Question: A B C D E F G The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current

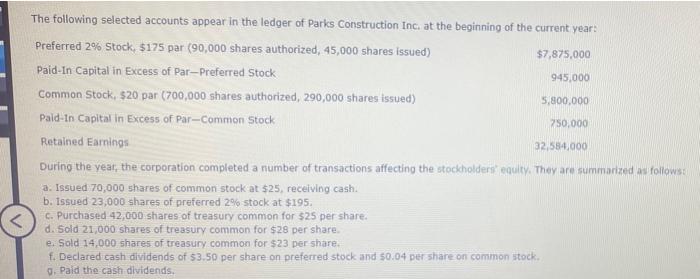

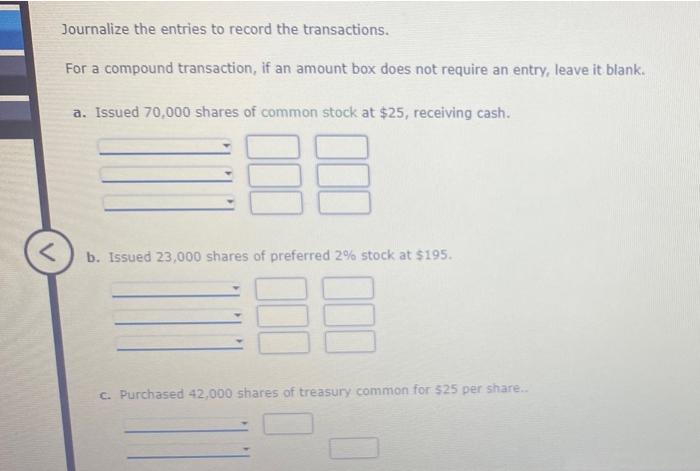

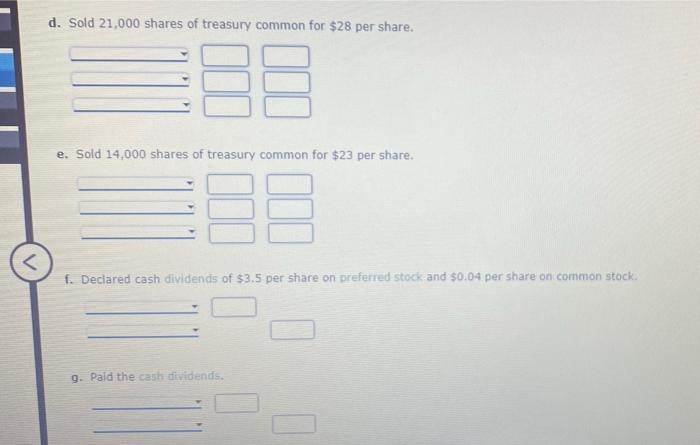

The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: Preferred 2% Stock, $175 par (90,000 shares authorized, 45,000 shares issued) $7,875,000 Paid-In Capital in excess of Par-Preferred Stock 945,000 Common Stock, $20 par (700,000 shares authorized, 290,000 shares issued) 5,800,000 Pald-in Capital in Excess of Par-Common Stock 250,000 Retained Earnings 32,584,000 During the year, the corporation completed a number of transactions affecting the stockholders gulty. They are summarized as follows: a. Issued 70,000 shares of common stock at $25, receiving cash. b. Issued 23,000 shares of preferred 2% stock at $195. C. Purchased 42,000 shares of treasury common for $25 per share. d. Sold 21,000 shares of treasury common for $28 per share. e. Sold 14,000 shares of treasury common for $23 per share f. Declared cash dividends of $3.50 per share on preferred stock and $0.04 per share on common stock g. Paid the cash dividends, Journalize the entries to record the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. a. Issued 70,000 shares of common stock at $25, receiving cash.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts