Question: A B D E F 1 FINANCIAL FUNCTIONS EXAMPLE Victory Trust 2 00 N 9 Investment Interest rate 10 Investment Amount 11 Investment Tem 7.25%

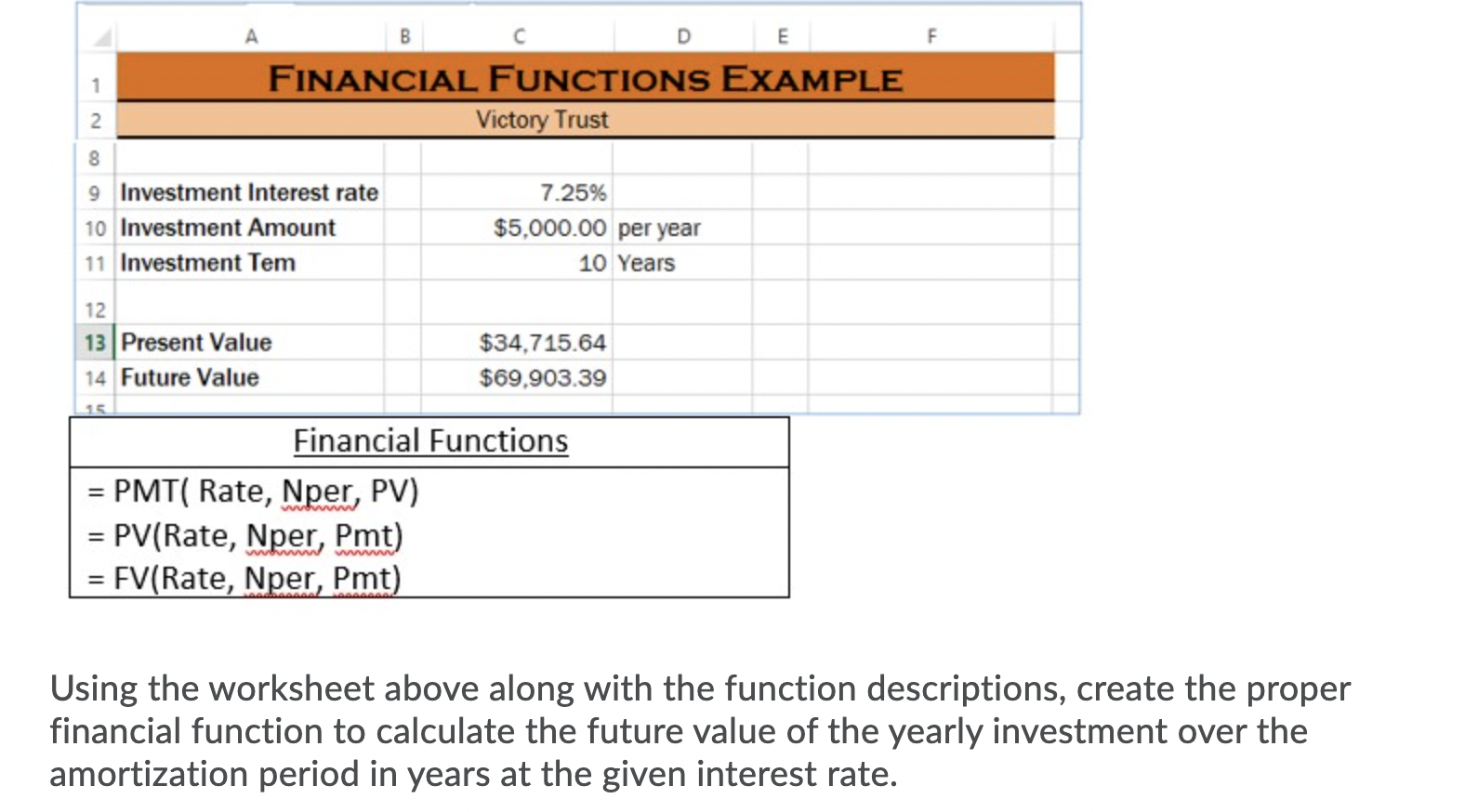

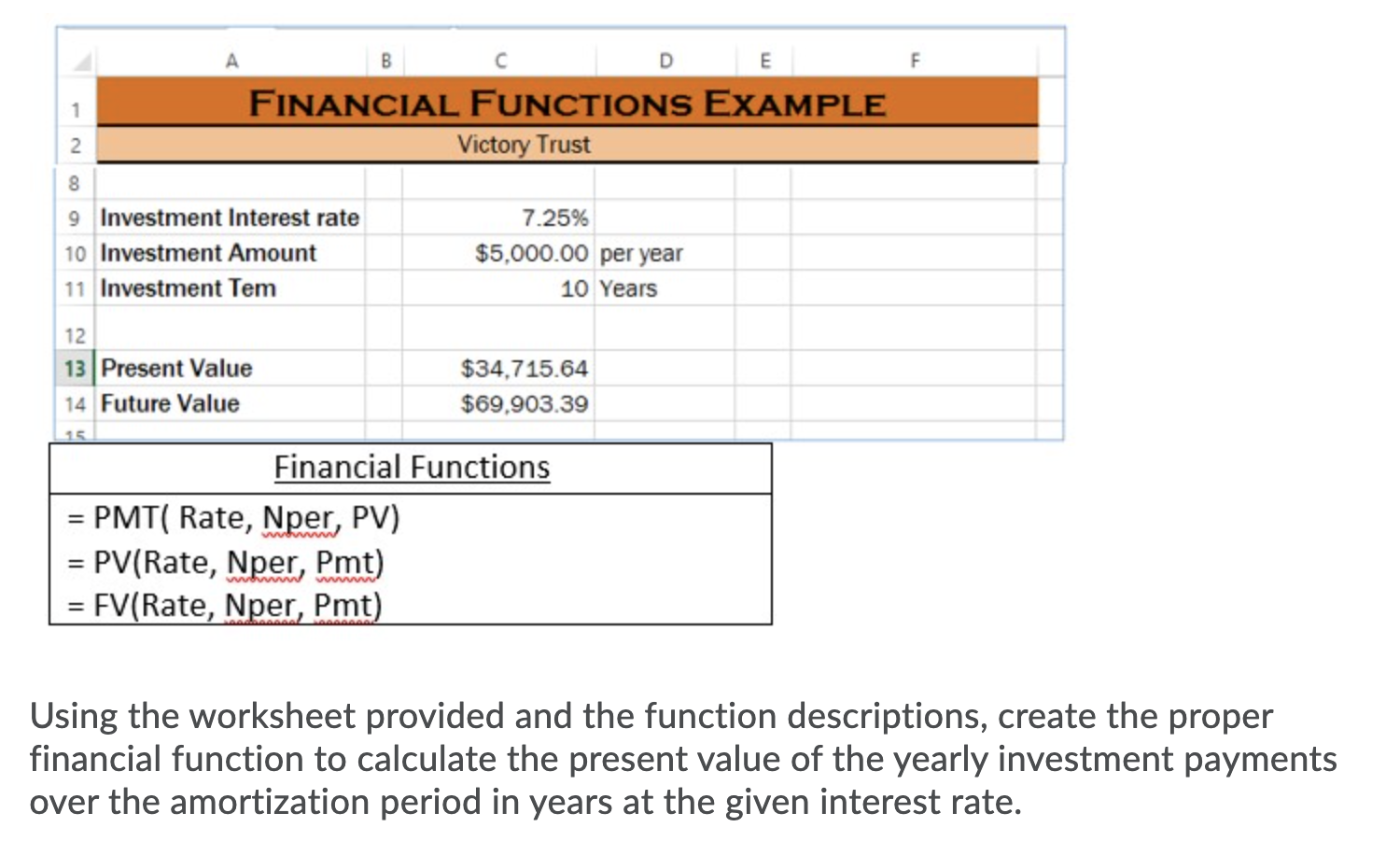

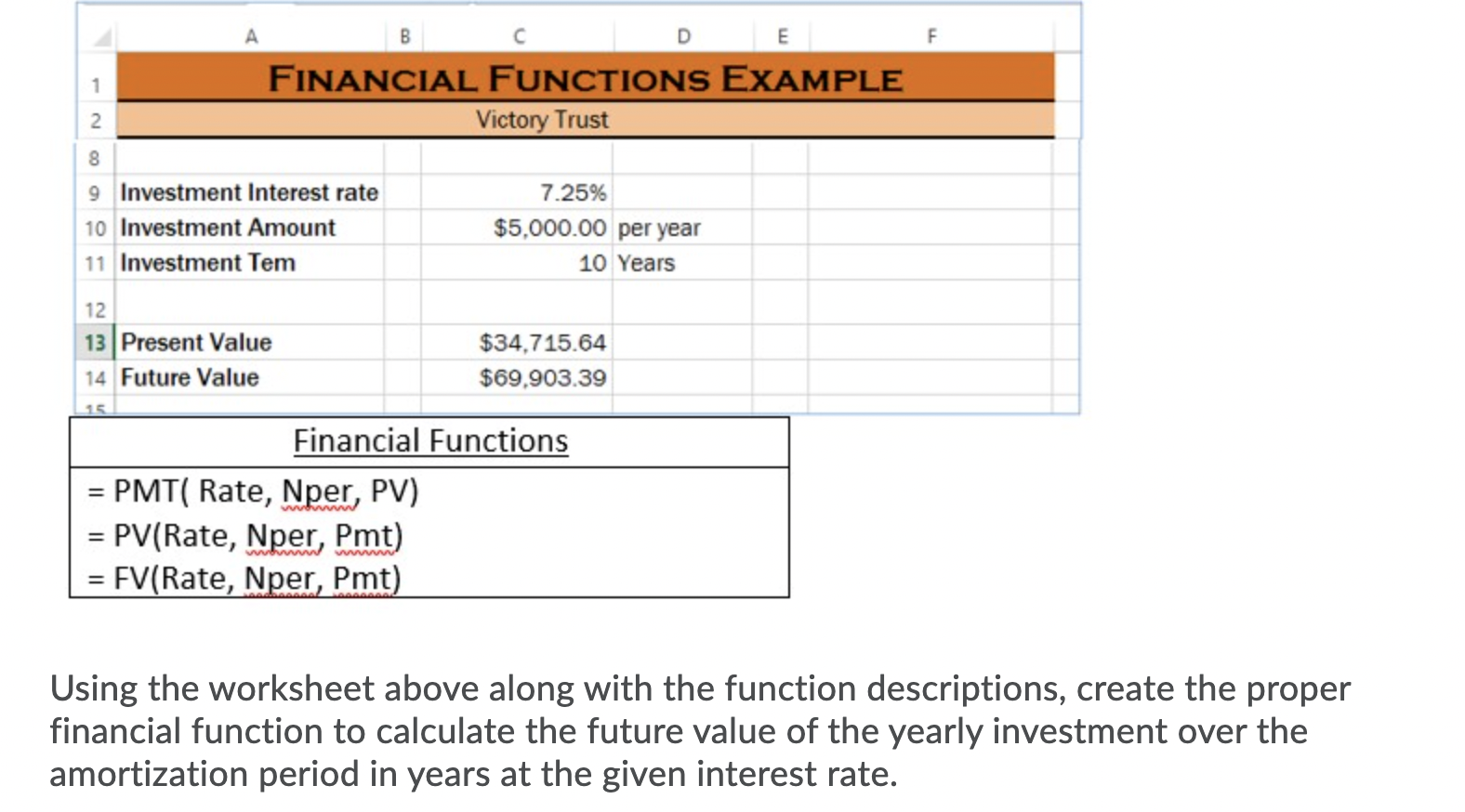

A B D E F 1 FINANCIAL FUNCTIONS EXAMPLE Victory Trust 2 00 N 9 Investment Interest rate 10 Investment Amount 11 Investment Tem 7.25% $5,000.00 per year 10 Years 12 13 Present Value 14 Future Value $34,715.64 $69.903.39 15 Financial Functions = PMT( Rate, Nper, PV) = PV(Rate, Nper, Pmt) = FV(Rate, Nper, Pmt) www www www Using the worksheet above along with the function descriptions, create the proper financial function to calculate the future value of the yearly investment over the amortization period in years at the given interest rate. B D E F 1 2 FINANCIAL FUNCTIONS EXAMPLE Victory Trust 8 9 Investment Interest rate 7.25% 10 Investment Amount $5,000.00 per year 11 Investment Tem 10 Years 12 13 Present Value 14 Future Value $34,715.64 $69.903.39 15 Financial Functions = PMT( Rate, Nper, PV) = PV(Rate, Nper, Pmt) FV(Rate, Nper, Pmt) wwwwww Using the worksheet provided and the function descriptions, create the proper financial function to calculate the present value of the yearly investment payments over the amortization period in years at the given interest rate. A B D E F 1 FINANCIAL FUNCTIONS EXAMPLE Victory Trust 2 00 N 9 Investment Interest rate 10 Investment Amount 11 Investment Tem 7.25% $5,000.00 per year 10 Years 12 13 Present Value 14 Future Value $34,715.64 $69.903.39 15 Financial Functions = PMT( Rate, Nper, PV) = PV(Rate, Nper, Pmt) = FV(Rate, Nper, Pmt) www www www Using the worksheet above along with the function descriptions, create the proper financial function to calculate the future value of the yearly investment over the amortization period in years at the given interest rate. A B D E F 1 FINANCIAL FUNCTIONS EXAMPLE Victory Trust 2 00 N 9 Investment Interest rate 10 Investment Amount 11 Investment Tem 7.25% $5,000.00 per year 10 Years 12 13 Present Value 14 Future Value $34,715.64 $69.903.39 15 Financial Functions = PMT( Rate, Nper, PV) = PV(Rate, Nper, Pmt) = FV(Rate, Nper, Pmt) www www www Using the worksheet above along with the function descriptions, create the proper financial function to calculate the future value of the yearly investment over the amortization period in years at the given interest rate. B D E F 1 2 FINANCIAL FUNCTIONS EXAMPLE Victory Trust 8 9 Investment Interest rate 7.25% 10 Investment Amount $5,000.00 per year 11 Investment Tem 10 Years 12 13 Present Value 14 Future Value $34,715.64 $69.903.39 15 Financial Functions = PMT( Rate, Nper, PV) = PV(Rate, Nper, Pmt) FV(Rate, Nper, Pmt) wwwwww Using the worksheet provided and the function descriptions, create the proper financial function to calculate the present value of the yearly investment payments over the amortization period in years at the given interest rate. A B D E F 1 FINANCIAL FUNCTIONS EXAMPLE Victory Trust 2 00 N 9 Investment Interest rate 10 Investment Amount 11 Investment Tem 7.25% $5,000.00 per year 10 Years 12 13 Present Value 14 Future Value $34,715.64 $69.903.39 15 Financial Functions = PMT( Rate, Nper, PV) = PV(Rate, Nper, Pmt) = FV(Rate, Nper, Pmt) www www www Using the worksheet above along with the function descriptions, create the proper financial function to calculate the future value of the yearly investment over the amortization period in years at the given interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts