Question: A B C D E F G H . J L 1 (3)2. You need to figure out the value of Royal. Calculate the rate

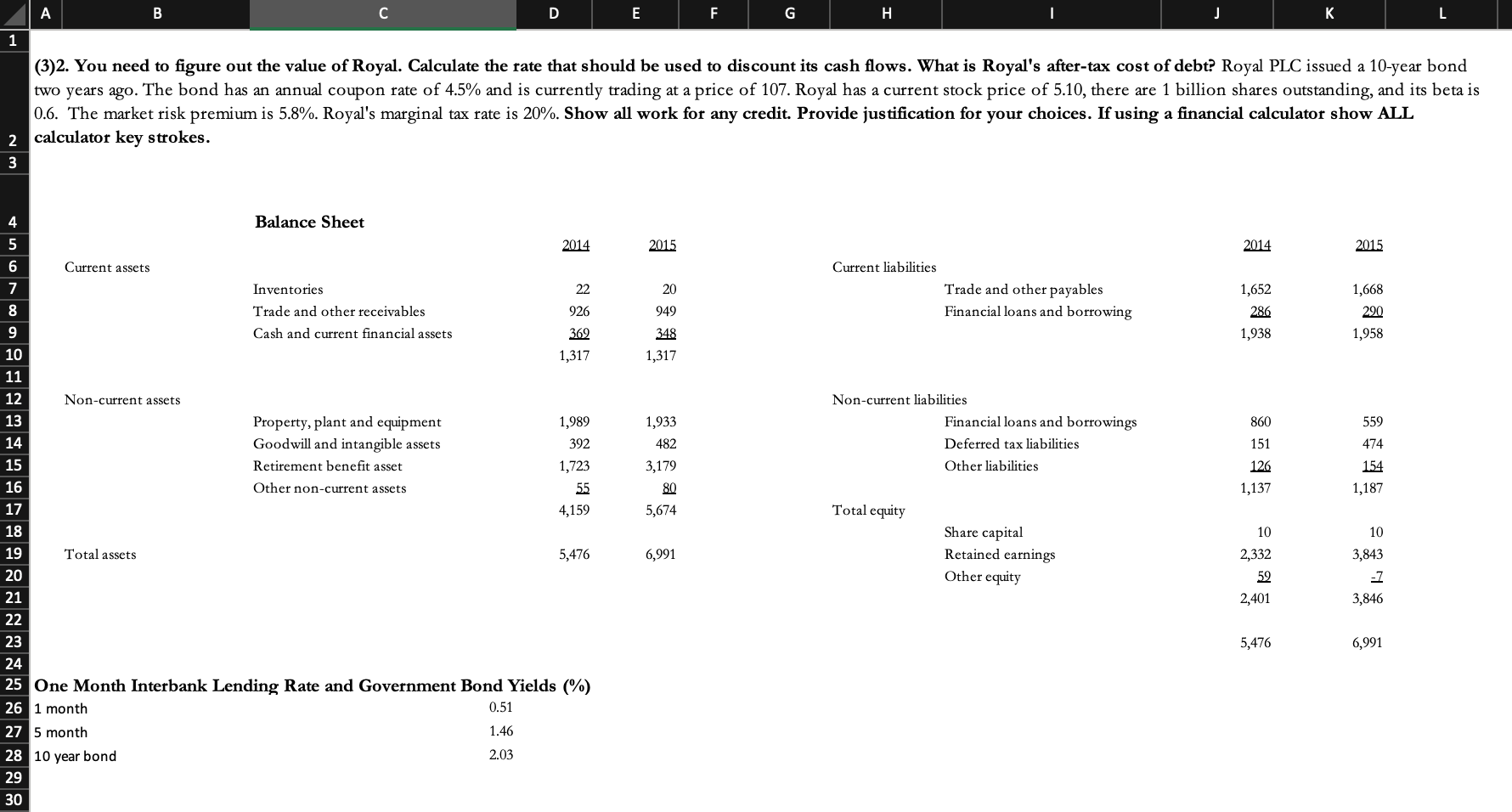

A B C D E F G H . J L 1 (3)2. You need to figure out the value of Royal. Calculate the rate that should be used to discount its cash flows. What is Royal's after-tax cost of debt? Royal PLC issued a 10-year bond two years ago. The bond has an annual coupon rate of 4.5% and is currently trading at a price of 107. Royal has a current stock price of 5.10, there are 1 billion shares outstanding, and its beta is 0.6. The market risk premium is 5.8%. Royal's marginal tax rate is 20%. Show all work for any credit. Provide justification for your choices. If using a financial calculator show ALL 2 calculator key strokes. 3 2015 2014 2015 Current liabilities 20 Trade and other payables Financial loans and borrowing 949 1,652 286 1,938 1,668 290 1,958 348 1,317 559 Non-current liabilities Financial loans and borrowings Deferred tax liabilities Other liabilities 474 1,933 482 3,179 80 5,674 860 151 126 1,137 4 Balance Sheet 5 2014 6 Current assets 7 Inventories 22 8 Trade and other receivables 926 9 Cash and current financial assets 362 10 1,317 11 12 Non-current assets 13 Property, plant and equipment 1,989 14 Goodwill and intangible assets 392 15 Retirement benefit asset 1,723 16 Other non-current assets 55 17 4,159 18 19 Total assets 5,476 20 21 22 23 24 25 One Month Interbank Lending Rate and Government Bond Yields (%) 26 1 month 0.51 27 5 month 1.46 28 10 year bond 2.03 29 30 154 1,187 Total equity 10 6,991 Share capital Retained earnings Other equity 10 2,332 59 2,401 3,843 -7 3,846 5,476 6,991 A B C D E F G H . J L 1 (3)2. You need to figure out the value of Royal. Calculate the rate that should be used to discount its cash flows. What is Royal's after-tax cost of debt? Royal PLC issued a 10-year bond two years ago. The bond has an annual coupon rate of 4.5% and is currently trading at a price of 107. Royal has a current stock price of 5.10, there are 1 billion shares outstanding, and its beta is 0.6. The market risk premium is 5.8%. Royal's marginal tax rate is 20%. Show all work for any credit. Provide justification for your choices. If using a financial calculator show ALL 2 calculator key strokes. 3 2015 2014 2015 Current liabilities 20 Trade and other payables Financial loans and borrowing 949 1,652 286 1,938 1,668 290 1,958 348 1,317 559 Non-current liabilities Financial loans and borrowings Deferred tax liabilities Other liabilities 474 1,933 482 3,179 80 5,674 860 151 126 1,137 4 Balance Sheet 5 2014 6 Current assets 7 Inventories 22 8 Trade and other receivables 926 9 Cash and current financial assets 362 10 1,317 11 12 Non-current assets 13 Property, plant and equipment 1,989 14 Goodwill and intangible assets 392 15 Retirement benefit asset 1,723 16 Other non-current assets 55 17 4,159 18 19 Total assets 5,476 20 21 22 23 24 25 One Month Interbank Lending Rate and Government Bond Yields (%) 26 1 month 0.51 27 5 month 1.46 28 10 year bond 2.03 29 30 154 1,187 Total equity 10 6,991 Share capital Retained earnings Other equity 10 2,332 59 2,401 3,843 -7 3,846 5,476 6,991

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts