and your firm has accepted Magic Natural Lid as an audit client. Consequently, Richard Craig has asked you to plan for the audit of MN for the 2021 financial year. You need to perform a risk assessment outlining potential risks of material misstatement In this audit. Please note that the risk assessment is based on the information provided in the case study above as well as the company's financial statements provided to you in the Excel file. Your risk assessment must cover the following: a) Identify and analyse ten risk factors (conditions) that indicates a risk of material misstatement. (Please link the narratives of the company with financial statements when appropriate) Explain which account and assertions might be misstated due to each risk factor. Determine the audit strategies or procedures that may address the risk of material misstatement. Use the following format to present your answer. Identify and | Which account and assertions Audit strategies or procedures to analyse the risk might be misstated. (b] address the risk of material factor (a) misstatement (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts