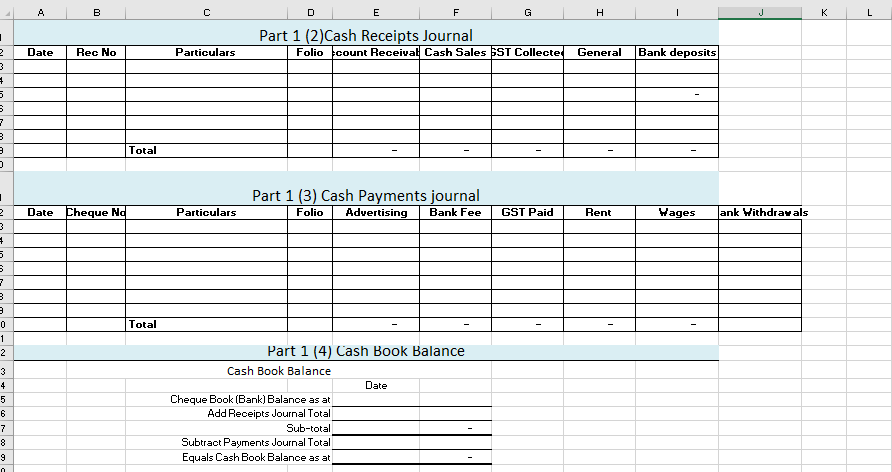

Question: A B D E F G H L 1 2 3 Part 1 (2)Cash Receipts Journal Folio count Receival Cash Sales SST Collecte Date Rec

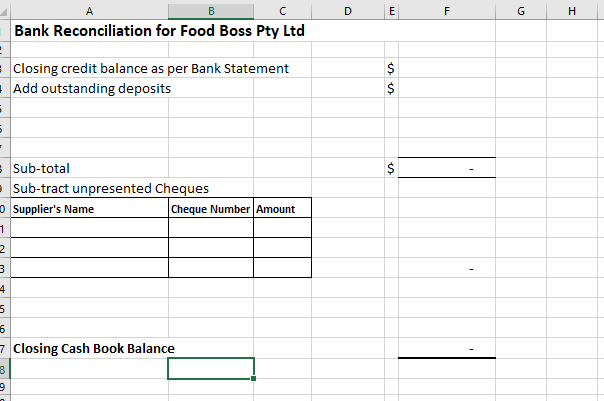

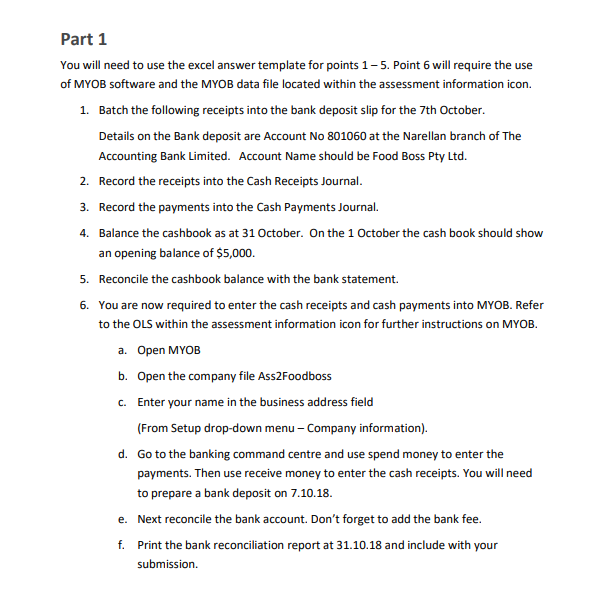

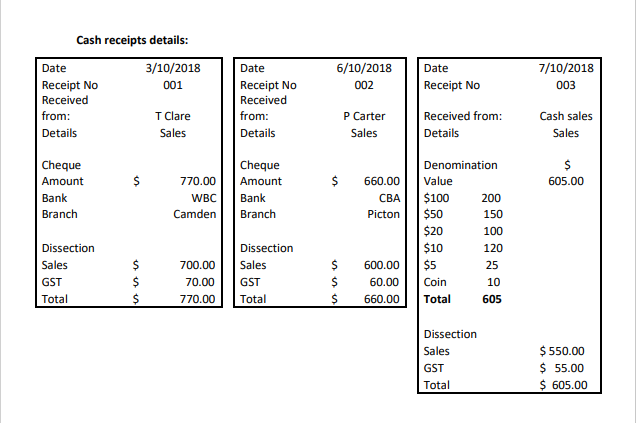

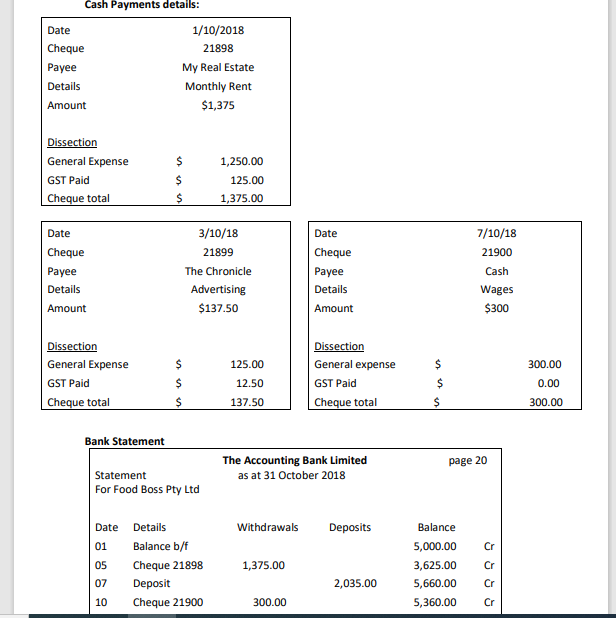

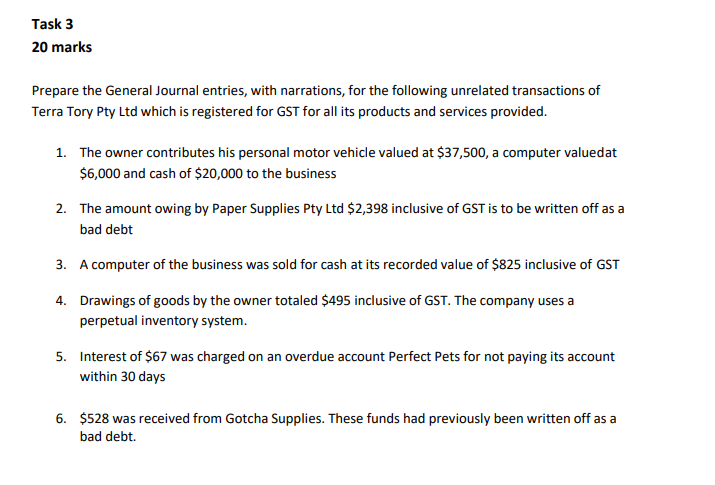

A B D E F G H L 1 2 3 Part 1 (2)Cash Receipts Journal Folio count Receival Cash Sales SST Collecte Date Rec No Particulars General Bank deposits 5 S 7 3 3 . Total 1 2 3 Part 1 (3) Cash Payments journal Folio Advertising Bank Fee Date Cheque Nd Particulars GST Paid Rent Wages ank Withdrawals 5 7 3 3 0 1 2 Total Part 1 (4) Cash Book Balance Cash Book Balance Date 3 4 5 6 7 8 9 Cheque Book (Bank) Balance as at Add Receipts Journal Total Sub-total Subtract Payments Journal Total Equals Cash Book Balance as at B D E F G H Bank Reconciliation for Food Boss Pty Ltd Closing credit balance as per Bank Statement Add outstanding deposits $ $ 5 $ Sub-total Sub-tract unpresented Cheques Supplier's Name Cheque Number Amount 1 2 3 4 5 6 7 Closing Cash Book Balance 8 9 Part 1 You will need to use the excel answer template for points 1 - 5. Point 6 will require the use of MYOB software and the MYOB data file located within the assessment information icon. 1. Batch the following receipts into the bank deposit slip for the 7th October. Details on the Bank deposit are Account No 801060 at the Narellan branch of The Accounting Bank Limited. Account Name should be Food Boss Pty Ltd. 2. Record the receipts into the Cash Receipts Journal. 3. Record the payments into the Cash Payments Journal. 4. Balance the cashbook as at 31 October. On the 1 October the cash book should show an opening balance of $5,000. 5. Reconcile the cashbook balance with the bank statement. 6. You are now required to enter the cash receipts and cash payments into MYOB. Refer to the OLS within the assessment information icon for further instructions on MYOB. a. Open MYOB b. Open the company file Ass2Foodboss c. Enter your name in the business address field (From Setup drop-down menu - Company information). d. Go to the banking command centre and use spend money to enter the payments. Then use receive money to enter the cash receipts. You will need to prepare a bank deposit on 7.10.18. e. Next reconcile the bank account. Don't forget to add the bank fee. f. Print the bank reconciliation report at 31.10.18 and include with your submission Cash receipts details: Date 3/10/2018 Receipt No 001 Received from: T Clare Details Sales 6/10/2018 002 Date Receipt No 7/10/2018 003 Date Receipt No Received from: Details P Carter Sales Received from: Details Cash sales Sales S 605.00 $ Cheque Amount Bank Branch 770.00 WBC Camden Cheque Amount Bank Branch 660.00 CBA Picton Denomination Value $100 200 $50 150 $20 100 $10 120 $5 25 Coin 10 Total 605 Dissection Sales GST Total $ $ 700.00 70.00 770.00 Dissection Sales GST Total $ $ $ 600.00 60.00 660.00 Dissection Sales GST Total $ 550.00 $ 55.00 $ 605.00 Cash Payments details: Date 1/10/2018 Cheque 21898 Payee My Real Estate Details Monthly Rent Amount $1,375 Dissection General Expense GST Paid Cheque total $ $ $ 1,250.00 125.00 1,375.00 Date Date Cheque Payee Details Amount 3/10/18 21899 The Chronicle Advertising $137.50 Cheque Payee Details 7/10/18 21900 Cash Wages $300 Amount $ $ Dissection General Expense GST Paid Cheque total 125.00 12.50 Dissection General expense GST Paid Cheque total 300.00 0.00 $ $ $ 137.50 $ 300.00 Bank Statement The Accounting Bank Limited as at 31 October 2018 page 20 Statement For Food Boss Pty Ltd Withdrawals Deposits Cr Date Details 01 Balance b/t 05 Cheque 21898 07 Deposit 10 Cheque 21900 1,375.00 Balance 5,000.00 3,625.00 5,660.00 5,360.00 Cr 2,035.00 Cr 300.00 Cr Task 3 20 marks Prepare the General Journal entries, with narrations, for the following unrelated transactions of Terra Tory Pty Ltd which is registered for GST for all its products and services provided. 1. The owner contributes his personal motor vehicle valued at $37,500, a computer valuedat $6,000 and cash of $20,000 to the business 2. The amount owing by Paper Supplies Pty Ltd $2,398 inclusive of GST is to be written off as a bad debt 3. A computer of the business was sold for cash at its recorded value of $825 inclusive of GST 4. Drawings of goods by the owner totaled $495 inclusive of GST. The company uses a perpetual inventory system. 5. Interest of $67 was charged on an overdue account Perfect Pets for not paying its account within 30 days 6. $528 was received from Gotcha Supplies. These funds had previously been written off as a bad debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts