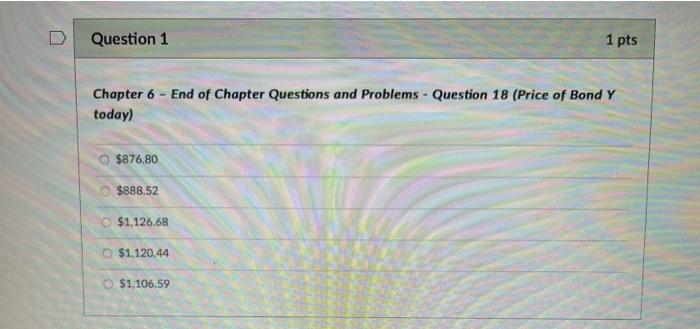

Question: Question 1 1 pts Chapter 6 - End of Chapter Questions and Problems - Question 18 (Price of Bond Y today) $876,80 $888.52 $1,126.68 0

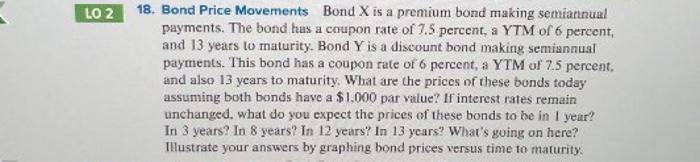

Question 1 1 pts Chapter 6 - End of Chapter Questions and Problems - Question 18 (Price of Bond Y today) $876,80 $888.52 $1,126.68 0 0 0 0 $1,120.44 $1,106.59 LO 2 18. Bond Price Movements Bond X is a premium bond making semiannual payments. The bond hus a coupon rate of 7.5 percent, a YTM of 6 percent, and 13 years to maturity. Bond Y is a discount bond making semiannual payments. This bond has a coupon rule of 6 percent, a YTM of 7.5 percent and also 13 years to maturity. What are the prices of these bonds today assuming both bonds have a $1,000 par value? If interest rates remain unchanged. what do you expect the prices of these bonds to be in 1 year? In 3 years? In 8 years? In 12 years? In 13 years? What's going on here? Tlustrate your answers by graphing bond prices versus time to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts