Question: A B C D E F G H I J K L M N Explain which of the folliwng two mutually exclusive projects you would

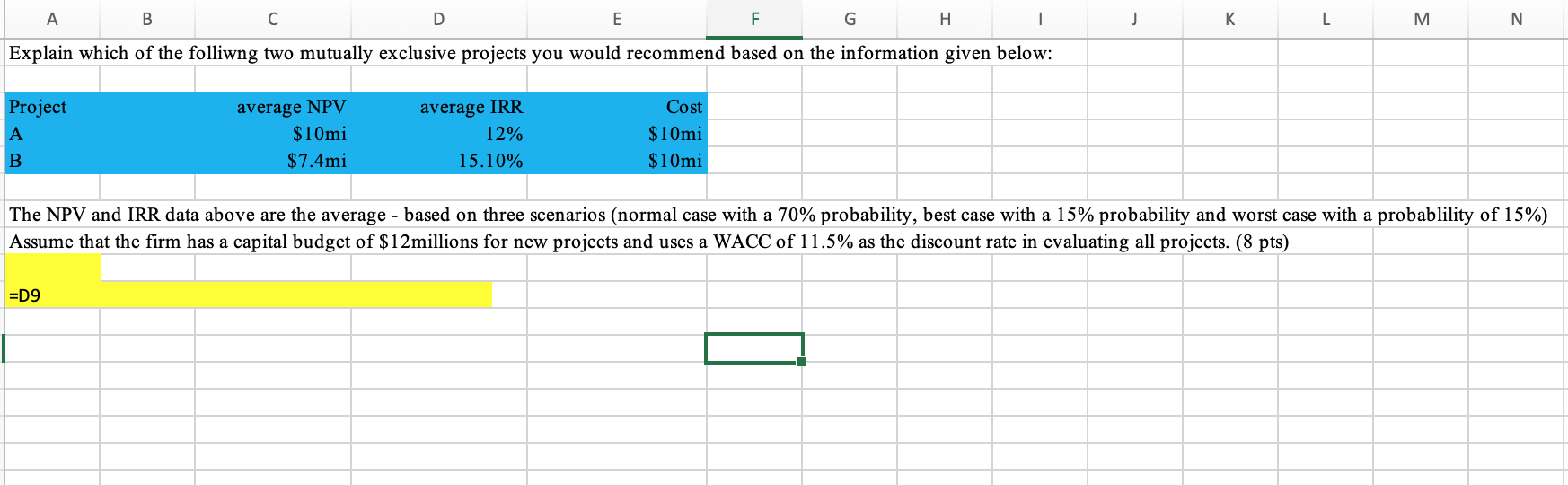

A B C D E F G H I J K L M N Explain which of the folliwng two mutually exclusive projects you would recommend based on the information given below: average NPV Project A average IRR 12% Cost $10mi $10mi B $7.4mi 15.10% $10mi The NPV and IRR data above are the average - based on three scenarios (normal case with a 70% probability, best case with a 15% probability and worst case with a probablility of 15%) Assume that the firm has a capital budget of $12millions for new projects and uses a WACC 11.5% as the discount rate in evaluating all projects. (8 pts) =D9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts