Question: A B C D E F G H I J 1 Problem 11.36 FCF and NPV for an Investment 2 The alternative to investing in

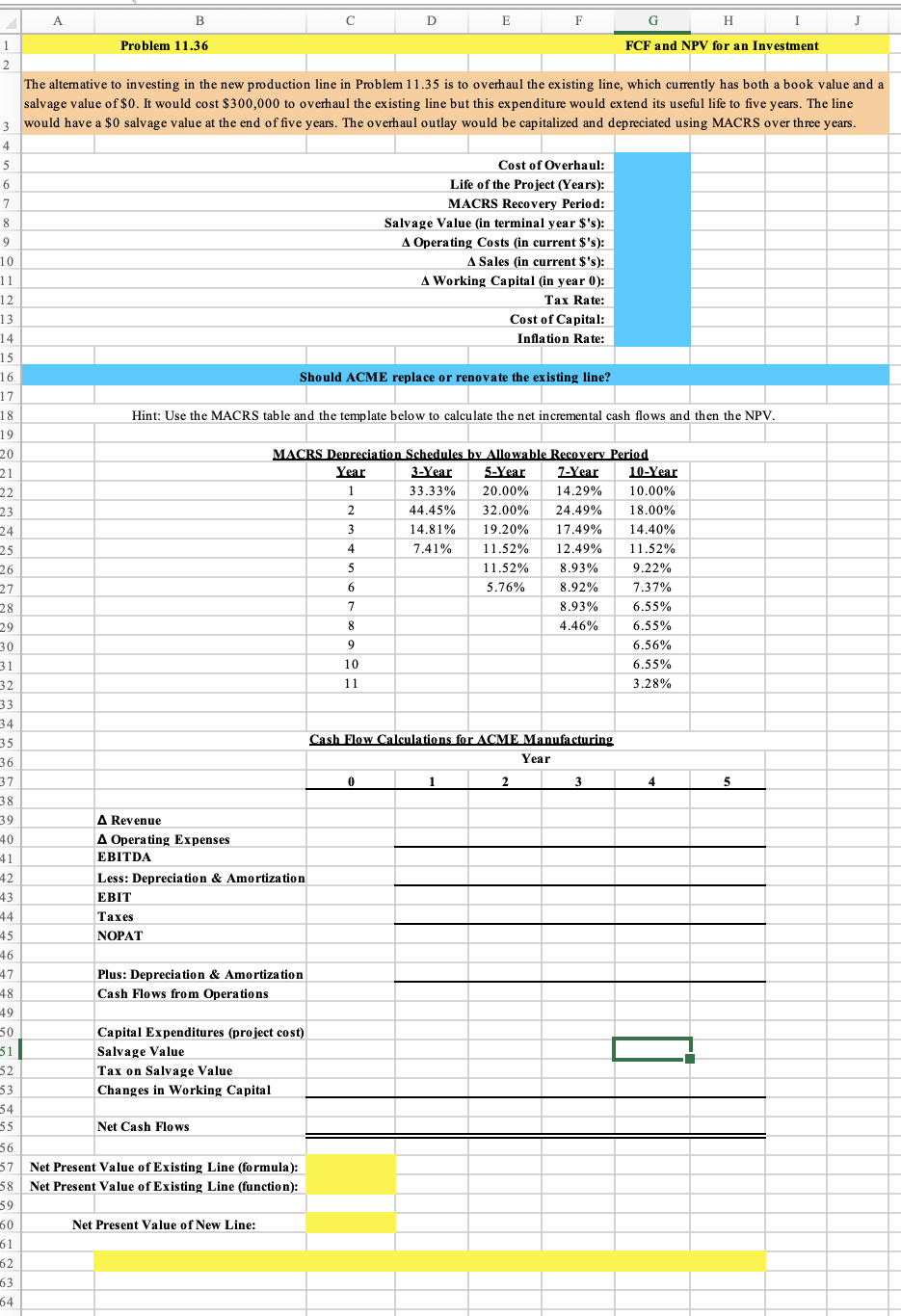

A B C D E F G H I J 1 Problem 11.36 FCF and NPV for an Investment 2 The alternative to investing in the new production line in Problem 11.35 is to overhaul the existing line, which currently has both a book value and a salvage value of $0. It would cost $300,000 to overhaul the existing line but this expenditure would extend its useful life to five years. The line would have a $0 salvage value at the end of five years. The overhaul outlay would be capitalized and depreciated using MACRS over three years. 3 4 5 Cost of Overhaul: 6 Life of the Project (Years): MACRS Recovery Period: 7 8 Salvage Value (in terminal year $'s): 9 A Operating Costs (in current $'s): A Sales (in current $'s): 10 11 A Working Capital (in year 0): Tax Rate: 12 13 Cost of Capital: Inflation Rate: 14 Should ACME replace or renovate the existing line? Hint: Use the MACRS table and the template below to calculate the net incremental cash flows and then the NPV. MACRS Depreciation Schedules by Allowable Recovery Period Year 5-Year 7-Year 10-Year 3-Year 33.33% 1 20.00% 14.29% 10.00% 2 44.45% 32.00% 24.49% 18.00% 3 14.81% 19.20% 17.49% 14.40% 7.41% 11.52% 12.49% 11.52% 11.52% 8.93% 9.22% 5.76% 8.92% 7.37% 7 8.93% 6.55% 8 4.46% 6.55% 9 6.56% 10 6.55% 11 3.28% Cash Flow Calculations for ACME Manufacturing Year 0 1 2 3 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 A Revenue A Operating Expenses EBITDA Less: Depreciation & Amortization EBIT Taxes NOPAT Plus: Depreciation & Amortization Cash Flows from Operations Capital Expenditures (project cost) Salvage Value Tax on Salvage Value Changes in Working Capital 54 55 Net Cash Flows 56 57 Net Present Value of Existing Line (formula): 58 Net Present Value of Existing Line (function): 59 60 Net Present Value of New Line: 53 61 62 63 64 4 5 6 4 5 A B C D E F G H I J 1 Problem 11.36 FCF and NPV for an Investment 2 The alternative to investing in the new production line in Problem 11.35 is to overhaul the existing line, which currently has both a book value and a salvage value of $0. It would cost $300,000 to overhaul the existing line but this expenditure would extend its useful life to five years. The line would have a $0 salvage value at the end of five years. The overhaul outlay would be capitalized and depreciated using MACRS over three years. 3 4 5 Cost of Overhaul: 6 Life of the Project (Years): MACRS Recovery Period: 7 8 Salvage Value (in terminal year $'s): 9 A Operating Costs (in current $'s): A Sales (in current $'s): 10 11 A Working Capital (in year 0): Tax Rate: 12 13 Cost of Capital: Inflation Rate: 14 Should ACME replace or renovate the existing line? Hint: Use the MACRS table and the template below to calculate the net incremental cash flows and then the NPV. MACRS Depreciation Schedules by Allowable Recovery Period Year 5-Year 7-Year 10-Year 3-Year 33.33% 1 20.00% 14.29% 10.00% 2 44.45% 32.00% 24.49% 18.00% 3 14.81% 19.20% 17.49% 14.40% 7.41% 11.52% 12.49% 11.52% 11.52% 8.93% 9.22% 5.76% 8.92% 7.37% 7 8.93% 6.55% 8 4.46% 6.55% 9 6.56% 10 6.55% 11 3.28% Cash Flow Calculations for ACME Manufacturing Year 0 1 2 3 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 A Revenue A Operating Expenses EBITDA Less: Depreciation & Amortization EBIT Taxes NOPAT Plus: Depreciation & Amortization Cash Flows from Operations Capital Expenditures (project cost) Salvage Value Tax on Salvage Value Changes in Working Capital 54 55 Net Cash Flows 56 57 Net Present Value of Existing Line (formula): 58 Net Present Value of Existing Line (function): 59 60 Net Present Value of New Line: 53 61 62 63 64 4 5 6 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts