Question: a) Based on the RM10,000 personal financing 10-year facility, with Base Rate = 2.5% and spread = 5.05%, find the selling price. b) What is

a) Based on the RM10,000 personal financing 10-year facility, with Base Rate = 2.5% and spread = 5.05%, find the selling price.

b) What is the justification of having Ceiling Rate as practiced by Islamic banks and not in conventional bank?

c) Due to rising inflation, the central bank raises interest-rate/profit-rate by 1%. How does the Islamic bank accommodate the rate increase?

5 d) Can the bank do the same as above when the facility is based on fixed rate payment? Explain why.

e) The spread of the facility = 5.5%. What is the Shariah position for setting finance charge/profit rate based on the spread?

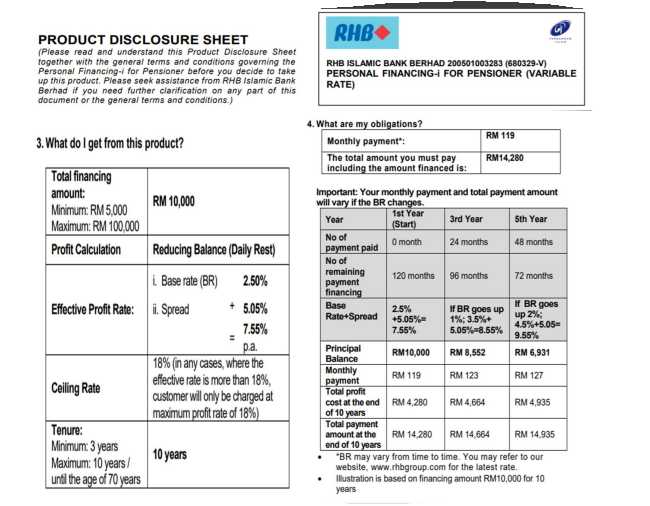

RHB PRODUCT DISCLOSURE SHEET (Please read and understand this Product Disclosure Sheet together with the general terms and conditions governing the Personal Financing-i for Pensioner before you decide to take up this product. Please seek assistance from RHB Islamic Bank Berhad if you need further clarification on any part of this document or the general terms and conditions.) RHB ISLAMIC BANK BERHAD 200501003283 (680329-V) PERSONAL FINANCING-I FOR PENSIONER (VARIABLE RATE) 3. What do I get from this product? Total financing amount: RM 10,000 Minimum: RM 5,000 Maximum: RM 100,000 Profit Calculation Reducing Balance (Daily Rest) . Base rate (BR) 2.50% Effective Profit Rate: i. Spread 7.55% pa 18% (in any cases, where the effective rate is more than 18%, Ceiling Rate customer wil only be charged at maximum profit rate of 18%) Tenure: Minimum: 3 years 10 years Maximum: 10 years until the age of 70 years + 5.05% 4. What are my obligations? RM 119 Monthly payment: The total amount you must pay RM14,280 including the amount financed is: Important: Your monthly payment and total payment amount will vary if the BR changes. 1st Year Year 3rd Year 5th Year (Start) No of O month 24 months 48 months payment paid No of remaining 120 months 96 months 72 months payment financing Base If BR goes 2.5% If BR goes up Rate+Spread +5.05% 1%; 3.5%+ 4.5%+5.05 7.55% 5.05%=8.55% 9.55% Principal RM10,000 RM 8,552 RM 6,931 Balance Monthly RM 119 RM 123 RM 127 payment Total profit cost at the end RM 4,280 RM 4,664 RM 4,935 of 10 years Total payment amount at the RM 14,280 RM 14,664 RM 14,935 end of 10 years "BR may vary from time to time. You may refer to our website, www.rhbgroup.com for the latest rate Illustration is based on financing amount RM10,000 for 10 years up 2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts