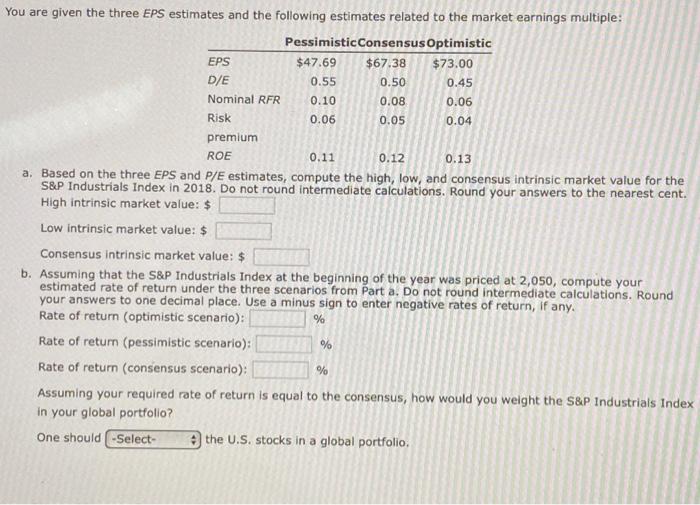

Question: a. Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S&P Industrials Index in 2018

a. Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S\&P Industrials Index in 2018 . Do not round intermediate calculations. Round your answers to the nearest cent. High intrinsic market value: $ Low intrinsic market value: $ Consensus intrinsic market value: $ b. Assuming that the S\&P Industrials Index at the beginning of the year was priced at 2,050 , compute your estimated rate of return under the three scenarios from Part a. Do not round intermediate calculations. Round your answers to one decimal place. Use a minus sign to enter negative rates of return, if any. Rate of return (optimistic scenario): % Rate of retum (pessimistic scenario): % Rate of return (consensus scenario): Assuming your required rate of return is equal to the consensus, how would you weight the S\&P Industrials Index in your global portfolio? One should the U.S. stocks in a global portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts