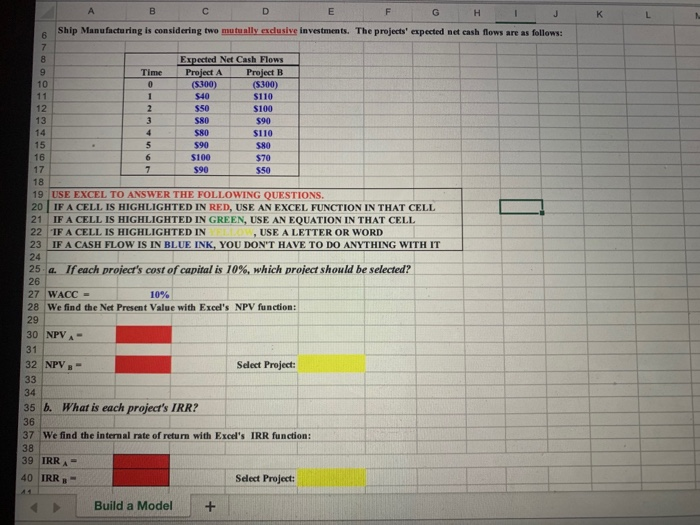

Question: A B C Ship Manufacturing is considering the m D E F G H ostly exclusive investments. The projects' expected set cash flows are as

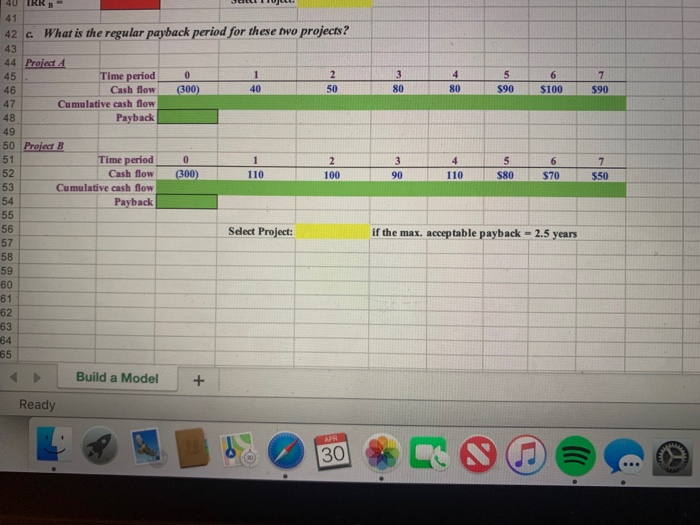

A B C Ship Manufacturing is considering the m D E F G H ostly exclusive investments. The projects' expected set cash flows are as follows: K L Expected Net Cash Flows Project Project B (300) (5300) $40 $110 50 SNO S100 590 S110 S100 19 USE EXCEL TO ANSWER THE FOLLOWING OUESTIONS 20 IF A CELL IS HIGHLIGHTED IN RED, USE AN EXCEL FUNCTION IN THAT CELL 21 IF A CELL IS HIGHLIGHTED IN GREEN, USE AN EQUATION IN THAT CELL 22 IF A CELL IS HIGHLIGHTED IN , USE A LETTER OR WORD 23 IF A CASH FLOW IS IN BLUE INK, YOU DON'T HAVE TO DO ANYTHING WITH IT 25. a. If each project's cost of capital is 10%, which project should be selected? 27 WACC - 10% 28 We find the Net Present Value with Excel's NPV function: 30 NPV Select Project: 35 b. What is each project's IRR? 37 We find the internal rate of return with Excel's IRR function: 39 TRR 40 TRR Select Project: Build a Model + 4U IKK 42 c. What is the regular payback period for these two projects? 44 0 (300) Project 4 Time period Cash flow Cumulative cash flow Payback 567 $90 $100 $90 80 40 46 47 50 Project B Time period Cash flow Cumulative cash flow Payback 0 (300) 53 56 Select Project: if the max. acceptable payback = 2.5 years 59 60 52 Build a Model + Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts