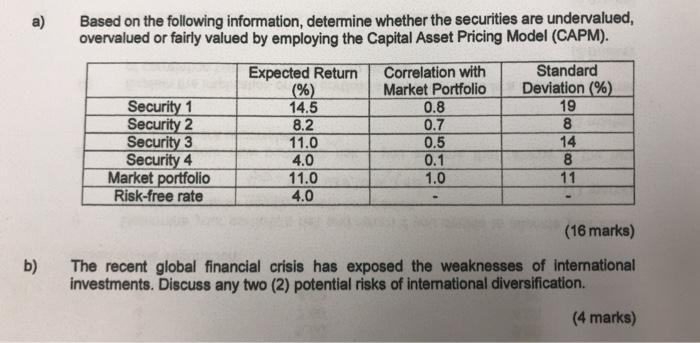

Question: a) Based on the following information, determine whether the securities are undervalued, overvalued or fairly valued by employing the Capital Asset Pricing Model (CAPM).

a) Based on the following information, determine whether the securities are undervalued, overvalued or fairly valued by employing the Capital Asset Pricing Model (CAPM). b) Expected Return Correlation with (%) Market Portfolio Standard Deviation (%) Security 1 14.5 0.8 19 Security 2 8.2 0.7 8 Security 3 11.0 0.5 14 Security 4 4.0 0.1 8 Market portfolio 11.0 1.0 11 Risk-free rate 4.0 (16 marks) The recent global financial crisis has exposed the weaknesses of international investments. Discuss any two (2) potential risks of international diversification. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Answer a To determine whether the securities are undervalued overvalued or fairly valued using the Capital Asset Pricing Model CAPM we need to calcula... View full answer

Get step-by-step solutions from verified subject matter experts