Question: a) Based only on risk-adjusted expected returns, which asset allocation would your client prefer? b) According to Roys safety first criterion, which of the three

a) Based only on risk-adjusted expected returns, which asset allocation would your client prefer?

b) According to Roy’s safety first criterion, which of the three allocation is the best?

c) Recommend the strategic asset allocation for your client. Explain reasoning for your selection.

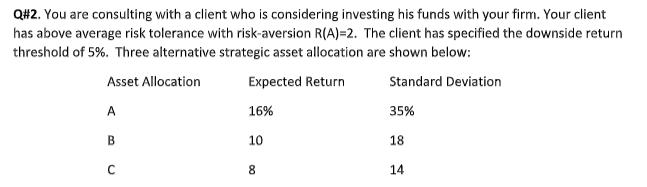

Q#2. You are consulting with a client who is considering investing his funds with your firm. Your client has above average risk tolerance with risk-aversion R(A)=2. The client has specified the downside return threshold of 5%. Three alternative strategic asset allocation are shown below: Asset Allocation Expected Return Standard Deviation 35% A B C 16% 10 8 18 14

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts