Question: ------------------------ a) BE3-9 Prepare and post transaction and adjusting entries for unearned revenue. (LO 2) AP On March 1, 2017, Big North Insurance received $4,800

------------------------

a)

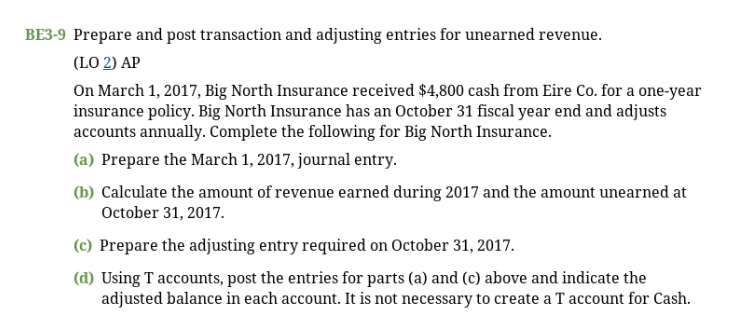

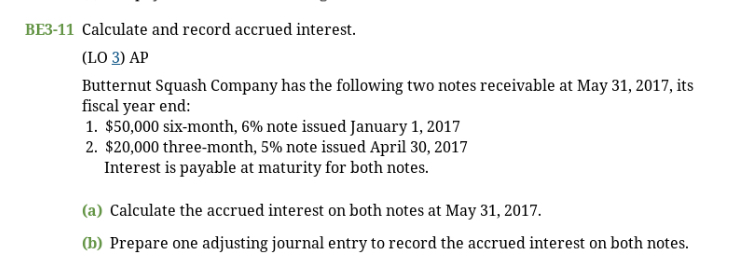

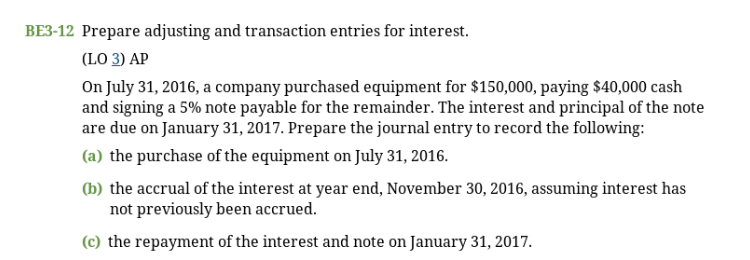

BE3-9 Prepare and post transaction and adjusting entries for unearned revenue. (LO 2) AP On March 1, 2017, Big North Insurance received $4,800 cash from Eire Co. for a one-year insurance policy. Big North Insurance has an October 31 fiscal year end and adjusts accounts annually. Complete the following for Big North Insurance. (a) Prepare the March 1, 2017, journal entry. (b) Calculate the amount of revenue earned during 2017 and the amount unearned at October 31, 2017. (c) Prepare the adjusting entry required on October 31, 2017. (d) Using T accounts, post the entries for parts (a) and (c) above and indicate the adjusted balance in each account. It is not necessary to create a T account for Cash.BE3-11 Calculate and record accrued interest. (LO 3) AP Butternut Squash Company has the following two notes receivable at May 31, 2017, its fiscal year end: 1. $50,000 six-month, 6% note issued January 1, 2017 2. $20,000 three-month, 5% note issued April 30, 2017 Interest is payable at maturity for both notes. (a) Calculate the accrued interest on both notes at May 31, 2017. (b) Prepare one adjusting journal entry to record the accrued interest on both notes.HES-12 Prepare adjusting and transaction entries for interest. {LD 3} AP n July 31, 2016, a company purchased equipment for $153,331}, paying $40,030 caSh and signing a 5% note payable for the remainder. The interest and principal of the note are due on Ianuary 31, 201?. Prepare the journal entry to record the following: [a] the purchase of the equipment on ]uly 31, 2016. [lo] the accrual of the interest at year end, November 30, 2013, assuming interest has not previously been accrued. {c} the repayment of the interest and note on ]anuary 31, 201

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts