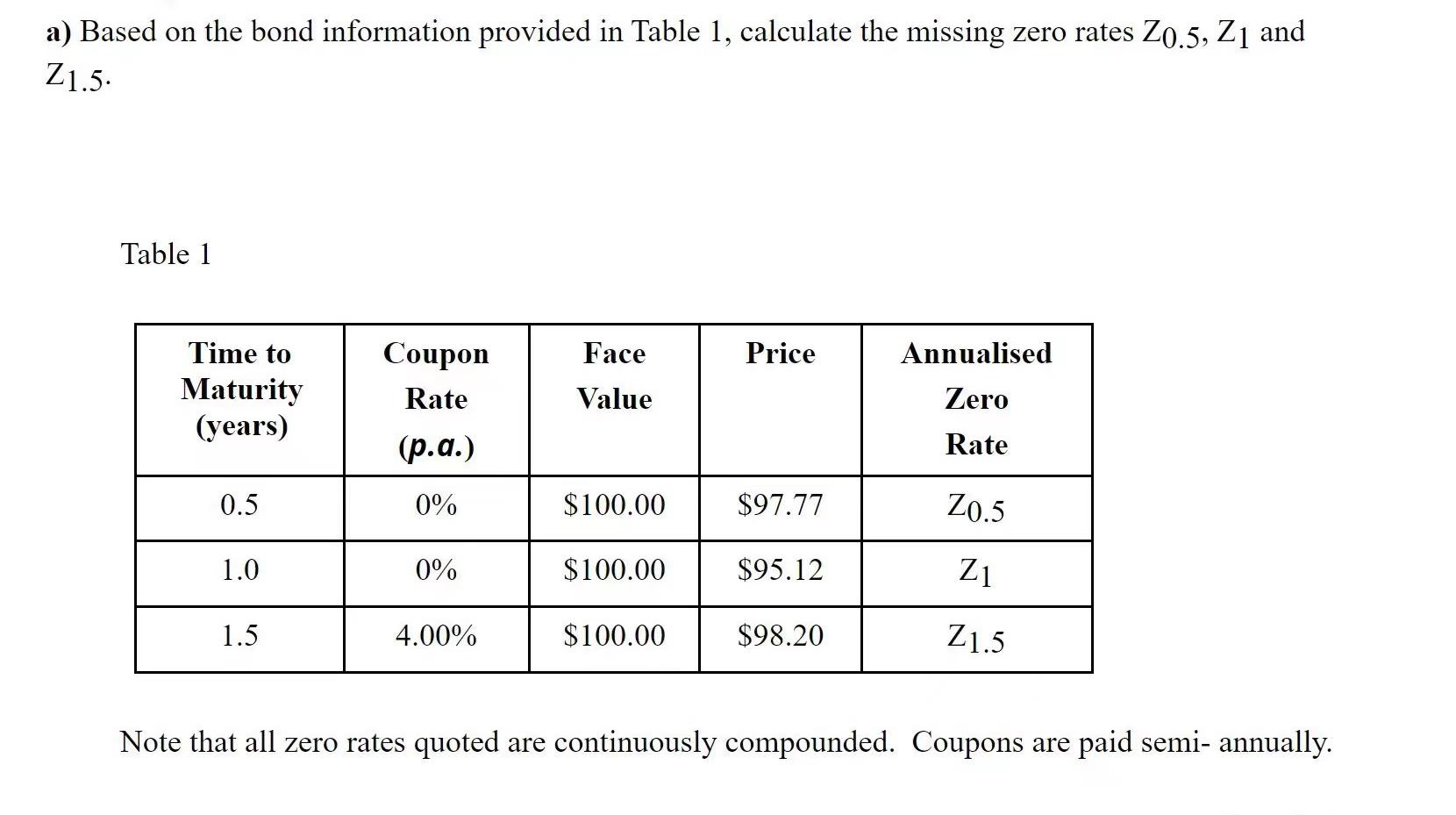

Question: a) Based on the bond information provided in Table 1, calculate the missing zero rates 20.5, Z1 and 21.5. Table 1 Face Price Annualised Time

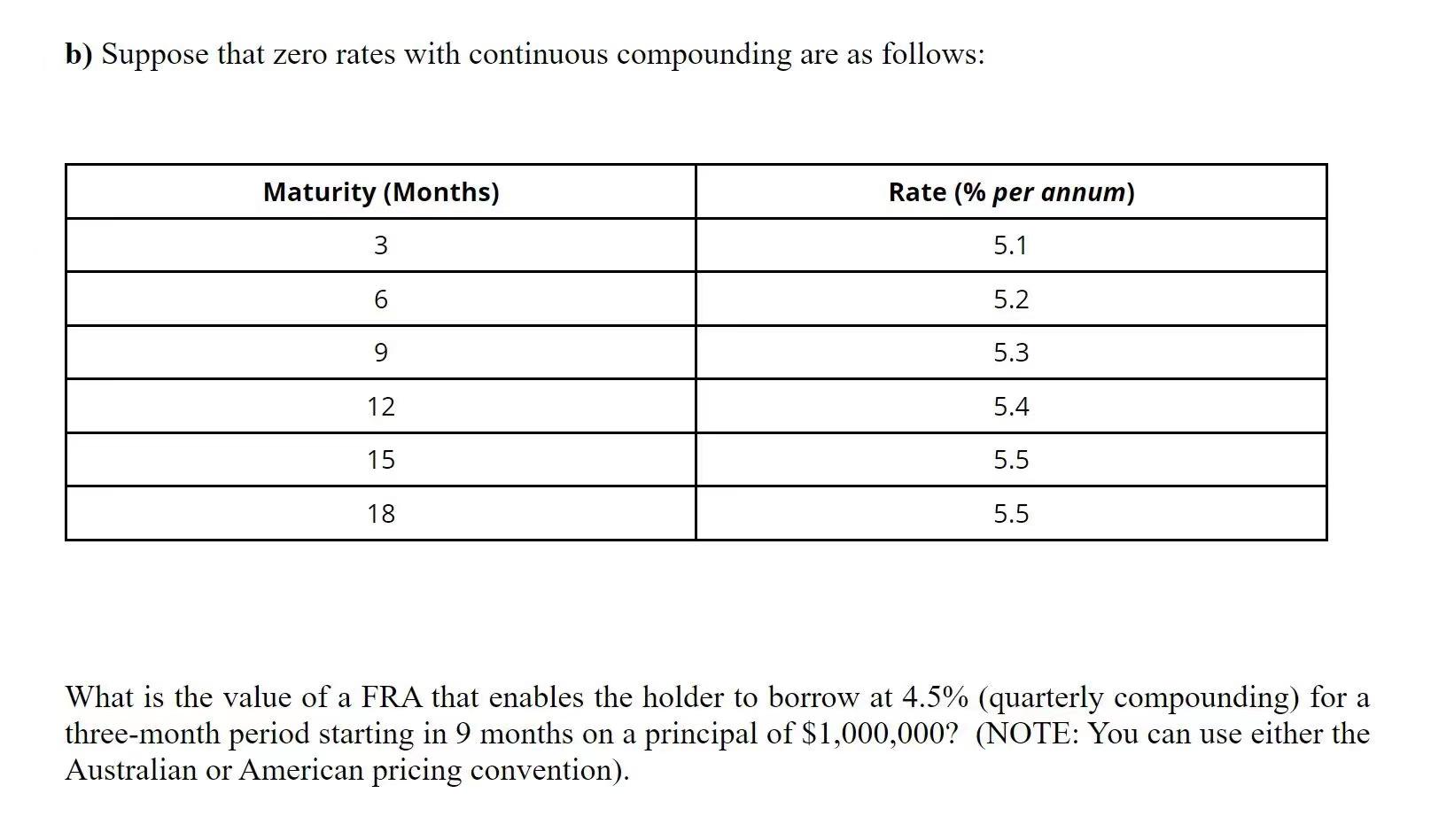

a) Based on the bond information provided in Table 1, calculate the missing zero rates 20.5, Z1 and 21.5. Table 1 Face Price Annualised Time to Maturity (years) Coupon Rate Value Zero (p.a.) Rate 0.5 0% $100.00 $97.77 20.5 1.0 0% $100.00 $95.12 21 1.5 4.00% $100.00 $98.20 21.5 Note that all zero rates quoted are continuously compounded. Coupons are paid semi- annually. b) Suppose that zero rates with continuous compounding are as follows: Maturity (Months) Rate (% per annum) 3 5.1 6 5.2 9 5.3 12 5.4 15 5.5 18 5.5 What is the value of a FRA that enables the holder to borrow at 4.5% (quarterly compounding) for a three-month period starting in 9 months on a principal of $1,000,000? (NOTE: You can use either the Australian or American pricing convention). a) Based on the bond information provided in Table 1, calculate the missing zero rates 20.5, Z1 and 21.5. Table 1 Face Price Annualised Time to Maturity (years) Coupon Rate Value Zero (p.a.) Rate 0.5 0% $100.00 $97.77 20.5 1.0 0% $100.00 $95.12 21 1.5 4.00% $100.00 $98.20 21.5 Note that all zero rates quoted are continuously compounded. Coupons are paid semi- annually. b) Suppose that zero rates with continuous compounding are as follows: Maturity (Months) Rate (% per annum) 3 5.1 6 5.2 9 5.3 12 5.4 15 5.5 18 5.5 What is the value of a FRA that enables the holder to borrow at 4.5% (quarterly compounding) for a three-month period starting in 9 months on a principal of $1,000,000? (NOTE: You can use either the Australian or American pricing convention)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts