Question: Hi Tutor, Please answer Part B - Question 3 & 4 Please provide a reference to support your answer. Thanks. A B C D E

Hi Tutor,

Please answer Part B - Question 3 & 4

Please provide a reference to support your answer.

Thanks.

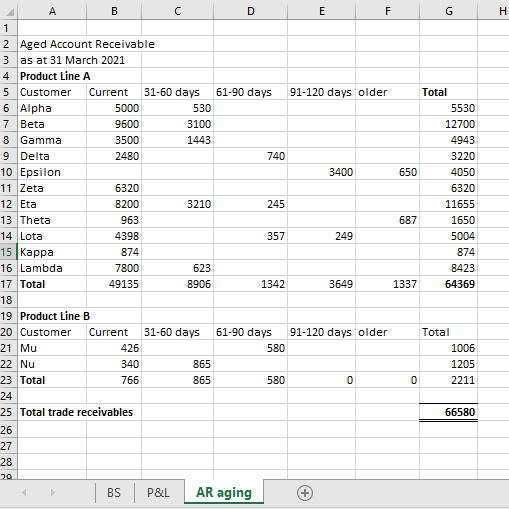

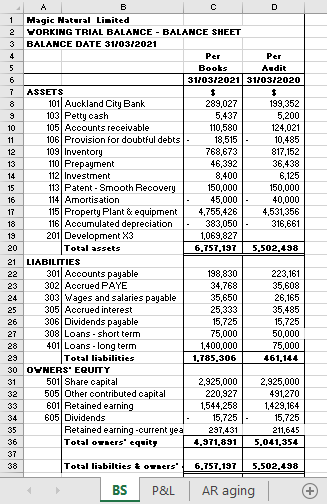

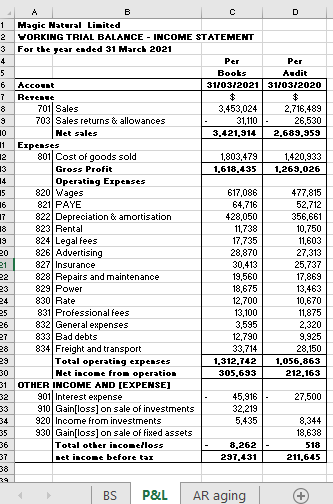

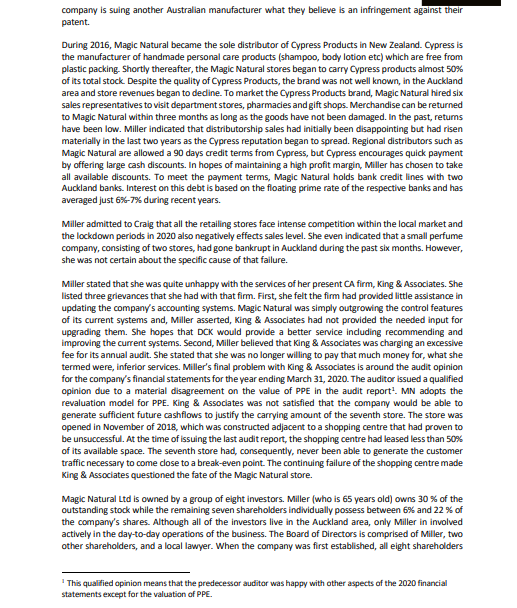

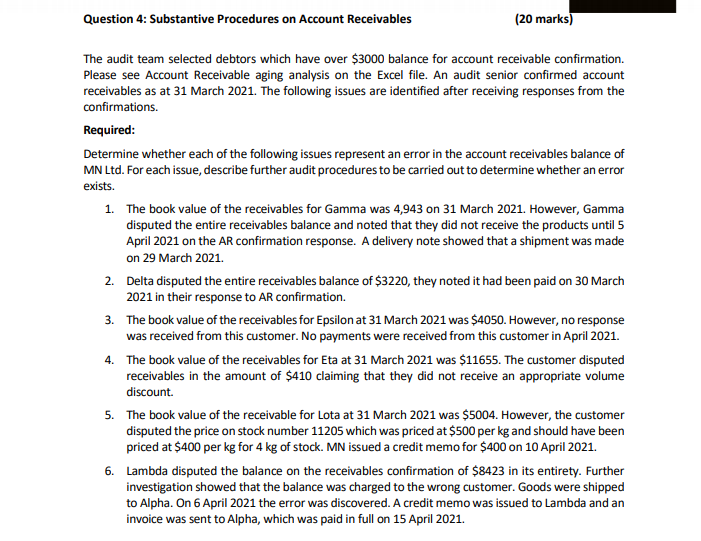

A B C D E F G H Aged Account Receivable as at 31 March 2021 4 Product Line A 5 Customer Current 31-60 days 61-90 days 91-120 days older Total 6 Alpha 5000 530 5530 7 Beta 9600 3100 12700 8 Gamma 3500 1443 4943 9 Delta 2480 740 3220 10 Epsilon 3400 650 4050 11 Zeta 6320 6320 12 Eta 8200 3210 245 11655 13 Theta 963 687 1650 14 Lota 4398 357 249 5004 Kappa 874 874 16 Lambda 7800 623 8423 17 Total 49135 8906 1342 3649 1337 64369 18 19 Product Line B 20 Customer Current 31-60 days 61-90 days 91-120 days older Total 21 Mu 426 580 1006 22 Nu 340 865 1205 23 Total 766 865 580 0 2211 24 25 Total trade receivables 66580 26 27 28 BS P &L AR aging +B C Magic Natural Limited YORKING TRIAL BALANCE - BALANCE SHEET 3 BALANCE DATE $1/03/2021 4 Per Per Books Andit 31/03/2021 31/03/2020 7 ASSETS $ 101 Auckland City Bank 289,027 199,352 103 Petty cash 5.437 5,200 10 105 Accounts receivable 110,580 124,021 11 106 Provision for doubtful debts 18,515 10,485 12 109 Inventory 768.673 817.152 13 110 Prepayment 46,392 36,438 14 112 Investment 8,400 6,125 15 113 Patent - Smooth Recovery 150,000 150,000 16 114 Amortisation 45,000 40,000 17 115 Property Plant & equipment 4,755,426 4,531,356 18 116 Accumulated depreciation 383,050 316,661 13 201 Development X3 1,069,827 20 Total assets 6.757.197 5.502.498 21 LIABILITIES 23 301 Accounts payable 198,830 223,161 23 302 Accrued PAYE 34,768 35,608 24 303 Wages and salaries payable 35,650 26,165 25 305 Accrued interest 25,333 35,485 26 306 Dividends payable 15,725 15,725 27 308 Loans - short term 75,000 50,000 28 401 Loans - long term 1,400,000 75,000 23 Total liabilities 1.785.306 461,144 30 OVNERS' EQUITY 31 501 Share capital 2,925,000 2.925,000 32 505 Other contributed capital 220,927 491,270 33 601 Retained earning 1,544.258 1,429,164 34 605 Dividends 15,725 15,725 35 Retained earning -current yea 237,431 211,645 36 Total owners' equity 4.971.891 5.041.354 37 38 Total liabilties & owners' 6.757.197 5.502.498 BS P &L AR agingB C Magic Natural Limited WORKING TRIAL BALANCE - INCOME STATEMENT 3 For the year ended 31 March 2021 Per Per Books Audit 6 Account 31/03/2021 31/03/2020 Revenue $ $ 8 701 Sales 3,453,024 2,716,489 A 703 Sales returns & allowances 31,110 26,530 Net sales 3.421.914 2.689.959 11 Expenses 2 801 Cost of goods sold 1,803,479 1,420,933 Gross Profit 1.618 435 1.269 026 14 Operating Expenses 5 820 Wages 617,086 477.815 16 821 PAYE 64,716 52,712 822 Depreciation & amortisation 428,050 356,661 823 Rental 11,738 10,750 324 Legal fees 17,735 11,603 826 Advertising 28,870 27,313 327 Insurance 30,413 25,737 12 828 Repairs and maintenance 19,560 17.869 829 Power 18,675 13,463 830 Rate 12,700 10,670 15 831 Professional fees 13,100 11,875 26 832 General expenses 3,595 2,320 27 833 Bad debts 12,790 9,925 834 Freight and transport 33,714 28,150 13 Total operating expenses 1.312.742 1.056.863 30 Net income from operation 305 693 212.163 31 OTHER INCOME AND [EXPENSE] 32 901 Interest expense 45,916 27,500 910 Gain[loss] on sale of investments 32,219 920 Income from investments 5.435 8,344 930 Gain[loss] on sale of fixed assets 18,638 Total other incomelloss B.262 518 37 net income before tar 297 431 211 645 BS P&L AR agingTHE AUDIT OF MAGIC NATURAL LIMITED Background Celia Miller is the Chief Executive Officer (CEO) of Magic Natural (MN) Lid, a manufacturer and wholesale distributor and retailer of toiletries and cosmetics based in Auckland. MN is a private company, Miller is both the Chair of the Board of Directors and CEO. Although Magic Natural Lid had previously been audited by King & Associates, a Chartered Accountants firm, Miller has recently become aware of DCK, Chartered Accountants, a second-tier accounting firm, through word of mouth. Her interest in the accounting firm was heightened when she discovered that DICK audited the primary bank with which she did business. In March 2020, Miller contacted her bankers who arranged for a lunch meeting with one of the CA firm's audit partners Richard Craig. At that time, a wide-ranging conversation was held concerning Magic Natural Lid as well as DCK. Miller discussed the history of the company along with her hopes for the future. She also discovered that one of her grandnephew (her sister's grandson] work for DCK as a senior associate auditor. Craig, in turn, described many of the attributes possessed by his CA firm. The firm has 12 offices throughout New Zealand and offers a range of services induding assurance, consulting, and tax. Subsequently, Miller appointed Richard Craig of DCK as the auditor for the financial audit of 2021. The reporting date for MN is 31 March. On 1 June 2020, another meeting was held to discuss further details about the potential engagement. Craig, Miller and you, Les Chang, an audit manager of DCK who would be assisting in the investigation of this prospective dient, were in that meeting. Both Craig and you were quite interested in learning as much as possible about the hand-made toiletries and cosmetics business. DCK has never had a client in this field. Thus, the engagement offers an excellent opportunity to break into a new industry. During a rather lengthy conversation with Miller, Craig and Chang were able to obtain a significant amount of information about the company and the possible audit engagement. During the conversation, the following facts about Magic Natural Ltd are established: Miller, a qualified cosmetic chemist, founded Magic Natural Ltd in 1995 as a wholesale distributor of hand- made soaps. Today, the company handles an expanded line of organic skin care products. The company sources ingredients both locally and internationally following its ethical buying policy. The products are produced in Auckland and distribute to retailers (like pharmacies and department stores) throughout New Zealand. In 2004, the production of hand-made soaps was dropped by Magic Natural in a move to concentrate on hair and skin care products. It also became a BioGro Certified organic skin care manufacturer during that year. BloGro certification program is awarded to manufacturers, producers and farmers who comply to organic standards. This certificate is trusted by consumers in New Zealand. With the expansion in business, the company started setting up retail stores to market its products in addition to wholesale distributions. This business did well and the company expanded thereafter at the rate of one new store every two or three years. Presently seven stores are in operation, three in Auckland with one in each of major cities in New Zealand. The first six were set up in rented spaces within shopping centres. However, the most recent store was located in a building constructed by Magic Natural itself, adjacent to a new shopping mall on the east side of Auckland. In addition, the company owns a two-stories building in East Tamaki Auckland. The ground floor is a warehouse, production and packaging lines and office area for packaging staff and sales personnel, and the upstairs provide office space for the company's administrative staff, a kitchen, laboratories and meeting rooms. The industry has multiple regulations to ensure the product is safe to use. The company has stringent quality control process and also invests heavily in its R&D to formulate new products. The company has a patent for its Smooth Recovery anti-aging serum. Currently thecompany is suing another Australian manufacturer what they believe is an infringement against their patent. During 2016, Magic Natural became the sole distributor of Cypress Products in New Zealand. Cypress is the manufacturer of handmade personal care products (shampoo, body lotion etc) which are free from plastic packing. Shortly thereafter, the Magic Natural stores began to carry Cypress products almost 50%% of its total stock. Despite the quality of Cypress Products, the brand was not well known, in the Auckland area and store revenues began to dedine. To market the Cypress Products brand, Magic Natural hired six sales representatives to visit department stores, pharmacies and gift shops. Merchandise can be returned to Magic Natural within three months as long as the goods have not been damaged. In the past, returns have been low. Miller indicated that distributorship sales had initially been disappointing but had risen materially in the last two years as the Cypress reputation began to spread. Regional distributors such as Magic Natural are allowed a 90 days credit terms from Cypress, but Cypress encourages quick payment by offering large cash discounts. In hopes of maintaining a high profit margin, Miller has chosen to take all available discounts. To meet the payment terms, Magic Natural holds bank credit lines with two Auckland banks. Interest on this debt is based on the floating prime rate of the respective banks and has averaged just 6%-7% during recent years. Miller admitted to Craig that all the retailing stores face intense competition within the local market and the lockdown periods in 2020 also negatively effects sales level. She even indicated that a small perfume company, consisting of two stores, had gone bankrupt in Auckland during the past six months. However, she was not certain about the specific cause of that failure. Miller stated that she was quite unhappy with the services of her present CA firm, King & Associates. She listed three grievances that she had with that firm. First, she felt the firm had provided little assistance in updating the company's accounting systems. Magic Natural was simply outgrowing the control features of its current systems and, Miller asserted, King & Associates had not provided the needed input for upgrading them. She hopes that DCK would provide a better service including recommending and improving the current systems. Second, Miller believed that King & Associates was charging an excessive fee for its annual audit. She stated that she was no longer willing to pay that much money for, what she termed were, inferior services. Miller's final problem with King & Associates is around the audit opinion for the company's financial statements for the year ending March 31, 2020. The auditor issued a qualified opinion due to a material disagreement on the value of PPE in the audit report'. MN adopts the revaluation model for PPE. King & Associates was not satisfied that the company would be able to generate sufficient future cashflows to justify the carrying amount of the seventh store. The store was opened in November of 2018, which was constructed adjacent to a shopping centre that had proven to be unsuccessful. At the time of issuing the last audit report, the shopping centre had leased less than 50%% of its available space. The seventh store had, consequently, never been able to generate the customer traffic necessary to come close to a break-even point. The continuing failure of the shopping centre made King & Associates questioned the fate of the Magic Natural store. Magic Natural Lid is owned by a group of eight investors. Miller (who is 65 years old) owns 30 % of the outstanding stock while the remaining seven shareholders individually possess between 6% and 22 % of the company's shares. Although all of the investors live in the Auckland area, only Miller in involved actively in the day-to-day operations of the business. The Board of Directors is comprised of Miller, two other shareholders, and a local lawyer. When the company was first established, all eight shareholders This qualified opinion means that the predecessor auditor was happy with other aspects of the 2020 financial statements except for the valuation of PPE.agreed that an audit by an independent CA firm would be held annually. This same requirement was also a requirement of the banks participating in the company's financing. Each of the seven stores is operated by a manager and an assistant manager. In addition, three to six sales reps also work at each store on a part-time basis. In hopes of improving lagging store sales, Miller initiated a bonus system during 2019 which already appears to be boosting revenues. Under this plan, every manager and assistant manager will each receive a bonus based on the income earned by their store during the previous year. The bonus amount is calculated as a percentage of the gross profit of the store less any directly allocable expenses. Magic Natural is in the process of opening a new store which will begin operations by December 2021. Earlier 2020, Miller formed a separate company to construct this latest store. Upon completion, the building will be leased to Magic Natural Lid. Although Miller was confident that this new store would do well, she wanted to avoid any further accounting problems associated with the uncertainty of success. Miller indicated to Craig that growth was one of her primary business objectives. She stated that the Cypress distributorship offered unlimited growth opportunity and that, once firmly established, each of the Magic Natural stores was profitable financial investment. She also intends to expand the marketing of the skin care products into the Chinese market via the Chinese website Alibaba. Part A Audit Planning and Professional Ethics (40 marks) Question 1. Professional Ethics: [10 marks) Auditors must comply with ethical requirements in Professional Ethics Standards when accepting a new client. Referring to the information given: a) Identify three situations that may impose ethical threats to the auditors and the audit firm. bj For each situation, explain potential threats to professional ethical requirements. c) Discuss possible safeguards to address each threat In your answer, refer to the relevant paragraphs in PES 1 standards. Question 2. Audit Planning (30 marks) Assume that all potential ethical threats have been mitigated and your firm has accepted Magic Natural Lid as an audit client. Consequently, Richard Craig has asked you to plan for the audit of MN for the 2021 financial year. You need to perform a risk assessment outlining potential risks of material misstatement In this audit. Please note that the risk assessment is based on the information provided in the case study above as well as the company's financial statements provided to you in the Excel file. Your risk assessment must cover the following: a) Identify and analyse ten risk factors (conditions) that indicates a risk of material misstatement. (Please link the narratives of the company with financial statements when appropriate) Explain which account and assertions might be misstated due to each risk factor. Determine the audit strategies or procedures that may address the risk of material misstatement. Use the following format to present your answer. Identify and | Which account and assertions Audit strategies or procedures to analyse the risk might be misstated. (b] address the risk of material factor (a) misstatement (c)PART B: UNDERSTANDING THE INTERNAL CONTROL PROCESS AND ASSESSING CONTROL RISK MN customers are a mix of businesses, such as pharmacies, department stores, hotels, beauty spas and bouquet gifts stores and individual consumers. The businesses customers can buy on accounts and individual consumers purchase via the seven stores or MN's website. As part of the interim audit, Ann Hill the audit senior on this audit has completed a 'walk-through' to understand the sales processes. The following is a summary of the procedures she documented on the audit file: General information on Magic Natural Ltd's IT computer systems Magic Natural Lid owns its own computers and computer software for sales, inventory management, purchases, payroll, general ledger, and other accounting applications. None of the accounting processing is outsourced. Darshana Patel, the IT manager heads Magic Natural's computer operations. Darshana is relatively new to the company. She also has taken on the responsibility for system security. Emily Wong serves as an assistant to the Financial Controller, Mike Penrose, and she is responsible for following-up on exception reports generated by the computer systems (outlined below). The company's accounting and inventory management systems comprises a network of computers at locations in the offices, warehouse and a central server to handle all accounting and inventory entries. Printers are located in areas in which printed documents or records are routinely needed. The computer system is used to control and process most transactions, to print documents, produce accounting records, and prepare periodic financial statements. Access is controlled by passwords. Only employees with jobs requiring computer data entry or access to file information and reports are given passwords. Passwords are required to enter the system and specific applications within the system. All entered data are processed by batch processing at the end of the day. Data is stored in the respective transaction files in the central server. Most input is backed up by paper trails of source documents. The company has strong backup capabilities and no hardware malfunctions have resulted in the loss of data. Initiating Sales Business customers make orders via phone or email to sales staff. Sales orders are entered into the computer by sales staff. The computer only accepts a sales order if the customer is in the approved customer list. If the customer is not on the approved customer list the order is routed to Emily Wong who searches the prospective customer's credit background and compile the information for Mike Penrose to review. Mike then puts his written approval or disapproval on the credit report. If credit is not approved, Emily contacts the customer directly and asks if the company is prepared to pay before delivery. If the customer is willing to pay before delivery, the customer will be on the approved customer list with a notation to ship only on payment received basis. If credit is approved, the customer is added to the approved customer list by Emily and a credit limit of $3000 is automatically assigned. For credit sales, the standards payment term is 30 days since the day of shipment, but this can be negotiated. An interest is charged on all receivables over 30 days or an agreed period (if a customer has non- standards credit limit or payment terms) at a rate of Official Cash Rate (OCR) plus two percent. Mike Penrose and Emily Wong are the only individuals with authority to update the approved customer master file which includes information on whether goods can be shipped on credit or pay before delivery. Delivering GoodsA sales order is stored in ordering transaction file. Every night, the computer in Warehouse retrieves information from the ordering transaction file. In the morning, a warehouse supervisor accesses the computer and prints out the list of sales orders. The warehouse supervisor works with a warehouse clerk together to pack each order on the list (they split the list to pack. For example, each person packs 20 orders). Whoever packs an order also prepares a triplet of pre-numbered packing slips. One copy goes with the package to be shipped, one copy goes on file in the Warehouse and the third copy goes to Emily (see below). The warehouse supervisor then updates the computer based on all the packing slips to show that the sales orders have been packed. At this time, the inventory level is reduced. Once the products are packed, the packages are shipped on the day or the next day. MN uses an external carrier to deliver chemicals. The carrier comes once a day to pick up the packages in the afternoon, they give the Warehouse a delivery docket for each shipment. After the carrier picks up the packages, the corresponding packing slips and the delivery dockets, which signed by the freight carrier, are sent to Emily- According to the sales policy, the sales are recognised at time of shipping. Recording Sales Once the Warehouse updates the sales orders as packed, both the sales transaction file and the accounts receivable master file are updated. Sales invoices are prepared every night based on the information entered in the Warehouse. The computer prepares an invoice based on the customer information, the information on goods shipped, and the pricing information from the master price file. Approved prices are modified quarterly based on quantities in inventory, recent production costs, and competitive forces in the marketplace. Prices are determined at a meeting involving Celia Miller, Mike Penrose and Alice Wilson, the sales director. Mike Penrose is responsible for updating the master price file, which is reviewed by Alice. The company also grants a 5% discount to orders over $5000, which automatically calculated by the computer. The computer checks to see that the following fields have appropriate alpha or numeric information before the invoice is processed: . Customer information (code and address) . Quantities ordered for each stock number . Quantities packed for each stock number . Prices are checked against the master price list . Packing slip number The computer performs a reasonableness test on the amount of the sale invoice based on the customer number and customer sales history. A transaction is not processed without further approval if the calculated sales invoice is greater than 120%% of the largest sale to the customer in the last two years. The computer automatically sends an electronic invoice to the contact details stored in the approved customer file. Transactions that do not pass the above controls are not processed and are printed on an error report. Emily Wong is responsible for clearing all exceptions in the next day, including approving sales that exceed the reasonableness test. Receiving payments Customers are required to pay directly to the bank accounts of Magic Natural. Kathy Bloom, the cashier, logs onto MN's internet banking (view only access) and prepares a daily list of receipts received. The daily list of receipts is sent to Emily who receives remittance advices from customers. (Not all customers sentremittance advices). Emily agrees the amount showed in the list to the corresponding sales invoice and remittance advice. If it agrees, she ticks the invoice as paid in the computer, which reduces the account receivables balances. Other Procedures Emily prepares a monthly bank reconciliation which is reviewed by Mike. Mike also reviews an aging of accounts receivable monthly. She and Emily Wong follow-up on past due accounts. Mike Penrose prepares any journal entries to write-off accounts receivable for amount this is overdue over 120 days. Question 3 Assessing control risks in the revenue cycle (40 Marks) Identify four control weaknesses in the revenue cycle. Explain how each control weakness may affect the financial statements (i.e. which accounts and assertions are at risk of material misstatement) and identify the audit procedures to test the account(s) and assertion(s) that are at risk. (20 marks) You are required to present your answers according to this format: Identify a control which accounts and assertions Audit procedures to test the weakness (2 marks) are at risk k of material account(s) and assertion(s) that misstatement (1 mark) are at risk (2 marks] 2 3 etc Identify five control strengths in the revenue cycle and explain why each control is a strength [ie. which accounts and assertions does it strengthen). For each control strength, identify audit procedures to test the effectiveness of control. (20 marks) You are required to present your answers according to this format: Identify a control Why it is a strength (which | test of control (2 marks) strength (1 mark) accounts and assertions does it strengthen) (1 mark] 1 2 3 etcQuestion 4: Substantive Procedures on Account Receivables (20 marks) The audit team selected debtors which have over $3000 balance for account receivable confirmation. Please see Account Receivable aging analysis on the Excel file. An audit senior confirmed account receivables as at 31 March 2021. The following issues are identified after receiving responses from the confirmations. Required: Determine whether each of the following issues represent an error in the account receivables balance of MN Ltd. For each issue, describe further audit procedures to be carried out to determine whether an error exists. 1. The book value of the receivables for Gamma was 4,943 on 31 March 2021. However, Gamma disputed the entire receivables balance and noted that they did not receive the products until 5 April 2021 on the AR confirmation response. A delivery note showed that a shipment was made on 29 March 2021. 2. Delta disputed the entire receivables balance of $3220, they noted it had been paid on 30 March 2021 in their response to AR confirmation. 3. The book value of the receivables for Epsilon at 31 March 2021 was $4050. However, no response was received from this customer. No payments were received from this customer in April 2021. 4. The book value of the receivables for Eta at 31 March 2021 was $11655. The customer disputed receivables in the amount of $410 claiming that they did not receive an appropriate volume discount. 5. The book value of the receivable for Lota at 31 March 2021 was $5004. However, the customer disputed the price on stock number 11205 which was priced at $500 per kg and should have been priced at $400 per kg for 4 kg of stock. MN issued a credit memo for $400 on 10 April 2021. 6. Lambda disputed the balance on the receivables confirmation of $8423 in its entirety. Further investigation showed that the balance was charged to the wrong customer. Goods were shipped to Alpha. On 6 April 2021 the error was discovered. A credit memo was issued to Lambda and an invoice was sent to Alpha, which was paid in full on 15 April 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts