Question: mostly needing part two the three questions being solved:-) GameShop is going through a fast growth period, which is expected to end after 5 years.

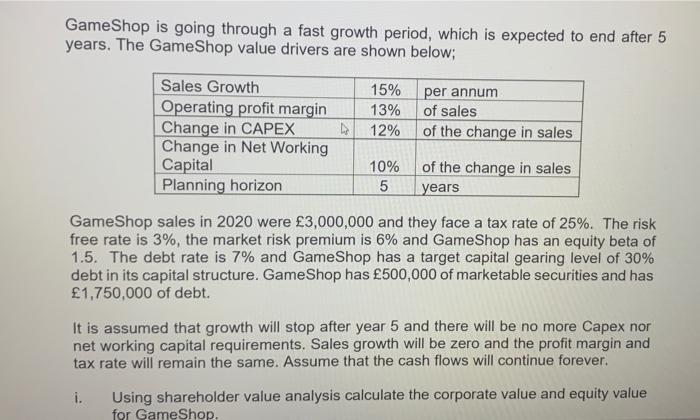

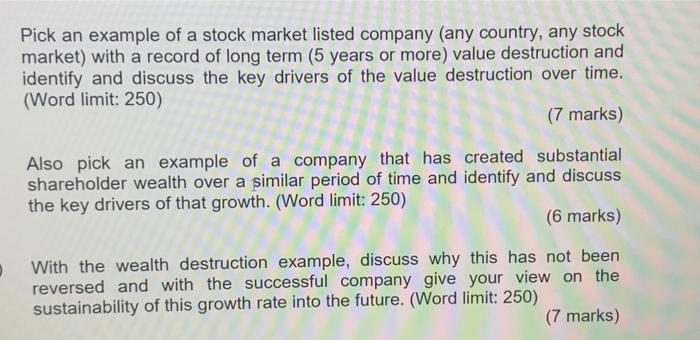

GameShop is going through a fast growth period, which is expected to end after 5 years. The GameShop value drivers are shown below; Sales Growth 15% per annum Operating profit margin 13% of sales Change in CAPEX 12% of the change in sales Change in Net Working Capital 10% of the change in sales Planning horizon 5 years GameShop sales in 2020 were 3,000,000 and they face a tax rate of 25%. The risk free rate is 3%, the market risk premium is 6% and GameShop has an equity beta of 1.5. The debt rate is 7% and GameShop has a target capital gearing level of 30% debt in its capital structure. Game Shop has 500,000 of marketable securities and has 1,750,000 of debt. It is assumed that growth will stop after year 5 and there will be no more Capex nor net working capital requirements. Sales growth will be zero and the profit margin and tax rate will remain the same. Assume that the cash flows will continue forever. i. Using shareholder value analysis calculate the corporate value and equity value for GameShop. Pick an example of a stock market listed company (any country, any stock market) with a record of long term (5 years or more) value destruction and identify and discuss the key drivers of the value destruction over time. (Word limit: 250) (7 marks) Also pick an example of a company that has created substantial shareholder wealth over a similar period of time and identify and discuss the key drivers of that growth. (Word limit: 250) (6 marks) With the wealth destruction example, discuss why this has not been reversed and with the successful company give your view on the sustainability of this growth rate into the future. (Word limit: 250) (7 marks) GameShop is going through a fast growth period, which is expected to end after 5 years. The GameShop value drivers are shown below; Sales Growth 15% per annum Operating profit margin 13% of sales Change in CAPEX 12% of the change in sales Change in Net Working Capital 10% of the change in sales Planning horizon 5 years GameShop sales in 2020 were 3,000,000 and they face a tax rate of 25%. The risk free rate is 3%, the market risk premium is 6% and GameShop has an equity beta of 1.5. The debt rate is 7% and GameShop has a target capital gearing level of 30% debt in its capital structure. Game Shop has 500,000 of marketable securities and has 1,750,000 of debt. It is assumed that growth will stop after year 5 and there will be no more Capex nor net working capital requirements. Sales growth will be zero and the profit margin and tax rate will remain the same. Assume that the cash flows will continue forever. i. Using shareholder value analysis calculate the corporate value and equity value for GameShop. Pick an example of a stock market listed company (any country, any stock market) with a record of long term (5 years or more) value destruction and identify and discuss the key drivers of the value destruction over time. (Word limit: 250) (7 marks) Also pick an example of a company that has created substantial shareholder wealth over a similar period of time and identify and discuss the key drivers of that growth. (Word limit: 250) (6 marks) With the wealth destruction example, discuss why this has not been reversed and with the successful company give your view on the sustainability of this growth rate into the future. (Word limit: 250) (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts