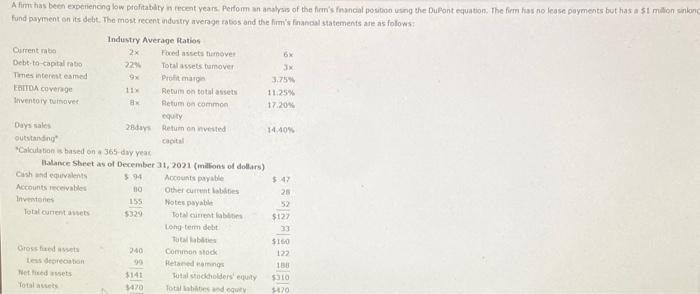

Question: fund payment on its debt. The most recent industry average rabss and the fimis fonancal statements are as folows: Income Statement for Year Ended December

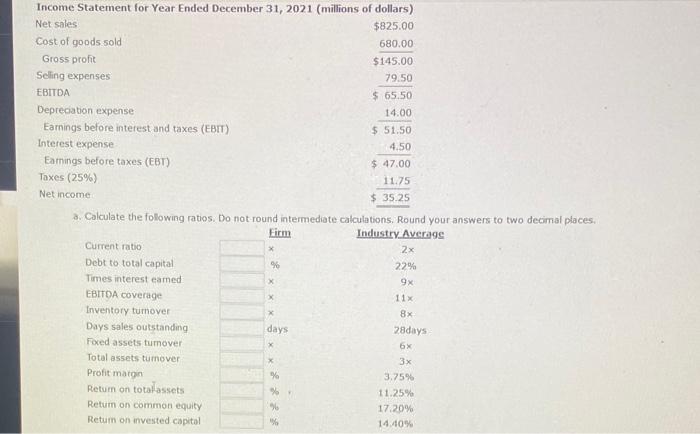

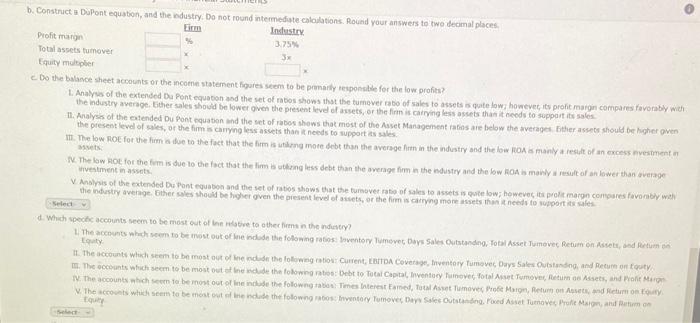

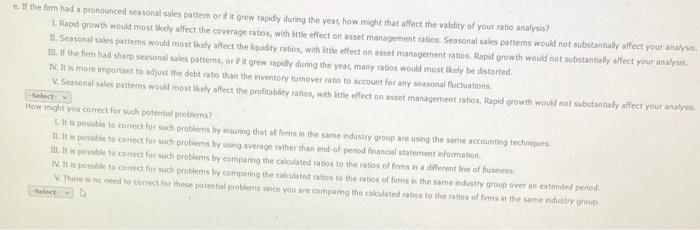

fund payment on its debt. The most recent industry average rabss and the fimis fonancal statements are as folows: Income Statement for Year Ended December 31, 2021 (millions of dollars) Net sales Cost of goods sold Gross profit Seling expenses EBITDA Deprecation expense Eamings belore interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (25\%) Net income $825.00 $145.00680.00 a. Calculate the following ratios. Do not round intermediate calculations. Round your answers to two decimal places. Current ratio Debt to total capital Times interest eamed EBITDA coverage Industrv Averogs Inventory tumover Days sales outstanding Fored assets tumover Total assets tumover Profit matgn Retum on totalassets Retum on common equity Retum on invested capital Firmx%xxxdaysxx%%%6%IndustryAve2x22%9x11x8x28days6x3x3.75%11.25%17.20%14.40% Abere thecentwiststement higures scems to be pranaily responsilde for the low profits? the induetry extenerd bu Pont equabon and the set of nabos shows thst the tumever rabo of sakes to assets is quate laws howevec, its profit margin compares favoraby wief. the present level of siles, of the fime in camne the set of rabos shows that most of the Aaset Managensent rafins are below the wiverages. Fither assets should be higher gven. Bsyets: Wivestment in assets. d. Which spocke accoints seen to be most out of hin robve to other firman the ndistry? A oquaty: e. If the firn had a pronounced seasonal sales pattern or if it grew rapidy during the yeac, how might that affect the valitity of your ratio analysis? T. Rapd growth would most thely affect the covernge rabos, with ittle effect on asset management ratios. Seasonal sales pattems would not substantialy affect your analyse, D: Seasonal sales pattens would most lloely affect the fipuidity ratios, with Ittle effect on asset management ratios. Rapid growth would not substantialy affect your analyiss. III. If the firm had sharp seasonal sales pattems, or if it grew rapiby danng the yeac, many ratos would most ikely be distorted. NV. It is more importans to adjust the debt rato than the iventery tumoyer ratio to arcount for any sessonal fuctuations. Q. Seavonal sales patterns would most ikely affect the profitabodty ratios, weh Ithe effect on asset manogement ratios, Rapid growith would nor substanbaly affect your analysis. How might you cotred for such potentul arobiens? T. It is peseble to conect for such problems by insaing that at fimis in the same industry aroop ate using the same accounting tectiniques. 7i. It is posstice to correct for wach probeens by useng average nather than end-of-penod frandal statement information. Iil. It is posuble to conect for soch broblems by compering the calailated ratios to the ratios of fims in a dfferent lne of futiness. W. It is possile to cunect for noch protiems by companing the calculated ratios to the rabos of fums in the sume nidistry group over an extended penisd. V. There is ne need to corifci for thesen potentalprodems stico you are compang the cakalated racos to tho matios of firms in the sume ndistry greve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts