Question: A B D E F H 2 1 You are given the expected returns and standard deviations for stocks A, B, and C and

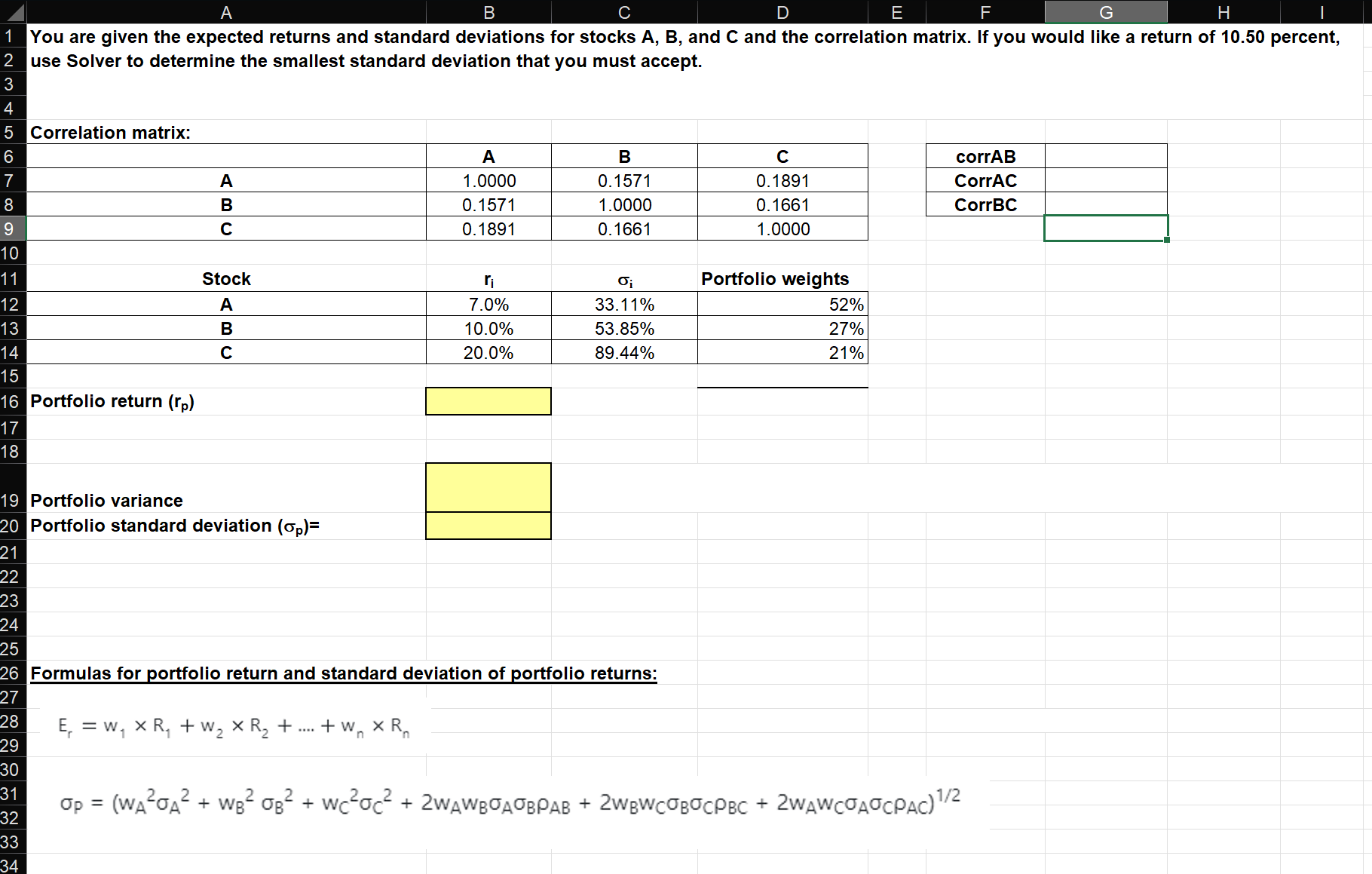

A B D E F H 2 1 You are given the expected returns and standard deviations for stocks A, B, and C and the correlation matrix. If you would like a return of 10.50 percent, use Solver to determine the smallest standard deviation that you must accept. 3 4 5 Correlation matrix: 6 A B C corrAB 7 8 9 ABC 1.0000 0.1571 0.1891 CorrAC 0.1571 1.0000 0.1661 CorrBC 0.1891 0.1661 1.0000 10 11 Stock ri Portfolio weights 12 13 14 ABC 7.0% 33.11% 52% 10.0% 20.0% 53.85% 89.44% 27% 21% 156 15 16 Portfolio return (rp) 17 18 19 Portfolio variance 20 Portfolio standard deviation (p)= 21 22 23 24 25 26 Formulas for portfolio return and standard deviation of portfolio returns: 27 28 1 E = w x R + W x R + .... +Wn R 29 30 31 2 32 Op = (WAA + WB B + wcc + 2WAWBOOBPAB + 2WBWCBPBC + 2WAWCOACPAC) 1/2 33 34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts