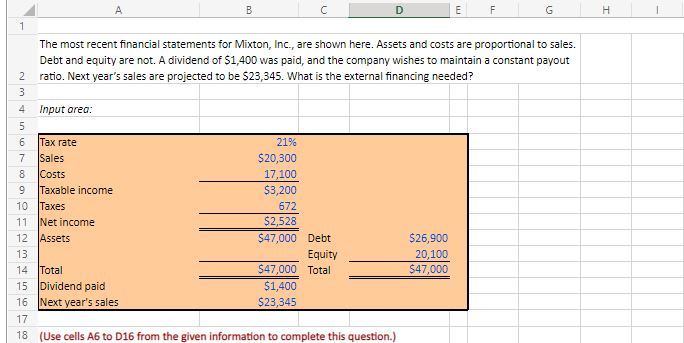

Question: A B D E F G H no EN The most recent financial statements for Mixton, Inc., are shown here. Assets and costs are proportional

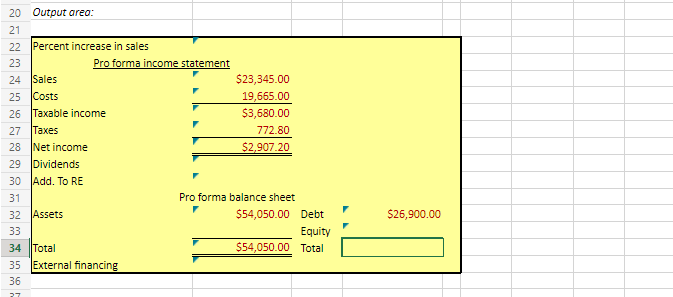

A B D E F G H no EN The most recent financial statements for Mixton, Inc., are shown here. Assets and costs are proportional to sales. Debt and equity are not. A dividend of $1,400 was paid, and the company wishes to maintain a constant payout 2 ratio. Next year's sales are projected to be 523,345. What is the external financing needed? 3 4 Input area: 5 Tax rate 21% Sales $20,300 Costs 17,100 Taxable income $3,200 10 Taxes 672 11 Net income $2,528 12 Assets $47,000 Debt $26,900 13 Equity 20,100 14 Total $47,000 Total $47,000 15 Dividend paid $1,400 16 Next year's sales $23,345 17 18 (Use cells A6 to 016 from the given information to complete this question.) 20 Output area: 21 22 Percent increase in sales 23 Pro forma income statement 24 Sales $23,345.00 25 Costs 19,665.00 26 Taxable income $3,680.00 27 Taxes 772.80 28 Net income $2,907.20 29 Dividends 30 Add. To RE 31 Pro forma balance sheet 32 Assets $54,050.00 Debt 33 Equity 34 Total $54,050.00 Total 35 External financing 36 $26,900.00 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts