Question: A bank makes a 30 year Fully Amortizing FRM for $800,000 at an annual interest rate of 4.5% compounded monthly, with monthly payments. What is

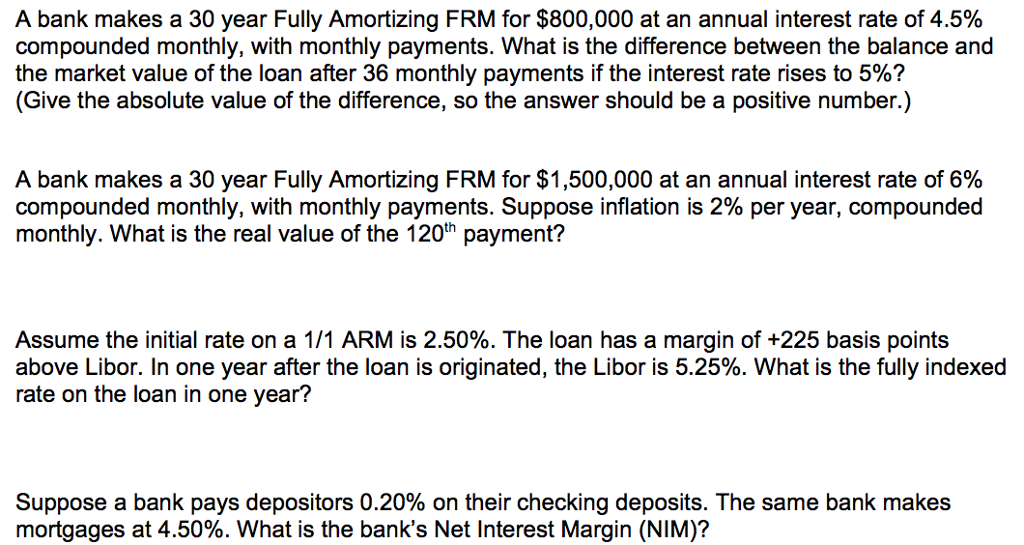

A bank makes a 30 year Fully Amortizing FRM for $800,000 at an annual interest rate of 4.5% compounded monthly, with monthly payments. What is the difference between the balance and the market value of the loan after 36 monthly payments if the interest rate rises to 5%? (Give the absolute value of the difference, so the answer should be a positive number.) A bank makes a 30 year Fully Amortizing FRM for $1,500,000 at an annual interest rate of 6% compounded monthly, with monthly payments. Suppose inflation is 2% per year, compounded monthly. What is the real value of the 120th payment? Assume the initial rate on a 1 /1 ARM is 2.50%. The loan has a margin of +225 basis points above Libor. In one year after the loan is originated, the Libor is 5.25%. What is the fully indexed rate on the loan in one year? Suppose a bank pays depositors 0.20% on their checking deposits. The same bank makes mortgages at 4.50%. What is the bank's Net Interest Margin (NIM)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts