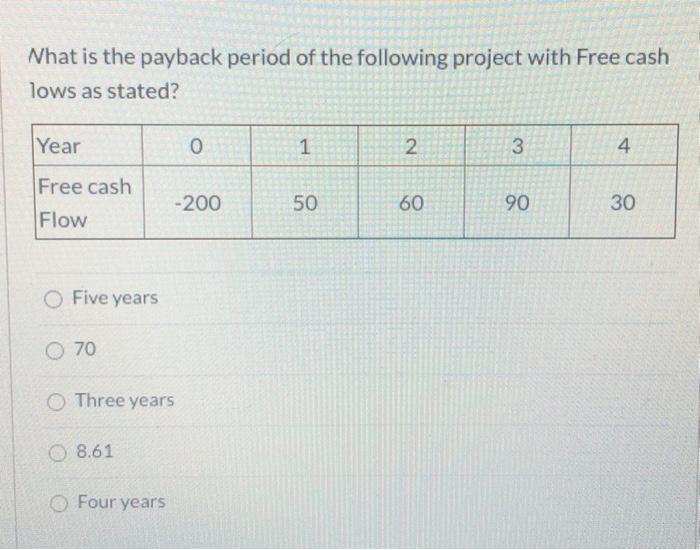

Question: a) b) c) please elaborate why the answer is the answer. please help a sis out. thank you in advance! What is the payback period

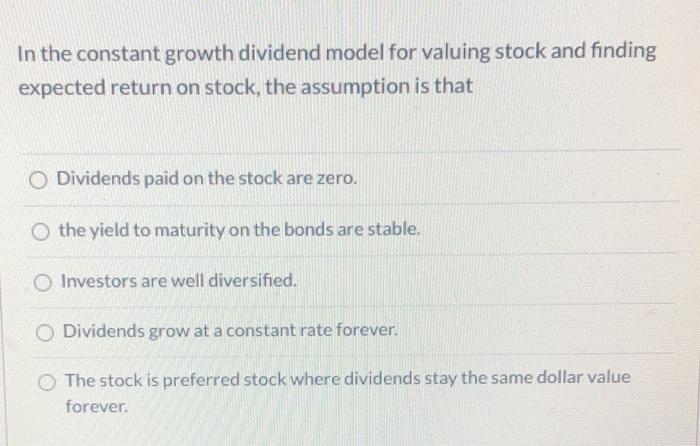

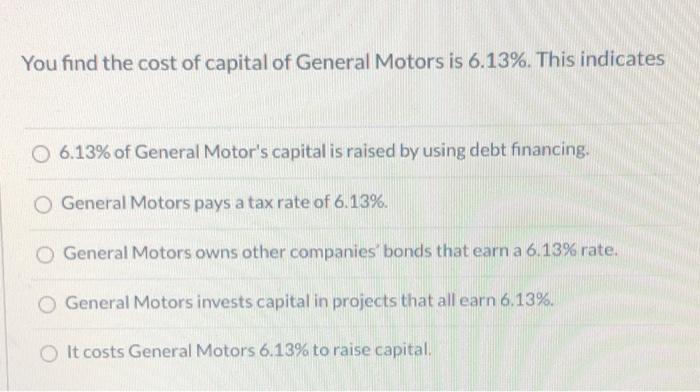

What is the payback period of the following project with Free cash lows as stated? Year 0 1 N 3 4 Free cash -200 50 60 90 30 Flow Five years 70 Three years O 8.61 Four years In the constant growth dividend model for valuing stock and finding expected return on stock, the assumption is that Dividends paid on the stock are zero. O the yield to maturity on the bonds are stable. Investors are well diversified. O Dividends grow at a constant rate forever. The stock is preferred stock where dividends stay the same dollar value forever. You find the cost of capital of General Motors is 6.13%. This indicates O 6.13% of General Motor's capital is raised by using debt financing, O General Motors pays a tax rate of 6.13%. General Motors owns other companies' bonds that earn a 6.13% rate. General Motors invests capital in projects that all earn 6.13%. It costs General Motors 6.13% to raise capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts