Question: The way the forward is quoted: POINTS Define points: forward points are the number of basis points added to or subtracted from the current spot

- The way the forward is quoted: POINTS

- Define points: forward points are the number of basis points added to or subtracted from the current spot rate of a currency pair to determine the forward rate for delivery on a specific value date.

- Calculate the outright forward quote from points (3 step process)[1]:

Example: JPY = USD (Class notes)

| Bid | Ask | |

| Spot | 118.27 | 118.37 |

| Forward 90 days | -143 | -140 |

| + Points | ||

| Outright forward quote 90 day |

Part C. Calculate the mid-rate of the spot rate and the outright forward quote presented in the example (above) in B.2.

(118.27+118.27)/2=118.32

(-143+(_140))/2=-141.5

Spot Mid Rate 1$=Jpy=118.32

Mid Rate of Outright forward quote = -141.5

QUESTION BELLOW

- The important thing to remember is which currency is being used as the home or base currency. That determines if you use the direct quote formula or indirect quote formula!!!!!! For example, the/$ quote is direct for the Japanese yen and indirect for the US dollar. If you want to calculate the forward quote in percentage terms for the US, you would use the indirect quote formula.

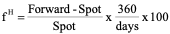

- For indirect quotes (i.e. quote expressed in foreign currency terms), the formula is

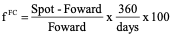

- For direct quotes (i.e. quote expressed in home currency terms), the formula is

*****We will use this formula a lot during the semester. You better learn it!

- Calculate the forward premium/discount using the midrates you calculated in C. above. Assume the United States is the home currency/country; therefore use the indirect or foreign quote formula.

Which currency is at a premium and which is at a discount?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts