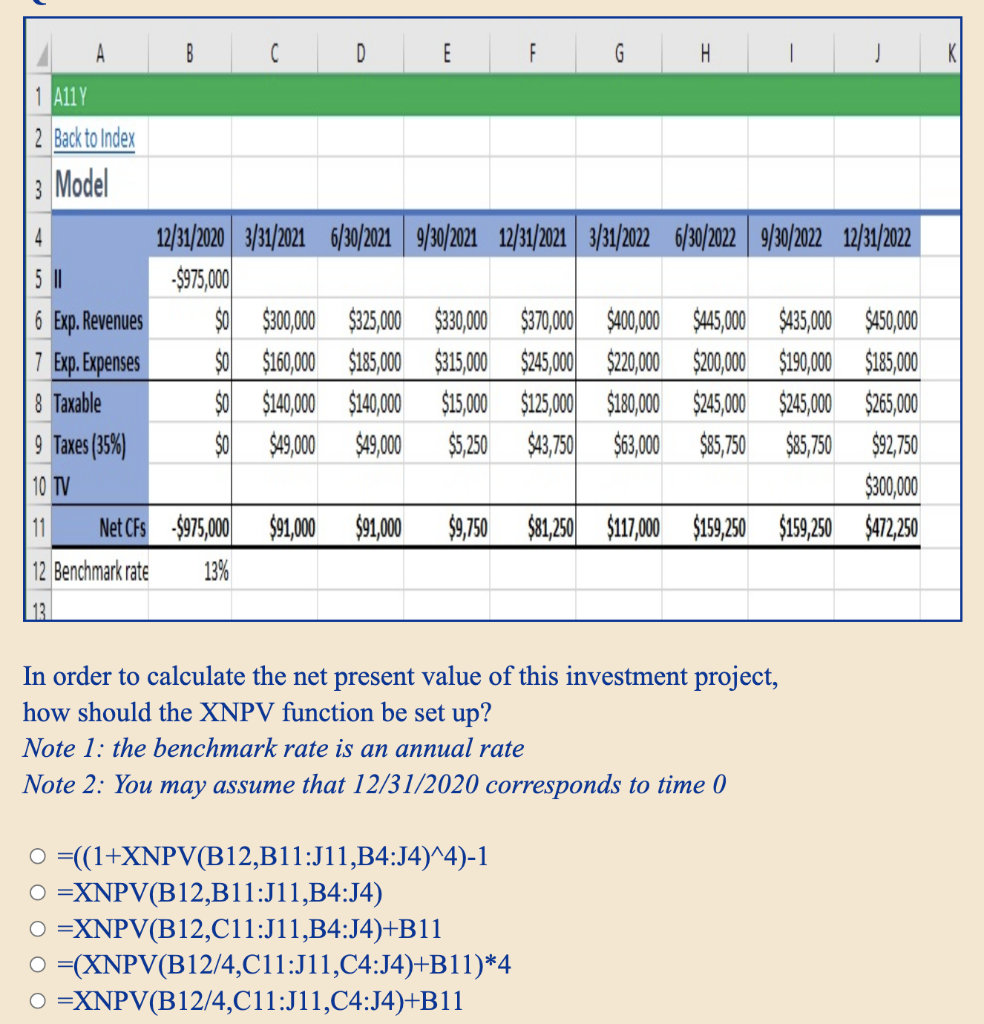

Question: A B C D E G H 1 A11Y 2 Back to Index 3 Model 4 12/31/2020 3/31/20216/30/2021 9/30/2021 12/31/2021 3/31/20226/30/2022 9/30/202212/31/2022 5 || -$975,000

A B C D E G H 1 A11Y 2 Back to Index 3 Model 4 12/31/2020 3/31/20216/30/2021 9/30/2021 12/31/2021 3/31/20226/30/2022 9/30/202212/31/2022 5 || -$975,000 6 Exp. Revenues $0 $300,000 $325,000 $330,000 $370,000 $400,000 $445,000 $435,000 $450,000 7 Exp. Expenses $0 $160,000 $185,000 $315,000 $245,000 $220,000 $200,000 $190,000 $185,000 8 Taxable $0 $140,000 $140,000 $15,000 $125,000 $180,000 $245,000 $245,000 $265,000 9 Taxes (35%) $0 $49,000 $49,000 $5,250 $43,750 $63,000 $85,750 $85,750 $92,750 10 TV $300,000 11 Net CFS $975,000 $91,000 $91,000 $9,750 $81,250 $117,000 $159,250 $159,250 $472,250 12 Benchmark rate 13% 13 In order to calculate the net present value of this investment project, how should the XNPV function be set up? Note 1: the benchmark rate is an annual rate Note 2: You may assume that 12/31/2020 corresponds to time 0 O =((1+XNPV(B12,B11:J11,B4:54)^4)-1 O =XNPV(B12,B11:J11,B4:14) =XNPV(B12,C11:J11,B4:54)+B11 O =(XNPV(B12/4,C11:J11,C4:34)+B11)*4 O =XNPV(B12/4,C11:J11,C4:34)+B11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts