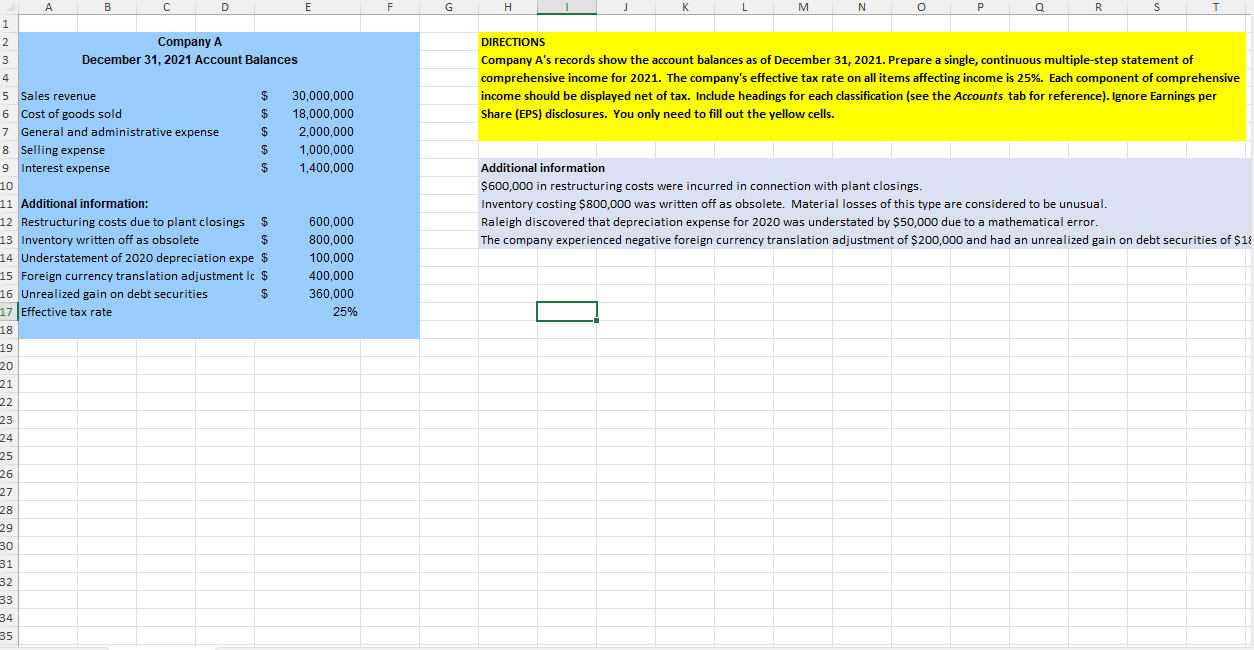

Question: A B C D E F G H K M N P R S T 1 Company A December 3 1 , 2 0 2

A

B

C

D

E

F

G

H

K

M

N

P

R

S

T

Company A

December Account Balances

Sales revenue

Cost of goods sold

General and administrative expense

Selling expense

Interest expense

Additional information:

tableRestructuring costs due to plant closings,$Inventory written off as obsolete,$Understatement of depreciation expe,$Foreign currency translation adjustment lc$Unrealized gain on debt securities$Effective tax rate,,

DIRECTIONS

Company As records show the account balances as of December Prepare a single, continuous multiplestep statement of comprehensive income for The company's effective tax rate on all items affecting income is Each component of comprehensive income should be displayed net of tax. Include headings for each classification see the Accounts tab for reference Ignore Earnings per Share EPS disclosures. You only need to fill out the yellow cells.

Additional information

$ in restructuring costs were incurred in connection with plant closings.

Inventory costing $ was written off as obsolete. Material losses of this type are considered to be unusual.

Raleigh discovered that depreciation expense for was understated by $ due to a mathematical error.

The company experienced negative foreign currency translation adjustment of $ and had an unrealized gain on debt securities of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock